The solution of Blockchain Trilemma by QuarkChain

Quarkchain – is a permissionless blockchain platform that aims to solve the blockchain-scalability problem without sacrificing much of the security and decentralization dimensions.

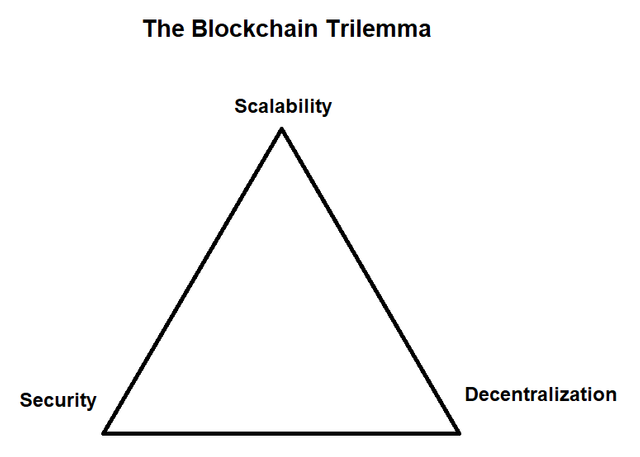

To fully understand what Quarkchain tries to achieve, at first, we need to understand the Blockchain Trilemma problem.

On the picture below is represented The Blockchain Trilemma problem. There are three main properties of blockchains: Scalability, Security and Decentralization. The blockchain-platform space in the near and mid-term future is likely to be shared among several platforms that will offer various combinations of these three dimensions. The understanding of what combination of these main properties QuarkChain offers is crucial to figure out its future position in the space.

The main blockchain-platform up to date – Ethereum suffers from Scalability issues (low transaction throughput), because it tries to achieve the scalability without sacrificing the high security and decentralization properties.

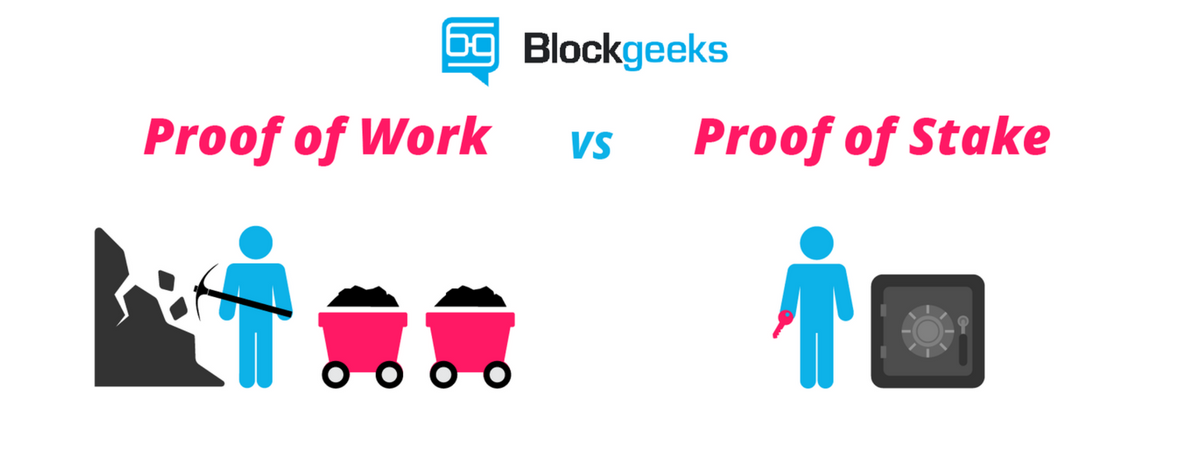

Ethereum also chose sharding as a way to scale, however, in contrast to Quarkchain, to maintain the current high level of security Ethereum plans to implement Casper FFG (the transition from PoW to hybrid PoW/PoS) first and sharding later.

Quarchain plans to remain fully PoW platform, which, on one hand, allows it to implement sharding faster than Ethereum, but on the other demands to significantly reduce the security of the network.

This happens due to that with the PoW algorithm miners don’t have anything to lose in case they commit an attack on the network. So, there are no disincentives for the bad behavior in the network and validators have nothing to lose for the malicious actions.

In PoS, on the other hand, if nodes undertake a bad action it is penalized by losing a part (or all) of its stake = it is punished.

So, in summary:

PoW = incentives for “good” actions in the network;

PoS = incentives for “good” actions in the network + disincentives for “bad” actions.

As there is an addition of punishment in PoS, this algorithm is more secure.

Now, let’s have a look at the solution proposed by the QuarkChain team.

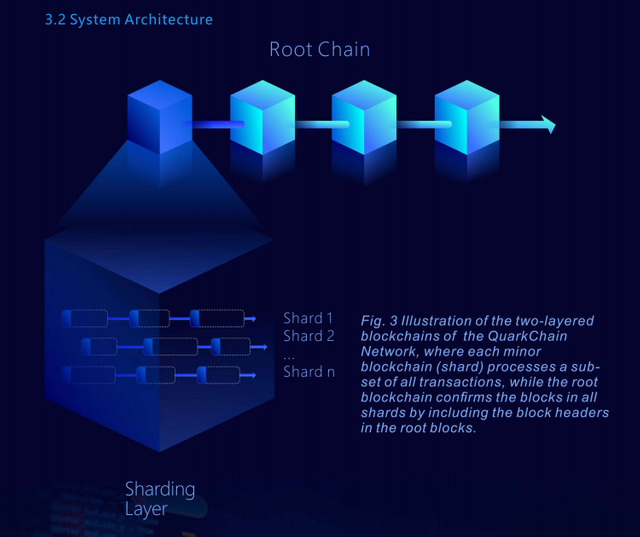

QuarkChain – is one more blockchain platform for Dapps with sharding as its main distinguishing feature. The team wants to build two-layer network. The first layer will be the root chain and the second layer will be shards. By transferring computations from the root chain to the unlimited number of shards Quarkchain will achieve higher transaction throughput. However, as we know from the Blockchain Trilemma, it is not that easy to just improve one of the blockchain dimensions. Solving of one problem often results in other tradeoff-problems. Thus, even after implying that Quarkchain can deliver the promised amount of transactions per second, it is crucially to assess how their solution affects the other two dimensions of their blockchain.

The hashing power is planned to be distributed in the following manner:

50% of it will secure the root chain;

Another 50% of the overall hashing power will be distributed across all shards.

(Although, these numbers are configurable)

Therefore, to commit the 51% attack on the main chain the attacker will need 50% of hashing power of the ROOT CHAIN, which will be just 25% of the OVERALL hashpower of the network.

51%*50% of the root chain = 25%

In another words, it will take only 25% of the miners to successfully attack the main chain. Which is twice as low as the number of miners needed for attack in Bitcoin and Ethereum networks.

Besides, as QuarkChain team writes in their WP: “running a super-full node could be very expensive in a high-throughput blockchain system. For example, 1M TPS with each transaction being 250 bytes would require 2 GBps network bandwidth, which becomes a huge barrier to many users…the traffic would generate about 20 Terabytes data per day or 7 Perabytes data per year”. Obviously, it creates significant barriers for small-scale miners, as only the large and centralized parties can afford such powerful hardware (which is very sad for a network, where 51% attack possible with only 25% hashpower).

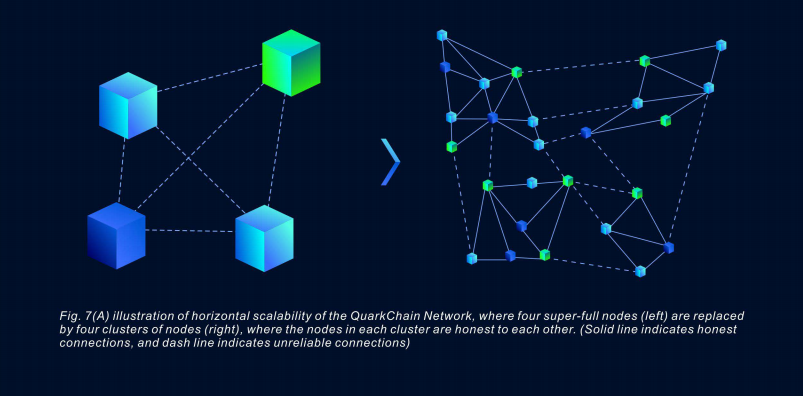

However, the QuarkChain team is aware about these problems and proposes the following solutions:

Regarding centralization - the small-scale miners will be able unite in a cluster and to super-full node collectively.

However, the large-scale miners with industrial-grade equipment will also be able to create such cluster, so I don’t really see much problem-solving here.

In addition, if we take into consideration the advantage, which large-scale ASIC manufacturers have, it becomes clear that PoW in 2018 - is not a sustainable solution at all.

As David Vorick from Sia points in his article "The State of Cryptocurrency Mining": "It’s estimated that Monero’s secret ASICs made up more than 50% of the hashrate for almost a full year before discovery, and during that time, nobody noticed. During that time, a huge fraction of the Monero issuance was centralizing into the hands of a small group, and a 51% attack could have been executed at any time." [1]

Regarding distribution of hashpower among shards – “We will be adopting a reward based incentivized mining structure where dynamic difficulty is adopted across shards. That way game theory concept comes in play and miners would be able to switch to shards that are providing better rewards.”

Which, also, won’t help much to prevent the capture of all shard's mining capacity, in my opinion, because if a large-scale miner wants to overtake the majority of hashpower in a shard it can just mine it even with losses and force smaller-scale miners to migrate to shards with better rewards/lower difficulty.

Technology resume: I don’t see how QuarkChain will be able to deliver a network with the high amount of transactions AND security/decentralization in the long term.

I want to add here, that I'm by NO MEANS a fully-competent technological expert and I urge you to continue exploring the technical aspects of this project on your own.

Team:

The founder has worked in Google, Dell and Facebook.

The senior software engineer has worked in Facebook, Instagram and Google.

I would like to see more engineers in the team, but comparing to hundreds of other ICOs, I would say that this team is good.

Partners and investors:

No institutional and famous partners listed on the QuarkChain website, which means, that, for some reason, market players with the ability to do extensive research decided that Quarkchain is not an attractive investment.

The usage of the token:

Token (QKC) is a “mode of payment and settlement”, which is not interesting and not very good in general. The only reason why in some future “rational” cryptocurrency space it can have a significant market cap is a “Store of Value” concept. However, in this field, the competitors of QuarkChain look more attractive. The EOS token gives you the right to participate in the network governance and in Ethereum, eventually, you will be able to stake your tokens and get passive income.

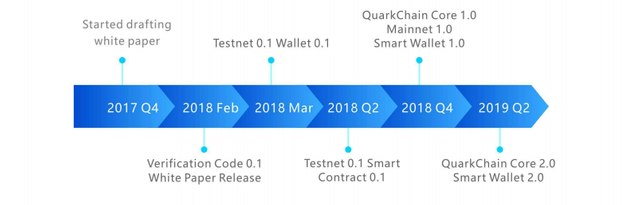

Roadmap

“Q4 2018: Release QuarkChain Core 1.0, Mainnet 1.0, together with Smart Wallet 1.0. QuarkChain Core 1.0 will provide basic functionalities of the QuarkChain Network and basic optimization. There is a plan to launch the mainnet at the same time. “(Which means that they may delay the actual launch of their mainnet).

“Q2 2019 Release QuarkChain Core 2.0, Mainner 2.0, together with Smart Wallet 2.0 QuarkChain Core 2.0 will further optimize QuarckChain core 1.0 and enable clustering feature so that a group of small scale nodes can form a cluster and run as a full node.” (which means the decreased security of their network up to this date).

Zilliqa – another blockchain project, which is going to have sharding, aims to launch its public mainnet in Q2, 2018 and to start deploying DApps in Q3, 2018. Which is definitely not good news for QuarkChain, because Zilliqa has some serious institutional backers and will have a sort of a first-mover advantage as a project with working sharding.

Other comments:

QuarkChain will use the EVM, which allows Dapps to easily migrate from Ethereum to QuarkChain.

PoW – the support of miners. However, to get this support, the team will have to attract powerful and centralized pools, which will be like shooting in its own leg for a blockchain with such combination of the trilemma dimensions.

The finality time (as I understand) for the root chain is 150s, which much longer than in some other competing projects ( for example EOS), where the finality will be achieved in much less time.

The target for growth:

The blockchain platforms are valued very high in the current market environment. The main competitor – Zilliqa has over $1billion capitalization.

Therefore, QuarkChain has potential for 10-20x or even more.

The structure of the ICO:

Hardcap of $20m.

$16m sold on private-sale with “10% release each month for the frst 4 months and 20% release each month for the later 3 months (the token is available at the end of each month 10%,10%,10%,10%,20%,20%,20%”.

4m for public sale with no lock-up.

It is very solid metrics for such project.

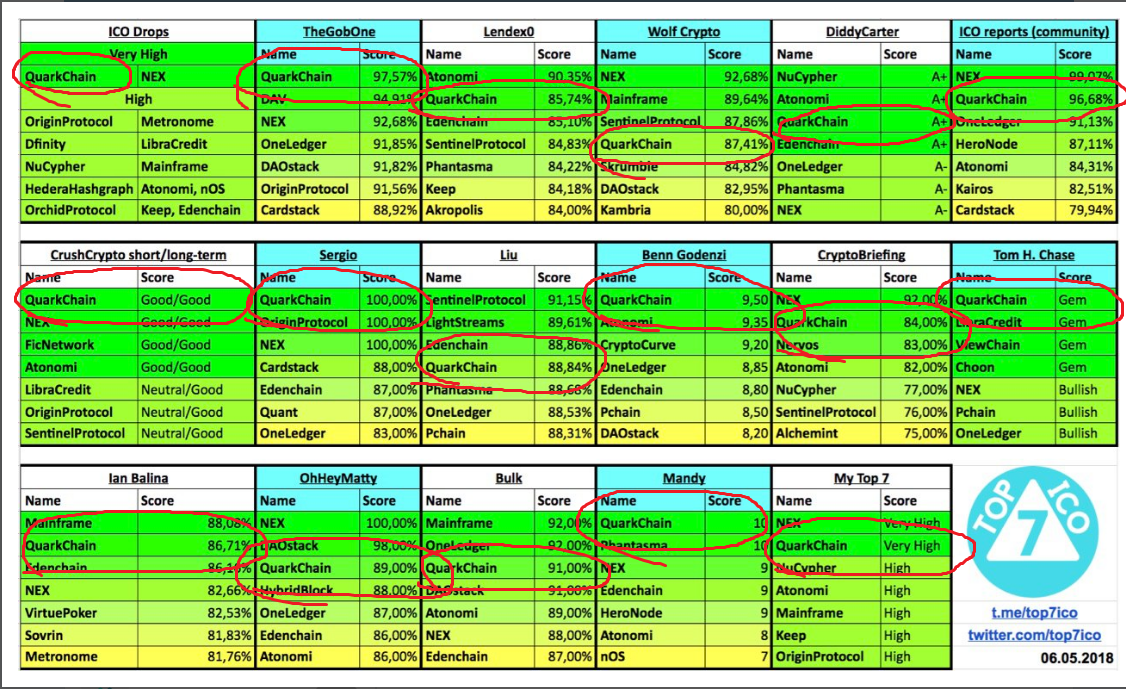

Hype and interest:

It is enormous.

The conclusion:

Even though it is unclear how the QuarkChain team will attempt to solve the security problem of their network (and will they be able or not at all), the current state of cryptocurrency space, ICO metrics and the amount of hype make this project a must-have for the short and mid-term.

Everyone, who gets into the public-sale will be extremely lucky because he or she will enjoy all benefits of the upward price movement + an instant liquidity.

Please, follow me on my Twitter, Steemit and Medium:

Twitter: https://twitter.com/IvKrll

Medium: https://medium.com/@kirillivanovich

In case you want to support or tip me:

Bitcoin: 1KTmAWQ5cjKVjhVCjum73mKtWQqiSny5gu

Ethereum: 0x1e7F481Ad51cb706f8DaDe68BB2e94CB651D4724

Doge: DEphBHAxTEr6aQUySErLxojPiCNozjgWbj

Sources:

- David Vorick, The State of Cryptocurrency Mining. https://blog.sia.tech/the-state-of-cryptocurrency-mining-538004a37f9b

Coins mentioned in post: