TIB: Today I Bought (and Sold) - An Investors Journal #243 - Food, Oil Drilling, Semiconductors, Japan Govt Bonds, 56 Percent Club Update

Europe on course to stop monetary easing. China slashes solar subsidies. Trading out of cheese and into fibre optics. Taking profits on Japan Government Bonds as rates rise across the world. Europe Muddles and Oil Rising reshapes the winners and losers in the May 56 Percent Club

Portfolio News

Europe Muddles Italian populists accuse the European Central Bank (ECB) of buying too few Italian bonds during the political turmoil which saw Italian bond yields rise dramatically - i.e., the ECB action was politically motivated.

It is true that the ECB bought more German bonds than they did Italian bonds. This was because of the maturity schedule of the German bonds they were holding. As the bonds matured they bought back like for like. In May, purchases of Italian bonds were in line with previous months. This is classic media scaremongering based on limited views of the data. We want a fight with Europe. We will find a pretext.

https://www.bloomberg.com/view/articles/2018-06-06/italians-play-russian-roulette-with-ecb

Much more important ECB news was a presentation by Chief Economist, Peter Praet, who has a fine mustache, who confirmed that the bank will discuss next week (June 14 - Latvia) how to wind down its bond purchase program. This had been the speculation but the agenda for the meeting did not formally include it as a topic.

Signals showing the convergence of inflation towards our aim have been improving, and both the underlying strength in the euro area economy and the fact that such strength is increasingly affecting wage formation supports our confidence that inflation will reach a level of below, but close to, 2 percent over the medium term

Peter Praet, ECB Chief Economist ECB

The questions then become? When will the easing begin? When will it be complete? When can we expect the next rate hike? How fast will the rate hikes come?

https://www.cnbc.com/2018/06/06/the-ecb-is-about-to-take-a-key-step-toward-an-easy-money-exit.html

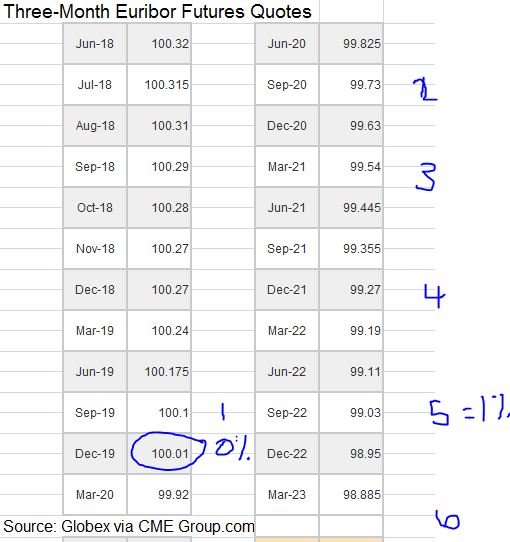

The current marginal lending facility rate is -0.45%. The Euribor futures market is showing a zero interest rate in December 2019 and 6 rates hikes in the next 5 years. 1% is set for September 2022 - looks like a good long run for a carry trade borrowing Euros. Here is a table I made

http://www.cmegroup.com/trading/interest-rates/stir/euribor.html

China Solar China took action to rein in the expansion of the solar industry, cut subsidies for the construction of solar farms and reduce tariffs paid for clean energy sales.

This had an immediate effect on solar stocks in China with the two leading suppliers of solar panels dropping 10 percent. Two largest fallers in one of my portfolios were Sunpower (SPWR) (a Chinese manufacturer) and Canadian Solar (CSIQ).

This seems to be a strange decision given that China's energy demand is growing rapidly and solar is a key plank in the strategy to reduce air pollution. In fact, in 2017 China added more solar capacity (53.1 GW) than the next 9 countries combined and more than the installed USA solar capacity. Maybe this has something to do with the tariffs imposed by the US on Chinese solar in particular. The argument for tariffs was that China was using subsidies on its solar industry to allow Chinese solar companies to compete in US markets. Killing the subsidies makes tariff negotiations easier. The reality is an industry does not need subsidies when it is operating at that massive scale - 53 GW in one year is massive scale.

Data from this article from Forbes.com

Bought

Applied Optoelectronics, Inc (AAOI): US Semiconductors. AAOI designs, manufactures, and sells various fiber-optic networking products worldwide. Customers are Internet data center operators, cable television and telecommunications equipment manufacturers, and Internet service providers.

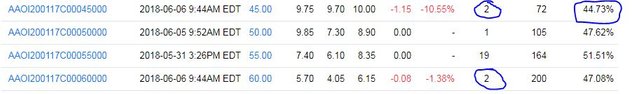

One of the talking heads mentioned AAOI as a possible trade idea a while back. I liked the shape of the chart - big highs, a pull back and then hammering out a bottom and breaking back up. I have had an outstanding bid on a bull call spread since then. That bid was taken up overnight. I bought a January 2020 45/60 bull call spread for net premium of $4.05 (9% of strike). This offers a 270% maximum profit potential. [Means: Bought strike 45 call options and sold strike 60 call options with the same expiry]

Let's look at the chart which shows the bought call (45), breakeven and 100% profit as blue rays and the sold call (60) as a red ray with the expiry date the dotted green line on the right margin.

The maximum profit line is below halfway back to 2017 highs. The 100% profit line is above the $50 target price set for the last broker upgrade. The financials show strong growth in revenues, solid operating margins and a modest debt to equity ratio. There is a lot to like especially if we continue to see economic growth driving the demand for network connectivity. Too bad I did not buy the stock when I first put the options bids on. The news headlines do portray a mixed story. Maybe the most important one is the level of short interest reported at 68% (Yahoo Finance)

https://seekingalpha.com/article/4179477-applied-optoelectronics-major-short-covering-underway

I do note from the options chains that I was alone on the trade. It also shows high implied volatility which is what motivated me to buy a spread.

Sold

Bega Cheese (BGA.AX): Australian Food Manufacturer. I had bought Bega Cheese as a play on the demand from China for milk products. Since my acquisition, Bega acquired the Australian portfolio of Mondelez International (including the iconic Vegemite brand and all Australia Kraft branded products). This does make Bega Cheese a lot more than a milk company. This investment has delivered its asymmetric return and is now more of a dividend play. I sold the 2nd half of my holding for a 40% profit since August 2017. I will use the funds to add to my holding in the newly listing Australian Income Fund (see TIB233 for the rationale on that fund)

Expiring Options

Transocean Ltd (RIG): Offshore Oil Driller. Rolled up strike 12 call options expiring in June to July 2018 strike 14 call options locking in 42% profit in five weeks. Premium for new contract is $0.33. In TIB219, I wrote "If price keeps doing what it has been doing on the past patterns, the new trade will make 500% before expiry on June 15". Expiry is still a week away and it seems that price is not following the required trajectory. I felt that a little more time was required. Let's see it on a chart which is an update of a chart presented in TIB235 when I first reported buying July 2018 strike 14 call options in other portfolios.

All I have done is update prices. The trade I have just closed was supposed to hit the pink ray for 500% profit. Price did not move like that - it did reach $14 and then fell back. There is still a chance that price could reach the top of the blue arrow before the July expiry - all one has to do is move the arrow rightwards to the start of the rise (the pink arrow). If it does that the trade will make maximum profit, which is 800% for this new trade. Somewhere lower than that is what I am expecting.

Shorts

Japanese 10 Year Government Bonds (JGB): Japanese bond yields have not escaped the rise in yields across the world even though Japan data remains somewhat lacklustre. May Retail sales declined after a strong April. Some analysts said they were not that bad. The yield chart tells its own story of an improving economy.

May retail sales weren’t that strong, but I don’t think they were that bad either

Hidenobu Tokuda, senior economist at Mizuho Research Institute.

In a show of confidence in the recovering economy, the Bank of Japan upgraded its assessment of private consumption for the first time in six months at its June meeting, when it kept monetary policy steady. The government has also raised its overall view of the economy for the first time in six months because of the growth in private consumption

I have 4 contracts short JGB's and futures expiry is coming up. I put in a take profit target on one contract so that I only have 3 to rollover at maturity this week. That bid was taken in by the spread at 15076 as price stretched down to the previous lows for an 11 basis point profit (0.07%). Contract size is ¥1 million.

56 Percent Club

Another month passes and it is time to report on the stocks and options that have done better than 56 percent up. Each month, I review all my portfolios and tabulate the 56 percent movers from all time and highlighting the ones from the last 12 months. I review stocks and options separately.

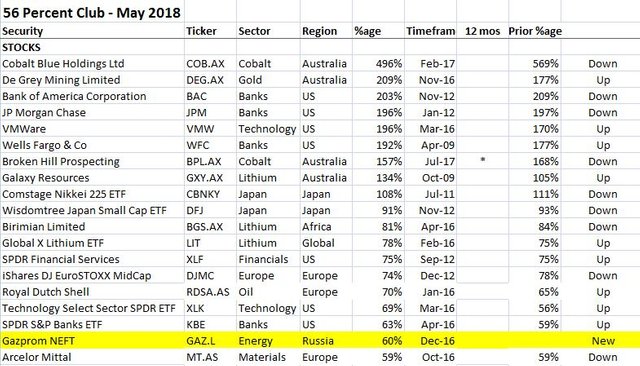

First is the table of stocks. I have highlighted ones that are new to the club in Yellow. I have also marked up whether they have gone up or down since last time.

What stands out?

- The list is shorter than last time (19 vs 23). There were 2 sales. Emeco Holdings (EHL.AX) would have been on the list. Global X Argentina ETF (ARGT) fell from grace after the sale

- No change in leadership with Cobalt Blue (COB.AX) dropping another 73% points but still close to 500%. I did sell some.

- In a challenging month half the list were risers in gold, technology, US banks, oil and lithium. Biggest mover up was Lithium producer, Galaxy Resources (GXY.AX) on the back of the sale of some of its salt brine tenements in Argentina.

- Dropping off the list are Dutch insurer, Aegon (AGN.AS), German Bank, Commerzbank (CBK.DE) and Cybersecurity supplier, FireEye (FEYE)

- Russian sanctions and Europe gas problems may have knocked Gazprom (OGZD.IL) off the list last month but new entrant is Russian Gas Supplier, Gazprom NEFT (GAZ.L)

- As last month only one of the 19 positions was bought within the last 12 months (Broken Hill Prospecting (BPL.AX).

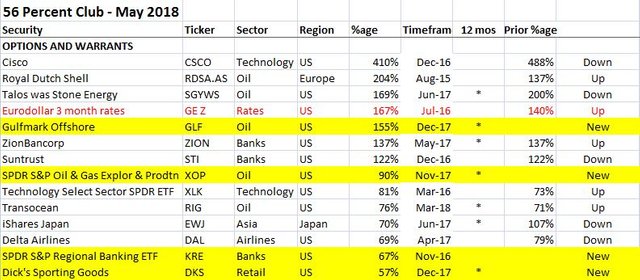

On the options side

What stands out here:

- A shorter list with 14 entrants vs 19 last time with 4 sold or rolled up for profits

- No change in leadership with Cisco (US Technology) dropping 78% points - since sold. I did sell or roll up holdings in US Banks (Fifth Third Bancorp (FITB) and Associated Bancorp (ASBC)), utilities Electricite de France (EDF.PA) and steel (ArcelorMittal (MT.AS)

- New entrants to the list are offshore oil driller, Gulfmark Offshore (GLF), US Oil Producers ETF (XOP), US Regional Banks ETF (KRE) and US retailer, Dicks Sporting Goods (DKS)

- Added back because of finger trouble last month is Zion Bancorporation (ZION)

- Fallen off the list are Europe Financials, Aegon (AGN.AS), Commerzbank (CBK.DE), Axa SA (CS.PA), ING NV (INGA.AS) and Zurich Insurance (ZURN. VX). It was truly a horror month for European financials - blame it on Italy. Also off is Cybersecurity supplier, FireEye (FEYE) and Russian ETF (RSX)

- After a stellar month in April, Europe's fall has been dramatic with only one counter left - oil giant, Royal Dutch Shell (RDSA.AS). It was also the fastest riser

- Oil plays now account for 5 out of the 14 places, most of which were bought in the last 12 months. Biggest surprise with that information is Delta Airlines (DAL) returning to the list. Oil is about 23% of its cost base.

There is a good question that arises when one compares the percentage rise for stocks versus options. There are stocks which have risen close to 200% (Bank of America or JP Morgan or VMware) but these do not feature at the top of the options list. A few reasons

- I like to roll up options to stay out-the-money so that I can win delta profits along the way - e.g,. I do have Bank of America options that I have been rolling from strike 11 since October 2012. Price is currently $30 level

- Options markets do not go out far in time compared to the holding time for stocks. Wells Fargo owned since April 2009 would have taken a lot of rolling up to still be in an options trade.

- Options markets for many of the US listed ETFs do not go out far in time - e.g., Global X Lithium ETF only has January 2019

- Many markets do not have liquid or any options (e.g., Australian mining stocks; UK stocks, Japanese stocks)

- Share prices have got quite high and contract sizes are above the size I like (e.g., JP Morgan at $107 needs $1,000 trade size for one contract)

- Implied volatility on some stocks, especially technology stocks, is prohibitive - e.g., 35% on VMWare

Cryptocurency

Bitcoin (BTCUSD): Price range for the day was $213 (2.7% of the high). Price stayed inside its tight trading range. The 4 hour chart shows the tightness

I watched an interview on CNBC with Brett Redfearn, SEC director of division and trading, where he talked about the regulatory challenges. The key takeout for me is that they understand the complexity (of global markets and of the difference between securities and commodities) and they see a need for regulation rather than closing access. The reality of the ICO markets has already overtaken them with most ICO's closed to US residents by the promoters.

https://www.cnbc.com/video/2018/06/06/sec-trading-markets-division-crypto.html

Moving right along this track, Coinbase acquires Keystone Capital, a FINRA registered broker dealer and a licensed alternative trading system (ATS) with a view to using this as the platform for its regulated crypto trading activity.

If approved, Coinbase will soon be capable of offering blockchain-based securities, under the oversight of the US Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA)

Coinbase President and Chief Operating Officer Asiff Hirji

CryptoBots

Outsourced Bot No closed trades on this account (212 closed trades). Problem children was unchanged (>10% down) - (14 coins) - ETH, ZEC (-41%), DASH (-44%), ICX, ADA, PPT (-40%), DGD, GAS (-47%), STRAT, NEO (-47%), ETC (-44%), QTUM, BTG (-47%), XMR.

PPT joined the -40% club and the worst at -47% is now a threesome of GAS, BTG, and NEO.

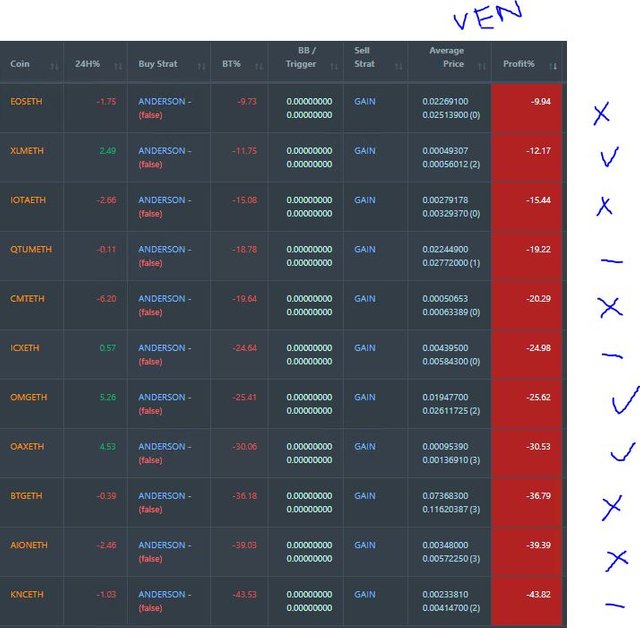

Profit Trailer Bot No closed trades. Dollar Cost Average (DCA) list remains at 12 coins with 4 coins improving, 3 flat and the other 5 worse. VEN pops on and off the list which has a -2% cutoff.

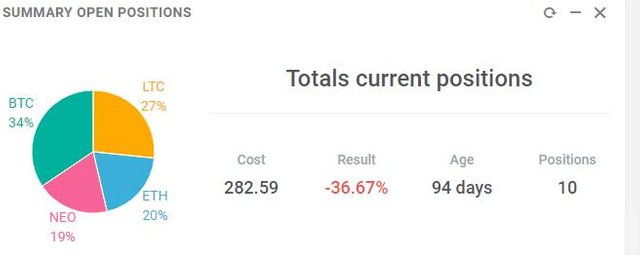

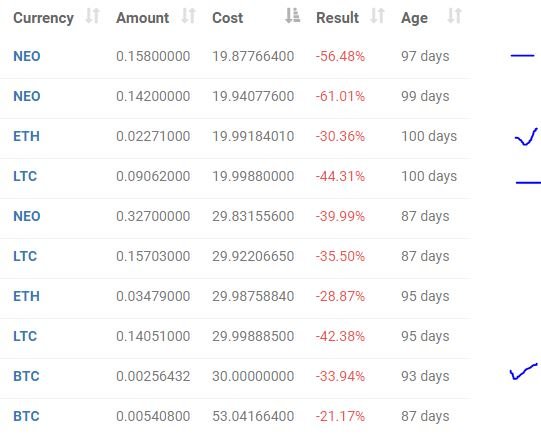

New Trading Bot Positions improved 1 point to -36.7% (was -37.4%).

NEO and LTC traded flat and ETH and BTC went up a point each

Currency Trades

Forex Robot did not close any trades and is trading at a positive equity level of 2.1% (higher than prior day's negative 1.8%). This bot has never traded with positive equity though it consistently closes trades at profit. Maybe it is time to check if the VPS is working.

Outsourced MAM account Actions to Wealth closed out 4 trades for 0.74% profits for the day.

Cautions: This is not financial advice. You need to consider your own financial position and take your own advice before you follow any of my ideas

Images: I own the rights to use and edit the Buy Sell image. News headlines come from Google Search and South China Morning Post and CNBC. All other images are created using my various trading and charting platforms. They are all my own work

Tickers: I monitor my portfolios using Yahoo Finance. The ticker symbols used are Yahoo Finance tickers

Charts: http://mymark.mx/TradingView - this is a free charting package. I have a Pro subscription to get access to real time forex prices

Bitcoin: Get started with mining Bitcoin for as little as $25 http://mymark.mx/Galaxy

June 6, 2018

Upvoted ($0.17) and resteemed by @investorsclub

Join the Investors Club if you are interested in investing.

Get your post resteemed to 72,000 followers. Go here https://steemit.com/@a-a-a

Awesome trades within your portfolio. I'm looking to short the airlines and somehow get into a Lithium play..I will have to check out that EFT.

Be aware that the LIT ETF invests in the full cycle of lithium. Only 60% is invested directly in materials. It has 3.5% in Tesla, for example

Source: http://etfdb.com/etf/LIT/

I have focused on going down a level - maybe looking at suppliers who can bring capacity on to market quickly - e.g., SQM.

Amplify have filed to launch a new ETF that goes wider than lithium in the battery world and will include some of the other materials (like cobalt). Its ticker will be BATT. That might be worth looking at when it launches.

https://whotrades.com/people/21440584/timeline/4390670?showMore=1

Welcome today is fun to transact.I've followed you. if you have time to stop by my blog.

really a good idea, thanks @carrinm i will always support you on this project.

ide yang bagus, terima kasih @carrinm saya akan selalu mendukung Anda dalam proyek ini.

Get your post resteemed to 72,000 followers. Go here https://steemit.com/@a-a-a