[Day 5] Top 7 Costliest Mistakes Trading Cryptocurrency #5. Not Understanding the Order Book Correctly

Since learning about bitcoin in 2014 I’ve always told my friends about it. I remember when bitcoin went from $500 to $1000 I started posting about it my Facebook, urging friends to learn about the technology. Once bitcoin 5x that price in a very short amount of time I had friends emailing me left and right asking how they can get some bitcoins and altcoins. The exchanges were very overwhelming to them and they didn’t understand how order books worked so that’s why I decided to add this to my series.

Table of Contents:

- FUD and FOMO

- Wrong Tools

- Wrong Entry Point

- Technical Analysis Done Wrong

- Not Understanding the Order Book Correctly.

- Risk Management

- Is Day Trading Really For You?

Not Understanding the Order Book Correctly.

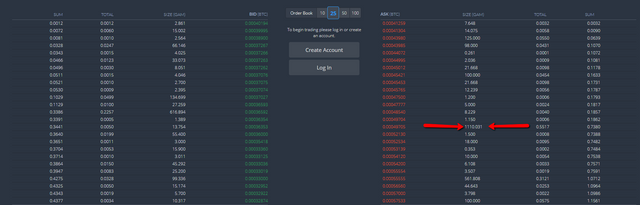

A common mistake that beginner traders make is not understanding the book spread. In short, they simply look at the top of the order book and gauge both the buying and selling price. However, those buying and selling price, generally, are of small quantity and doesn’t represent the actual demand or liquidity of the asset you are dealing with.

The solution is to look deeper and finding the sweet spot. Also, try to break your orders into smaller pieces which can help you be a better day trader.

Here’s an exaggerated example, if you were wanting to sell 1,000 of these low value GAM coins, you would have to go all the way down the list and sell at the amount 0.00049705btc each if you wanted to sell them all right away. If you listed to sell at the top of the order books it wouldn’t go through.