Viva: Revolutionizing the way to borderless home loan financing

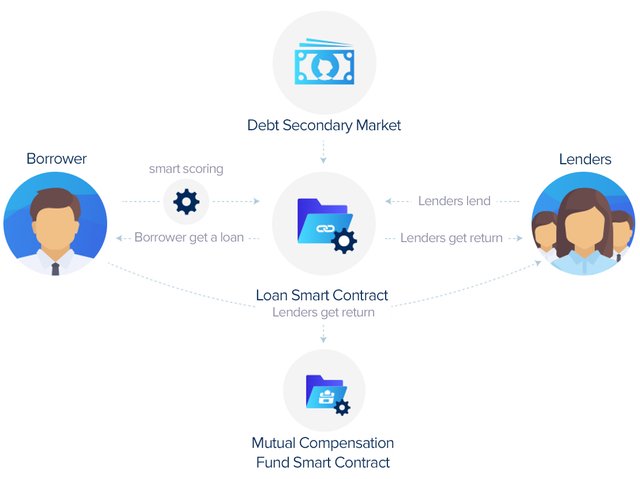

Viva network is revolutionizing the home loan financing by leveraging blockchain technology to make the process efficient, fast and transparent. It offers a free market where lenders and borrowers can set the conditions themselves and make the most out of this ecosystem.

This program is borderless, meaning everyone from anywhere can participate either as a lender or as a borrower by using this platform. The platform also provides assessments and recommendations based on its AI-based mechanism to facilitate the users for credible transactions. With its global reach, it becomes the first of its kind home loan financing program. To make it simpler, anyone from anywhere in the world can become a member if he has a smartphone and an internet connection.

There is a monopoly of financial institutions and banks and they keep a control to manipulate and exploit the needs of the home buyers. The traditional system is full of weaknesses with increased interest rates, slow loan processing and other regulatory barriers. Beside this, the home owner has to pay extra money for complaining to different laws respective of their countries. Viva has perfectly answered these problems where no outside impact can set the rules of the game. There are low interest rates with fast loan processing and efficient and transparent transactions.

Residential home owners can easily get home loans from lenders all across the world. Thus providing an alternate home financing option with a decentralized open market allowing them to set their own terms and conditions. They will get the loans more easily, quickly and with an interest rates of their choice. The process is also very simple where they only have to put their financial requirements on the platform. The platform will engage the investors and the home buyers will get the loans in fiat currencies.

This question first pops up in the head while reading about a mortgage system where home financing is so easy. There is sufficient share for the investors in the shape of Fractionalized mortgage shares which is an investment asset. This program is providing an asset-backed return to the loan providers which is based on the principal on the decades-old banking system. Investors will be happy to give loans to the needy ones through this platform because of their own benefits. So it’s a win-win scenario for all the parties. This shows how efficiently Viva network is designed to reward everyone connected to it.

Viva network offers a credit scoring system which helps the users to evaluate the stakeholders based on their credit rankings. Through this system the users will be able to improve their credit scores and appear more reliable to the respective parties. Credit score system is a very important mechanism to gauge the validity of the users since this is a borderless and global platform where no governments are involved.

Token

VIVA

Price

1 ETH = 35,714 VIVA

Bonus

Available

Bounty

Available

MVP/Prototype

Available

Platform

Ethereum

Accepting

ETH

Minimum investment

0.001 ETH

Hard cap

75,640 ETH

Country

Bermuda

Whitelist/KYC

KYC

Restricted areas

USA, China

Website:

https://www.vivanetwork.org/

Whitepaper:

https://www.vivanetwork.org/pdf/whitepaper.pdf

Facebook:

https://web.facebook.com/VivaNetworkOfficial/?_rdc=1&_rdr

Bitcointalk:

https://bitcointalk.org/index.php?topic=3430485.0;all

Telegram:

http://t.me/Wearethevivanetwork

Twitter:

https://twitter.com/TheVivaNetwork

Medium:

https://medium.com/@VivaNetwork

Viva is unrated project.

I really like this project

thanks for sharing such valuable info