TIB: Today I Bought (and Sold) - An Investors Journal #329 - Marijuana, Corn, US Interest Rates, Altcoins

US markets bounce some more on Fed speak and China speak. Trade action is bottom fishing in marijuana, reversals in corn and replacing Eurodollar shorts closed at the weekend. Bitcoin breaks out

Portfolio News

Market Rebound

Fed chief, Jay Powell calms market nerves in a speech on Financial Stability. Market thinks he will not go overboard.

Larry Kudlow is also calming market nerves saying the talks with China are going ahead. Market fears on two key topics squared off a little - the Fed and China. That only leaves slowing growth concerns

Treasury yields respond with the yield curve steepening a bit - short term yields down a tad and long term yields up a tad. What a difference a day makes in the headlines.

Europe continues to drag along behind - fair to say both speeches happened after Europe closed.

Cannabis Carnival

Marijuana markets have been sliding. US States are edging along as well - progress in Michigan and pushback in Illinois.

Bought

Aphria Inc (APHA.TO): Canadian Medicinal Marijuana. Canadian cannabis stocks have taken it on the nose through the selloff post legalization as the speculators depart the market. Have been waiting for a bounce to average down my entry price. That bounce came along today for the 2nd day - added a small parcel to one portfolio.

Corn Futures: Corn. I added one more long corn futures contract on a price reversal. As commodity prices are priced in US Dollars, the Fed move did give a nice jump to corn prices as the US Dollar weakened. The trade idea is for long run demand for corn from China (see TIB245)

Shorts

Eurodollar 3 Month Interest Rate Futures (GEZ): IG markets confirmed professional status on my account which gave me a lower margin requirement. I applied some of that margin to replacing one short contract closed in last week's squeeze.

The chart looked tidy enough waiting for a break below the trading range. Fed speak changed the direction after the trade was made.

Cryptocurency

Bitcoin (BTCUSD): Price range for the two days was $584 (15.4% of the low). I wrote yesterday with this chart in a Facebook group I moderate

The big price moves makes past levels mostly useless. The last two days has seen price range between $3600 (buyers) and $4000 (sellers) (the purple channel). The top of that channel is where the buyers were last week. When price breaks out of these channels it will go hard and then retest. Do not be surprised.

Well did I get that right? Here is the chart 12 hours later - also a 4 hour chart.

The encouraging part is price has now got back into territory where past price levels (bottom dotted red line) may play a role again. I will be keen to trade this long again if price comes back to retest $4000.

Ethereum (ETHUSD): Price range for the two days was $26 (26% of the low).

This chart looks like a classic testing of a strong support level with price twice testing $100 and rejecting it. We have some way to go to say price has bottomed, maybe clearing the next resistance level at $132 and retesting it.

CryptoBots

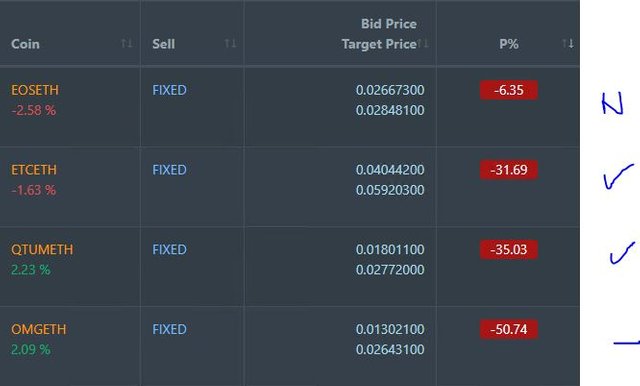

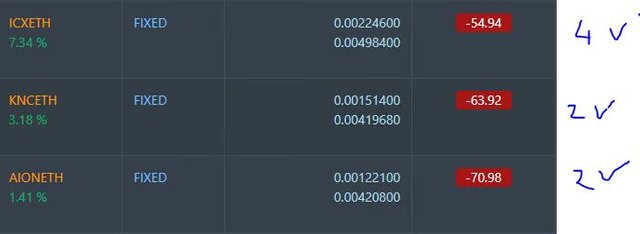

Outsourced Bot No closed trades. (222 closed trades). Problem children now at 19 coins. (>10% down) - ETH (-72%), ZEC (-65%), DASH (-69%), AE (-19%) LTC (-52%), BTS (-62%), ICX (-86%), ADA (-75%), PPT (-83%), DGD (-86%), GAS (-88%), SNT (-65%), STRAT (-78%), NEO (-85%), ETC (-67%), QTUM (-80%), BTG (-72%), XMR (-45%), OMG (-77%).

Coins moved in a band of 1 to 3 points, mostly up. GAS (-88%) remains the worst coin. STRAT (-78%) impoved 3 points to go up a level.

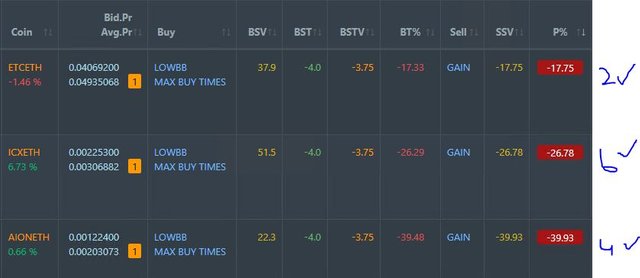

Profit Trailer Bot Six closed trades (3.16% profit) bringing the position on the account to 4.64% profit (was 4.26%) (not accounting for open trades). Average profit is distorted by high average profit on ZRX adjusted on cumulative holdings

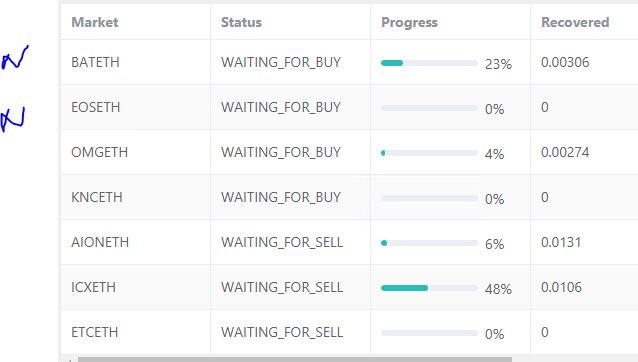

Dollar Cost Average (DCA) list drops to 3 coins with BAT moving off and onto profit

Pending list has seen some shuffling with 3 off (ZIL, ZRX, TRX) and 2 new (BAT and EOS). There were 8 coins with 2 new , 4 coins improving, 2 coins trading flat and 0 worse. (Image capture problems - only 7 showing - BAT went Nov 29)

PT Defender roll has seen some changes too with ZIL, ZRX and TRX completing defences. I added BAT and EOS to the list. BAT completed Nov 29.

New Trading Bot Trading out using Crypto Prophecy. Trades closed on TRX (1.85% open for 22 days) and NXS (1.82% open for one month). Trades remain open on FUEL, XLM, VET and SC

Currency Trades

Australian Dollar (AUDUSD): Sold US Dollars to fund pension payments in my Australian pension portfolio. Disappointing to see AUD strengthen by 4% in the last month. I have needed to make this transfer for a little while now and was not really paying attention.

Forex Robot closed 14 trades (0.46% profit) and is trading at a negative equity level of 2.9% (higher than prior 1.9%).

Cautions: This is not financial advice. You need to consider your own financial position and take your own advice before you follow any of my ideas

Images: I own the rights to use and edit the Buy Sell image. News headlines come from Google Search. All other images are created using my various trading and charting platforms. They are all my own work

Tickers: I monitor my portfolios using Yahoo Finance. The ticker symbols used are Yahoo Finance tickers

Charts: http://mymark.mx/TradingView - this is a free charting package. I have a Pro subscription to get access to real time forex prices

Bitcoin: Get started with mining Bitcoin for as little as $25 http://mymark.mx/Galaxy

Crypto Prophecy provides a useful tool to identify oversold and overbought coins - https://mymark.mx/CryptoProphecy

November 28, 2018

In hearing the news and reading online, I started to hear comments on the “Trump Put” as he continues to influence both fiscal and monetary policy. While great for the short term, it lead me to longer term concerns regarding the sustainability of this approach.

Posted using Partiko iOS

The market will always come back to the data. The problem is people tend to rely more heavily on the last things that happened and assume they will keep going on. Trumpisms influence that short term response system enormously. What I am finding is Trump always goes back to his election agenda like it is a to-do list. His attention will go away from that, the data will show what really is going on and then it will be back to agenda. If that is true, the way to unravel his impact on markets is to discount the words and focus on the impacts of his agenda.