WEIDEX - Let’s first explain what decentralized exchange is.

Hello ... If you are interested in joining the WEIDEX project or you are interested in joining the WEIDEX project, it is a good idea to read reviews that can help you get information that might help you in seeing their vision and mission during the WEIDEX project.

Introduction

Cryptocurrency global market is growing every day and cryptocurrencies are becoming part of our daily lives. We currently use Ether and Bitcoin to buy mobile phones, laptops, coffee and we can also use them to buy a house in the USA. Bitcoin and Ether are more valuable and less volatile than most National currencies in some regions and there is the need for additional exchanges where people can securely and publicly trade with such asset type. We want to use the blockchain, considering the global blockchain’s philosophy. We want to have freedom, choice, security, transparency, decentralization, immutability and all other benefits of this technology. Furthermore, most of the existing exchanges are centralized and subjected to untrusted third party. This is exactly the opposite of what blockchain offers. The only right way of exchanging crypto assets is the decentralized way. We have to develop new infrastructures, side chains, cross-chain transactions, lightning networks, but the first step is right in front of everyone – weiDex, a decentralized exchange market that does not need to rely on a third-party service to hold the customer's assets. Instead,

the trades occur directly between users through an automated process called smart contract. This process is known as the peer to peer transaction and the system can be achieved through a decentralized multi-signature escrow system, among other solutions that are currently being developed.

What is weiDex?

Let’s first explain what decentralized exchange is. A decentralized exchange is an exchange market that does not need to rely on a third-party service to hold the customer's assets. Instead, the trades occur directly between users (peer to peer) through an automated process called smart contract. This system can be achieved through a decentralized multisignature escrow system, among other solutions that are currently being developed.

weiDex is a fully featured decentralized exchange (DEX). It guarantees the highest possible security, full transparency and open source logic. The main idea behind the decentralized exchange is the removal of the third party and it doesn’t need to collect your personal data like email, name or identification number. All the logic is held by the smart contract. Hence only the users have the tendency to control their assets thereby making human mistakes very impossible. weiDex supports all Ethereum based tokens and by the end of the year, we will also support Neo based tokens.

weiDex User Experience

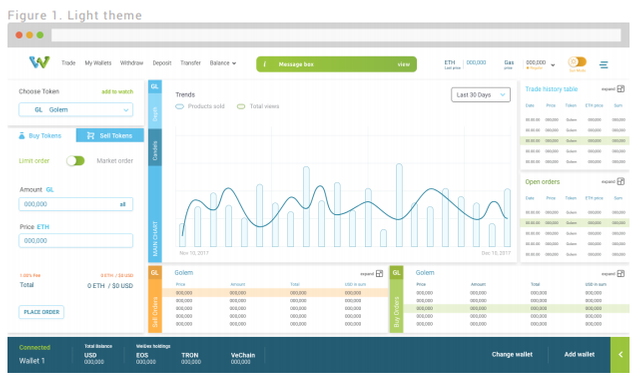

Our great user interface can be seen in Figure 1 and 2:

User experience (UX) focuses on having a deep understanding of users, what they need, what they value, their abilities, and also their limitations. UX is a growing field that is very much still being defined. We are creating a successful user-centered design encompassing the principles of humancomputer interaction (HCI) and we will provide the exact needs of the customer, without fuss or bother. Next comes simplicity and elegance that produce products that are a joy to own, a joy to use.

Every operation in weiDex is absolutely secure and risk free. You can also list your own token in an easy and fast way.

Additionally, weiDex can be also used for initial token distribution. If you issue a new token, we can list and distribute it, following your own rules. The beauty of this is that the hard work about crowdsale contracts will be replaced by our exchange service thereby giving you the opportunity to make any bounty programs with our built-in referral system.

Our Vision

We are going to make decentralized exchanges widely used and the main method for transferring crypto assets. Our vision is to provide the best services to our clients, from the user interface and user experience to the usability and performance. We will create a great, strong community with brave dreams like ours. Our main task to achieve our dream is to develop a decentralized technology for cross-chain transactions.

Market Opportunities

There were over 500 different cryptocurrency types that were available for trading in January 2015. It is important to note that only a few of them had a market cap that is over $10 million. By September 2017, the number of cryptocurrencies had increased to 1100 and the total market cap reached an all-time high of $60 billion by December 2017, the total market cap reached $600 billion which is a multiple of 10 in about two months.

In 2017 the cryptocurrency market reached an estimated $600 billion, and experts have forecast that it will reach an inevitable $700 billion. Despite a lot of financial skeptics predicting that cryptocurrency will fail in 2017, the value of the mother of all Cryptocurrencies, Bitcoin, increased by an estimated 2000%.

About $3.7 billion was raised by Token Sale in 2017 alone, raising the question, what is the future of venture capital? Despite skeptics and fear regarding the prospect of cryptocurrency in 2018 experts predict that the cryptocurrency market will continue to grow as institutional capital gets involved.

Even though the future of cryptocurrency remains uncertain, cryptocurrency is more than a fad. Even after considering its pros and cons, there is a high possibility that it is here for the long haul.

Problem Statement

Cryptocurrency seems to be the latest technological trend that many investors are recently focusing on. Cryptocurrency trading also comes with its own challenges and these challenges arise because of the nature of the market and the fact that it uses blockchain technology, a decentralized approach, and platform.

The challenges in cryptocurrency exchange have been a major setback to the growth of the industry and this points to the reason why the market is not globally adopted so far. Poor liquidity, poor market regulations, long process of compliance and complex integration are some of the challenges plaguing cryptocurrencies. Financial Institutions and banking sector benefits from these factors and government are planning to legalize the digital currencies.

Additionally, some of these exchanges are plagued with poor security and lack of investor's protection that a more regulated financial sector enjoys. There have been multiple dozens of cryptocurrency heists since 2011 and there are situations where many hacked exchanges had to shut down. A huge amount of bitcoins that would have worth more have been stolen while only a few have been recovered.

Our Technology

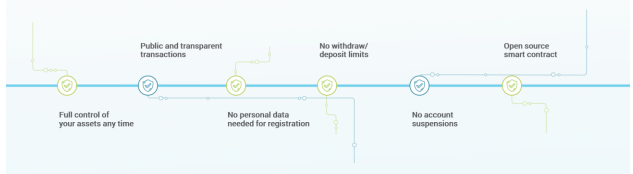

We have a lot of advantages over centralized exchanges. Most of them are about security, privacy, availability, and transparency.

We also have advantages over other existing decentralized exchanges:

- Referral System Program

- Low Fees

- Multiple Order Fulfillment

- Tokens Airdrop

- Cross-Chain Transactions

Referral System

Invite a friend and 20% of their exchange trading fee goes to your wallet. The number of users you invite determines the number of bonuses you will receive. This is often used strategy, we hope that when we have a good amount of users, we will make this count grow exponentially with the referral system. This functionality is entirely handled by the smart contract and such kind of referral bonuses has never been implemented on another decentralized exchanges.

Low Fees

As compared to other platforms that require huge procedures and huge pocket cut, weiDex is cost effective and minimizes time wastage. This is because the platform is created in a very fast and efficient blockchain network. You will only be charged little or no amount thereby making you deploy a payment service of your own. Even more, after a certain amount of volume is reached, there will be no fees. For example if the daily exchange volume is 1000 ETH, then all trades will be completely free for the rest of the day.

Multiple Order Fulfillment

We want to give you the best and most user-friendly way to trade. We brought to life the Multiple Order Fulfillment! This means that you can set an order for a certain amount and our smart contract will make sure to take as many transactions as needed to fulfill your request, while you get charged for just one transaction. It's a very time-saving and cost-effective feature for all users.

Cross-chain transactions

Cross-chain transactions are the golden apple of our project. This is one of the hardest and most difficult, unsolved problems in the blockchain technology. We have different blockchains, but they have their own ecosystem. We hope to unite them in a decentralized and secure way in order to exchange trading assets from separate blockchains. There are

different solution to this problem and these solutions include side chains or atomic swaps, but we offer a new innovative solution in which we will use our token and smart contract. Our plan is described in the following example:

We create a WeiDex mintable token (WDX) on the Ethereum network.

We create a WeiDex mintable token (WDX) on the Neo network.

Our goal is to transfer 1 WDX from Ethereum to Neo:

a) Burn 1 WDX on Ethereum blockchain.

b) Call smart contract function deployed on Neo blockchain with the transaction hash of the Ethereum burn transaction.

c) Check the transaction with Neo Oracle Smart Contract.

d) Mint 1 WDX on Neo blockchain if the Ethereum burn transaction is valid.

e) We successfully “transferred” 1 WDX from Ethereum to Neo blockchain.

f) The total supply of all WDX on all blockchains is still the same.

With this simple algorithm, we will be able to transfer all Neo based tokens for all Ethereum based tokens. With the integration of additional Ethereum like networks (smart contracts, oracles, etc), we will create one big ecosystem in which users can trade currencies in a decentralized way. Without any third parties e.g. centralized exchange.

Why Oracles? Decentralized oracles connect smart contracts to any external piece of data in a trustless way. This retrieval of data from the real world is done following the rules of a protocol that incentivizes all nodes to tell the truth and punishes them for lying. What do we have so far? The following explanation is applied for the current oracle implementation:

It is all done using TLSNotary. TLSNotary works by splitting the symmetric key and the MAC key among three parties, that is, the server (e.g. Etherscan to check the transaction validity), an auditee (Oraclize server) and an Auditor (Locked-down AWS instance of specially designed Amazon machine). The auditor calculates the symmetric key and MAC key and gives only the symmetric key to the auditee. The MAC key is not needed by the auditee as the MAC signature check ensures that the TLS data from the server was not modified in transit. With the symmetric encryption key, the auditee can now decrypt the data from the server. Because all messages are “signed” by the server using the MAC key and only the server and the auditor know the MAC key, a correct MAC signature can serve as proof that certain messages came from Etherscan and were not spoofed by the auditee.

The next technology that we are going to use in order to tackle the problem is atomic swaps.

What is Atomic Swap?

Put simply, an atomic swap (also sometimes referred to as a cross-chain swap or trade) is a nearly instantaneous exchange of one cryptocurrency to another which does not require a middleman or third party to oversee the transaction.

In computer programming, atomic denotes a unitary action or object that is indivisible, unchangeable, whole, and irreducible. What this means is that either the trade will be completed in full or it will be canceled and both parties will get their coins back.

Also, exchanges are centralized. These centralized exchanges go against the very thing cryptocurrencies set out to fix! Anything that is centralized is vulnerable to attack. Probably the most famous exchange hack of all time was the Mt Gox attack, when over $473 million worth of Bitcoin was stolen, about 7% of the total world’s supply. But even today hacks happen on a regular basis, such as Bithumb’s July of 2017.

Why Do We Need It?

Cryptocurrency transactions are not reversible. This means that right now the only way to safely transfer one coin to another is by using a trusted third party of some sort to ensure that both parties get the desired coin.

That’s why currently we rely on centralized exchanges such as Binance or Kraken to exchange our coins. This produces a few problems. For one, these exchanges make money off of… well, exchanging. Depending on the exchange, the fees can be quite small (or none), but some of the larger, wellknown exchanges, such as Coinbase, charge exorbitant fees, 4% for a credit card on top of a poor price on the coin to begin with. These add up over time, and can really eat into your gains.

How It Works

This example will use Bitcoin as the non-Ethereum cryptocurrency being traded. However, it works with any cryptocurrency that supports the same level of scripting as Bitcoin; including, but not limited to, Bitcoin Cash, Bitcoin Gold, and LiteCoin.

For this example, Alison holds Ether and John also holds Bitcoin. Alison is looking to give her Ether to John in exchange for his Bitcoins.

John generates a random secret key K and hashes it using SHA256 to generate a secret lock H(K).

John uses the secret lock, and a Bitcoin Script, to setup a transaction to Alison on the condition that she produces the secret key. If she does not do so within X hours then John can withdraw the funds.

John sends the secret lock H(K) to Alison along with the address of his transaction on the Bitcoin blockchain.

Alison checks John's transaction, verifying the details of the trade. If she does not agree then she does not need to do anything. After X hours, John can withdraw his funds.

Alison call a contract function with unique id that has been negotiated between both traders. She also uses the secret lock H(K) that was provided by John. This is a payable call and Alison must send her Ether when she makes this call.

John call another contract function to verify the details of the trade. If he does not agree, then he does not need to do anything. After X hours, Alison can invoke a contract function, getting a refund of her Ether.

John can now submit the secret key K associated with the secret lock to the smart contract. If he has provided the correct secret key, the contract will transfer Alison's Ether to John and store the secret key.

Alison can now acquire the secret key K.

Alison provides the secret key K to John's Bitcoin Script, and receives his Bitcoin.

This same process can be used to swap any other ERC Token for BTC.

Known Limitations

During a cross-chain atomic swap, funds are locked in contracts and scripts. If both traders participate faithfully in the trade then this will have no effect on either trader. The only latency in accessing funds is the latency of network communications, and blockchain confirmations.

However, if one trader is malicious then they are able to inconvenience the other trader by never agreeing to the trade. In this case, the funds will be locked for up to X hours. This number can be reduced to any value agreed upon by the traders but it should always be long enough that both traders have time to execute the atomic swap.

weiDex Token (WDX)

weiDex Token (WDX) has several different uses:

Users will have the chance to reduce their trading fee by 50%

When new tokens are listed on weiDex, they can use WDX as a payment method.

Users will be able to swap WDX between different blockchains e.g. ETH and NEO. In the roadmap, there is integration with Neo. After this integration is done, users will be able to trade between this platform using WDX.

After new tokens are listed, we will provide airdrop to all WDX holders, proportionate to the amount of WDX each user has.

Specification

- Token name - weiDex

- Token symbol - WDX

- Total supply - 50 000 000 WDX

- Token type - ERC-20

- Token Decimals - 18

Distribution & Allocation

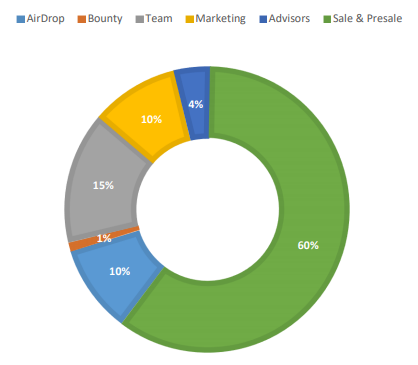

WeiDex’s intention is to allow a broad base of community members to participate in a Token Sale. WeiDex cannot guarantee that all prospective purchasers will be able to acquire their desired allocations during the Token Sale, where the maximum cap will be approximately $15 million. The amount of tokens sold during the Token Sale will be from a total sale pool of 30,000,000 WDX.

For a successful token sale reaching the hard cap the intended token distribution will be as follows:

Our customers will receive an airdrop based on their trading volume. The total amount of tokens that will be provided as airdrop is 5,000,000 WDX.

The airdrop will occur once a month and will affects every unique address that meets the trading volume conditions. The maximum amount of tokens each unique address can receive is up to 250 WDX. Therefore, the first 20 000 users that meet the trading volume requirement will be affected by the airdrop.

The amount of tokens for the team, the advisory board and the marketing will be locked. Every 90 days 25% of these tokens can be released. Therefore, the total amount of tokens for the team, advisors and marketing will be available after one year.

Token Sale Finances Breakdown

The majority of funds will be to continue the research & development of the exchange, while the remaining portion will be used to raise awareness about the decentralized exchange.

Some of the key costs include:

Technical Development Costs – will mainly be allocated to employee salaries and contractor costs for developing and securing the software.

Marketing and Communication Costs – getting the attention of target audiences by using slogans, packaging design, celebrity endorsements and general media exposure.

Accounting and Legal Costs – for the work associated with auditing and compliance within the jurisdictions the WeiDex team operate in.

Office and Indirect Costs – for office space as well as other employment related costs.

Event Hosting and Sponsorship – to spread awareness about WeiDex through attending or sponsoring various events.

Here are the reviews that I present to all of you in finding information and knowing the WEIDEX project that is currently being run by their team, if there are any shortcomings in explaining this article, don't worry, I have prepared a link for you to get accurate information and of course You will be able to talk directly with or their team, at the link.

For more information and joining WEIDEX social media today, please follow the following resources:

Website: https://weidex.market/?utm_source=bitcointalk

Whitepaper: https://weidex.market/images/whitepaper.pdf

ANN: https://bitcointalk.org/index.php?topic=4638484.0

Facebook: https://www.facebook.com/WeiDex-163716047661387/

Twitter: https://twitter.com/weidex2

Telegram: https://t.me/joinchat/IvU-mxJSkHeHzcms-S1ZYQ

Username: JUBAH84

Profile: https://bitcointalk.org/index.php?action=profile;u=1964710

ETH: 0x1C4Be60BDd042eB62d145BB1A02c011F7aA3DC1F