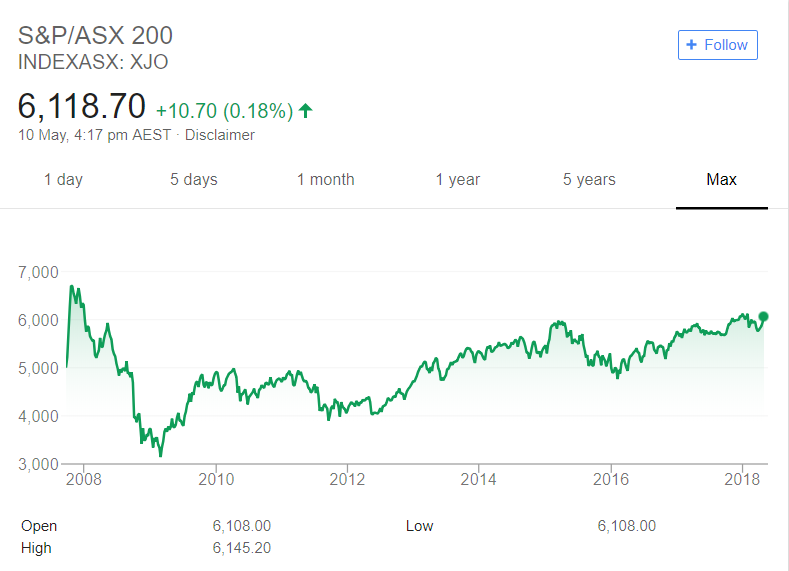

Australian stock market: still long term bullish vs bearish long term in cryptocurrency market

Australia real estate market is starting to drop down with clearance ratio around 65%, this number was 75% above in the past few years. However we can see that Australian share market is still in the long term bullish, take the ASX 200 for example. A typical bullish market is marked with slow uprising in both dip and peak of each cycle. We can view this bullish trend since the financial crisis in 2008. This also reflected the slow economic recovery since the great crash.

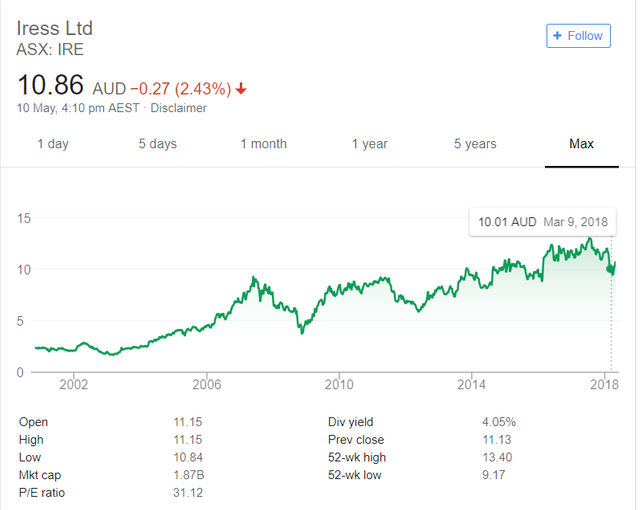

We can take another snapshot of the evaluation of price, as we can see in this instrument, the ratio of dividend and price is 4%, which is a typical home loan interest in Australia. This is the price somehow appealing, right? It is also in the long term bullish trend.

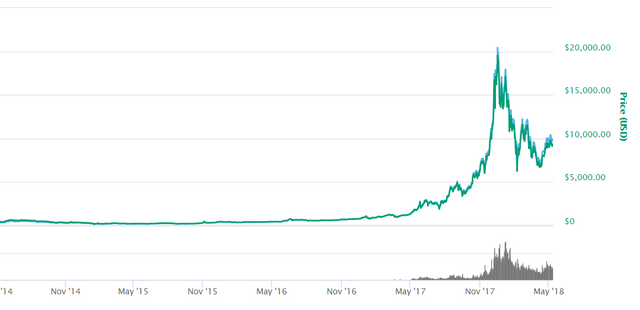

Let's take another snapshot of the crypto market:

A typical bearish market can be recognized by downwards trend, which can be identified by dip and dip, the peak point becomes lower and lower. I won't say which cryptocurrencies they are. You can guess.

Maybe it is time to switch to share market instead of cryptocurrency market.

You have a minor grammatical mistake in the following sentence:

It should be in the long run instead of in the long term.Your post is very good!

Now look me in the eye and Follow Me @cryptopay-blog