Akropolis: block for advanced retirees

State pension funds are subject to inflation, savings can be lost or stolen by fraudsters. Any banking structure operates according to the requirements of local legislation, can go bankrupt or suffer from a crisis. What will happen to pensions in 20-30 years, where is it safe to hide the accumulations "for old age"?

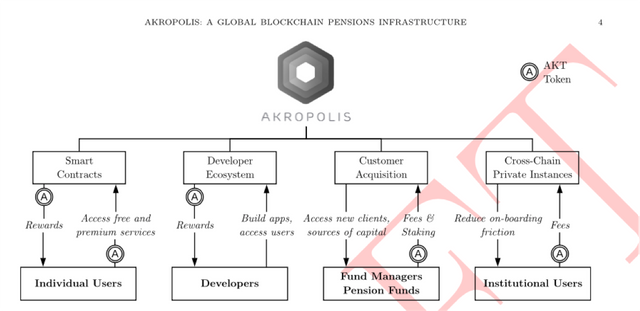

Figure 1. Schematic diagram of the work of Akropolis: all participants receive a reward for activity using AKT tokens

The creators of the Akropolis project integrate the capabilities of blockhouses and standard pension funds. The application is built on flexible smart contracts, investment decisions are made by accredited investors.

What is Akropolis?

Platform Akropolis - a single system for storing and managing pension funds, built on the technology of blocking. Developers seek to reduce inflationary and economic risks, making pension savings more stable and profitable for users. The program includes functions for five categories of users.

Individual User - an individual who wishes to save and increase pension savings using Akropolis. Such users receive an individual system access key associated with public keys.

Pension Funds are state or commercial pension funds working through Akropolis. Such users create their own infrastructure, attract new members (Individual User) to allocate funds.

Fund Managers - managers of the placed assets. Individuals or organizations that manage placed assets on behalf of private investors or organizations (Pension Funds). The task of users is to maximize the profit of the other groups of participants.

Asset Tokenisers are intermediaries that ensure the "digitization" of real assets and confirm their authenticity upon request. For example, a pensioner places fiat money on the account of a non-state pension fund registered in Akropolis. Asset Tokenisers confirms the total amount and "gives" the user a token.

Developers are individuals and companies that develop additional functions for Akropolis users. For example, financial analytics tools, services for the withdrawal of earned funds.

The Akropolis platform operates in accordance with the GDPR (General Data Protection Regulation), a document that guarantees the protection of personal data of citizens in the EU. Good news for investors: the product is aimed at a large European market.

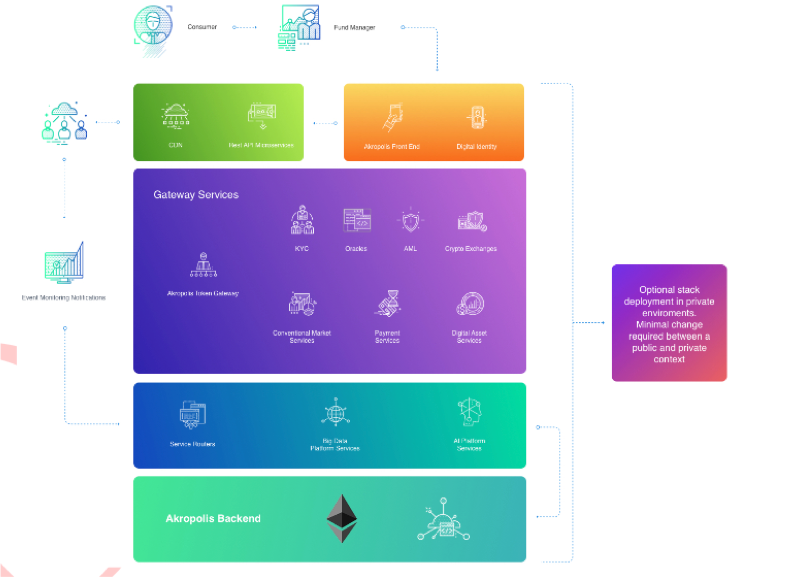

Figure 2. Akropolis architecture: the system is based on smart contracts Ethereum, procedure KYC and adaptive services

How does Akropolis work?

At the heart of the system are smart contracts and a decentralized, transparent architecture of the blockbuster. Transactions, personal data of users and legal information are stored on servers. Work with Akropolis is built on three procedures:

Onboarding. Registration of new users and loading of documents is carried out once, the user receives a token for payment of Fund Managers services.

Reporting. Fund Managers provide a report on the portfolios of assets, each user can select the desired manager. Akropolis is a more flexible platform than non-government pension funds, existing tokens can easily be "moved" between projects.

Ranking and Reputation. Each user of the platform receives a rating depending on the number of assets, compliance with legal requirements, feedback. For example, Asset Tokenisers receive points for fast document verification.

Before working with Akropolis, the user passes KYC (know your customer) procedure, all personal data is stored on separate servers (off-chain) in encrypted form. Information about transactions and storage of pension assets are stored in the on-chain.

How does the ICO go and what will happen to Akropolis next?

The developers released 900 million AKT tokens according to the ERC20 standard. Each coin is sold at a price of 6.9 cents, USD and ETH are accepted for payment.

The released tokens will be sold in the following proportion:

40% will be realized during the ICO.

10% will be spent to support project advisers and early investors.

10% will be invested in the marketing and development of the ecosystem.

20% will be spent on maintaining the development team.

20% will be a reserve fund and spending on project partners.

The team plans to collect 25 million dollars (hard cap), which are distributed in proportion:

50% of the funds are planned to spend on improving technology and "finding talent" - new developers in the team.

15% is planned to be invested in partnership with state organizations.

10% will cover the costs of marketing the project.

12% will be spent on legal registration of the international platform.

13% will cover operating expenses and unforeseen expenses.

Outcomes

Akropolis project is the result of joint work of developers, programmers, members of state regulating organizations. Project advisors are PriceWaterhouseCoopers, Kenetic Capital, Prime Block Capital.

What good is Akropolis for an investor? International target audience, competent legal design, elaborated MVP and abundance of technical information in Whitepaper. What are the chances of Akropolis to succeed? Pension reforms and economic crises worry the population of the whole world, therefore the platform will solve international problems with liquidity of savings.

More information:

Website: https://akropolis.io/

WhitePaper: https://view.attach.io/HJQ3yvpcM

Twitter: https://twitter.com/akropolisio

Facebook: https://www.facebook.com/akropolisio/

Telegram: https://t.me/joinchat/E2TUOVJlO0fWDgfnQmsHDQ

AUTHOR: tedotwijaya22

My Bitcointalk Profile Link: https://bitcointalk.org/index.php?action=profile;u=1928531