TIB: Today I Bought (and Sold) - An Investors Journal #240 - China, US Consumer Staples, Banks, Oil, Italy, Steel, Ethereum

Contrarian trading is the way to go when market messages get confused whether it is Italy, Spain, Jobs, Tariffs, etc. Profits in US banks go to Europe. It is also time for hedging trades in China and Consumer Staples. I am heading out of European steel as trade wars threaten.

Portfolio News

Europe Muddles It all happened in Europe as May came to an end.

Italy's two populist parties found a way to form a government and the new Prime Minster, Giuseppe Conte, was appointed. Italian stocks seems to like the certainty and came off the lows. Time will tell if the new policies will be bad for the economy, or not.

Meanwhile in Madrid, the Spanish parliament voted out the incumbent Prime Minster on the back of the corruption court cases involving his party leaders. In comes a new Socialist Prime Minister, Pedro Sánchez, also promising to improve the lot of working people while sticking to the budget set out my his predecessor (i.e., without spending any more money).

What is the impact going to be on the economies? Spain and Italy are in different stages of their reform processes. Under Mariano Rajoy, Spain made a lot of change. That augers well for a continued growth trajectory. The Italians have done very little reform and it is not clear to me that the new parties in power really want to reform the structural weaknesses in the economy. I am going to stay invested saying that they will make some progress because the extremes on the left and right of the coalition will force a middle ground. This article compares the two countries well.

https://www.wsj.com/articles/why-italy-is-flirting-with-euro-exit-and-spain-isnt-1528040526

While European markets were down on the week, short term interest rates voted - going up to recover the falls the week before. [Note: this is a price chart - rates fall when the chart rises]

Market Jitters US markets had a lot to be nervous about on Thursday when Europe was imploding and Donald Trump announced the steel and aluminium tariffs and bringing forward to risk of a trade war. US consumer spending data released on Thursday also pointed to softer spending - that sent Treasury yields down. Interestingly short term rates did not go down - they kept going up.

Along comes the jobs report on Friday and it was stronger than people expected. Treasury yields reversed and everyone seemed to forget Europe and believed again that the Federal Reserve would stay the course.

I did write a few days ago that before long the market would get back to the data and would focus on economic growth rather than fear. Short term interest rates were reflecting the data with Eurodollar looking just like Euribor.

Bought

Consumer Staples Select Sector SPDR ETF (XLP): US Consumer Staples. Consumer Staples stocks pay high dividends (3.6%). As treasury yields have risen above 3%, fund managers have been switching to lower risk Treasury yields. This has knocked the whole sector back so far 17% this year. The trade idea came from one of the talking heads as a hedging trade. If the markets pull back hard these stocks will bounce and claw back at least a half of what they have given away this year. I chose to invest through January 2020 call options as implied volatility was low. The premium to strike was a modest 4.6% set up on a day when the strike was only one strike out-the-money. It is now more.

The chart has a few nagging features. Price has made the first clear lower low on a weekly chart since the end of the GFC. That level could form a resistance level for price rises. That is the nature of hedging trades. Price does not have to get all the way back to the highs to make 100% - I will not be surprised to see it retest and get to a 50% profit level - then I will close it out.

Xtrackers Harvest CSI 300 China A ETF (ASHR): China A Shares. China was admitted to MSCI Indices effective June 1. This forces portfolio managers who are tracking indices to add China A Share stocks to their portfolios. This is not normally a solid enough reason to add stocks to my own portfolios. One of the talking heads suggested this addition as a way to hedge some of the Emerging Markets risk as China evolves its structures to behave more like a developing market and on the back of solid GDP growth. I added January 2020 strike 30 call options - I am already holding strike 34's which are under water.

Commerzbank AG (CBK.DE): German Bank. As I did in my small portfolio early last week, I added December 2020 strike 10 call options to put in a lower rung in the staircase of options in two of my portfolios. Normally I look to go out as far in time as I can go - the 2020 just looked cheaper than the 2021 options. I remain convinced the market is over-reacting to Europe news. The banks are in much better state of repair than the price moves down indicate.

Royal Dutch Shell plc (RDSA.AS): European Oil Producer. Royal Dutch Shell price has been holding around €30 for a few weeks but not really keen to move up to the next strike €32. I am holding 28's and 32's across a few of my portfolios. In TIB222, I wrote "I would really like a 30 strike opportunity." I noticed that there were strike 30 options listed for the new December 2022 expiries. Strike price of €2.58 is only 8.6% of strike with 4 and a half years to go to expiry.

In TIB222, I presented a chart covering the December 2021 strike 32 call options I bought. I have updated that chart by adding in the strike 30 options as pink rays and putting in the next expiry date (right hand margin dotted line).

The 100% profit lines are not that far apart and there is an extra year to go. I am encouraged by the OPEC hints to hold production cuts (leaked ahead of the June 22 meeting). The higher oil price flows directly to profits for Royal Dutch Shell.

FTSE MIB (Milano Indice di Borsa) (FTMIB): Italian Index. I have been holding December 2021 strike 21000 call options for some time (July 2017 - see TIB107) which have until the last crisis been in-the-money. I took the chance to average down my entry price in one of my portfolios. With a premium of €2477.5, this was 11.8% of strike which is higher than I like to pay but cheap for the mess Italy finds itself in. I have updated the chart presented in TIB107 to show the new breakeven and the new 100% profit level. The blue rays start where I bought the first contract.

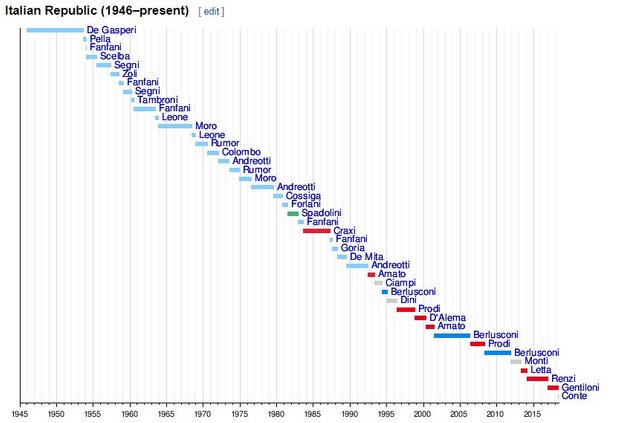

This might feel like a stretch as the 100% profit target is above all the highs going all the way back to the GFC collapse. However, I have modelled an Elliot wave (the left hand zig zag) and cloned it across to the current cycle. I need to see a repeat of that sort of move to get to 100%. There are 3 and half years to go and I am encouraged that the most recent high was as high as the 2009 high which was achieved in the midst of the populist party election win in March. More of a gamble is trying to guess how many PMs we will see by expiry - 42 since the war.

https://en.wikipedia.org/wiki/List_of_Prime_Ministers_of_Italy

Sold

Associated Banc-Corp (ASB): US Regional Bank. Sold November 18 strike 19.77 call warrants for 265% profit since November 2013. This was a trade idea from my investing coach who identified a number of call warrants that were issued as part of the TARP bailout after the GFC. These particular warrants have been in-the-money since October 2016. It would have been better to sell them then and convert to stock as the stock pays dividends. The warrants do not. This closes out the program of bank warrants purchased after the GFC bailouts.

ArcelorMittal (MT.AS): European Steel. Europe was included in the steel and aluminium tariffs which came into force on June 1 - time to bank some profits on European steel. Sold December 2020 strike 23.25 options for 234% profit since July 2016.

Cryptocurency

Bitcoin (BTCUSD): Price range for the weekend was $460 (5.9% of the high). Price tested the support line for 3 consecutive days and then broke higher with 3 consecutive higher highs. We will need to see price break through the resistance line that was the bottom of the previous range.

Ethereum (ETHUSD): One contract hit its take profit target at $602.14 for a $37.03 (6.5%) per contract profit. It always feels good to win a risky trade. Be aware that this type of win encourages one to trade that way more often. YOU HAVE BEEN WARNED. Profits from this trade will fund Bitcoin and Ethereum funding costs for a few weeks.

CryptoBots

Outsourced Bot 5 closed trades on this account - ADA (3.85% - twice), XLM (2.2%), XMR (2.75%), OMG (1.77%) (212 closed trades). Problem children was reduced by one with BTS trading back below 10% down (>10% down) - (14 coins) - ETH, ZEC, DASH (-42%), ICX, ADA, PPT, DGD (-43%), GAS (-44%), STRAT, NEO (-45%), ETC (-41%), QTUM, BTG (-45%), XMR.

BTG still the worst at -49%. NEO/GAS are not far behind.

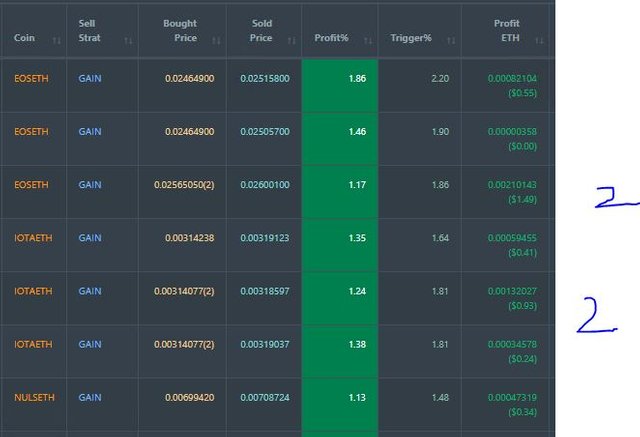

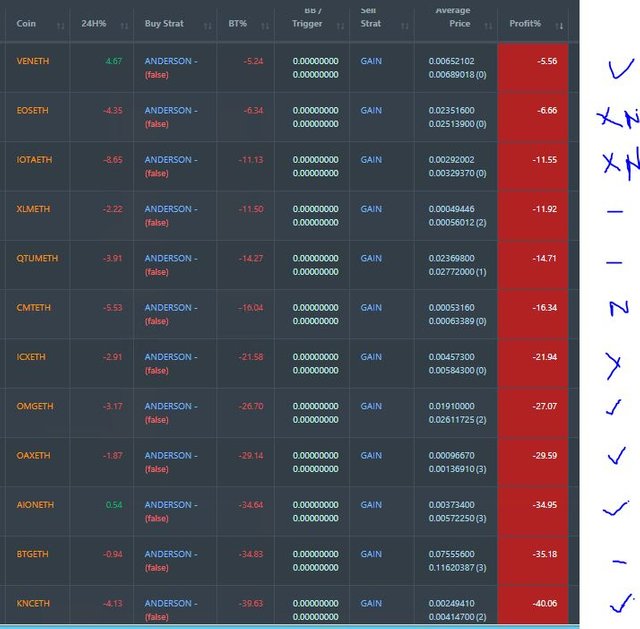

Profit Trailer Bot 7 closed trades for an average profit of 1.37% bringing overall profit on account to 0.46%.

Two of the trades came off the Dollar Cost Average (DCA) list (EOS and IOTA) - they promptly made it back to the list. DCA list remains at 12 coins with 5 coins improving, 3 coins trading flat and 4 worse. Biggest moves were EOS and IOTA which came off the list and came back on.

I had planned to change over to trading a whitelist. Ideally I should have reduced the trading pairs so that anything coming off the DCA list was not replaced. The consequence of not taking action is the DCA list is again 12 coins with one new entrant (CMT). Markets wait for nobody - plan an action and do it is the lesson.

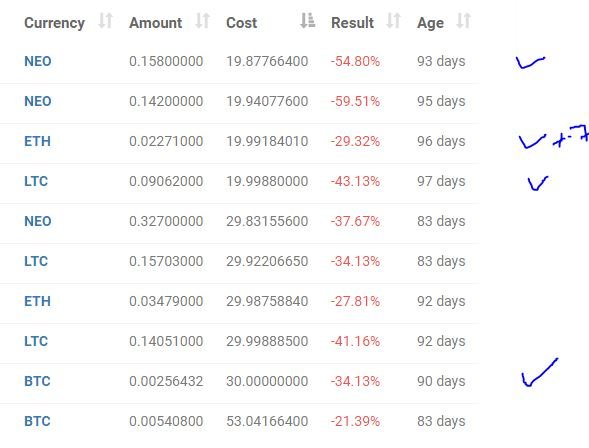

New Trading Bot Positions improved 5 points to -35.7% (was -40.3%).

All 4 coins traded better with ETH the strongest move (+7 points)

Currency Trades

Forex Robot did not close any trades and is trading at a negative equity level of 9.6% (lower than prior 13.2%). The robot appears to be geared to be short USD.

Outsourced MAM account Actions to Wealth closed out one trade for 0.16% profits for the day.

Cautions: This is not financial advice. You need to consider your own financial position and take your own advice before you follow any of my ideas. And do please heed the warnings I write in CAPITALS.

Images: I own the rights to use and edit the Buy Sell image. News headlines come from Google Search. Italy PMs comes from Wikipedia and is Creative Commons. All other images are created using my various trading and charting platforms. They are all my own work

Tickers: I monitor my portfolios using Yahoo Finance. The ticker symbols used are Yahoo Finance tickers

Charts: http://mymark.mx/TradingView - this is a free charting package. I have a Pro subscription to get access to real time forex prices

Crypto Trading: get 6 months free trades with Bitmex for leveraged crypto trading. http://mymark.mx/Bitmex

Bitcoin: Get started with mining Bitcoin for as little as $25 http://mymark.mx/Galaxy

May 31/June 1, 2018

Upvoted ($0.20) and resteemed by @investorsclub

Join the Investors Club if you are interested in investing.

@carrinm You have earned a random upvote from @botreporter & @bycoleman because this post did not use any bidbots.

hallo @carrinm

i like read this post.

this let me share your post.?

because in my opinion this is very useful for all users of cryptos

Resteem with my pleasure. Thanks

You are welcome @carrinm

from now on I will follow and resteem every your post to my friend in Indonesian.

hopefully the economy is stable and your investment goes well.welcome @carrinm.thanks

Thanks. My main investing thesis is for economies to keep growing. Stable and growing would be a great end result.

according to your graph will happen a very big change.like to exchange opinions with investors like you.allow me to share your post forever.

Hi, we have voted on your post because you have posted your article to either food, recipe, recipes, cooking or steemkitchen #tag. Steemkitchen is a brand new initiative where we want to build a community/guild focused purely on the foodie followers and lovers of the steem blockchain. Steemkitchen is out of the conceptual phase and growing each day. We would love to hear your thoughts and ideas.

We are almost ready to Launch the first Decentralized Recipe and Food Blog Website that will utilize the Steem BlockChain and its community to reward contributions by its members.

Please consider joining us at our new discord server https://discord.gg/XE5fYnk

Also please consider joining our curation trail on https://steemauto.com/ to help support each other in this community of food and recipe lovers.

Kind Regards

@steemkitchen

Ps. Please reply “No Vote” if you prefer not to receive this vote and comment in the future.

I am a foodie but this is not what this post is about unless the word STAPLES counts

I appologise, i was playing arround with the voting algorithm to narrow the vote down and it went rouge on me and posts scored higher on other periverals.

hopefully investment goes well with a stable economy. that's our hope success for @carrinm

Thanks. My main investing thesis is for economies to keep growing the way they have done for the last 8 years

amazing @ carrinm, very useful postings, allow me to share.

I would be very happy for you to share at any time

ok, thanks if you've got my new permission to share.

Resteem let everyone see it, a very good program for people out there who like to invest.

I looking at shorting the Staples until we are in the Recession, so I like your 2020 option trade as I anticipate the Markets starting go do down sometime next year.

I will be watching this closely. I am in two minds as to whether using options was right. Receiving the dividend might have lessened any pain.

I don't think the dividend matters if the price keeps fallen. Pending your strike price, I would consider turning the trade into a calendar spread and/or selling some options to supplement the dividends. What are your thoughts?