TIB: Today I Bought (and Sold) - An Investors Journal #330 - Japan (Electronics, Industrials, Pharma), US Retail

A trade ceasefire helps market moods over the weekend. Trade action in my portfolios is a rotation in Japan stocks - profits banked and first replacements found. Retail does not bounce enough for 1st year in 34.

.png)

Portfolio News

Market Jitters

Friday markets moved higher again despite misgivings about the trade situation.

The key news for the weekend was the agreement between US and China to suspend further new tariffs for 90 days to give chance for discussions to progress. The detail is that China has to demonstrate progress on 4 key fronts

- Better access to China markets

- Intellectual property theft

- Forced technology transfer

- Cybersecurity

A key agreement is China did agree to crack down on the sales of Fentanyl by making it a controlled substance. Fentanyl is a key constituent in opioid drugs. China also agreed to place orders on a wide range of US goods (agricultural and industrial)

The impact of the actions was immediate. US Dollar weakened. Commodity prices jumped. Asian and Australian stocks went up. Europe and US stock futures jumped. In my portfolios, as an example, corn futures gapped higher almost back to last highs

Some reality is needed. There is a lot to prove in 90 days but this could be a little better than just kicking the can down the road as there is a clear agenda out in the public domain.

Bought

I have been invested directly in Japanese stocks for several years and have been waiting for the big winners (say 100% plus or even 56% plus). What I observe is pricing is quite volatile and we do not see really big moves happening. I decided to change my approach to exiting Japan stocks and to set a hurdle take profits level. The hurdle is an arbitrary 35% and I replace with stocks that meet a Price to Book or Price to Sales or Price Earnings screen level.

Sankyo Kasei Corporation (8138.T): Japan Industrials (mostly chemicals). I ran my stock screens for Japan. Sankyo Kasei appeared on both Price to Book and Price to Sales screens. The chart shows a steady decline from late 2017 highs and a break through the weekly downtrend line.

The business operates in a wide range of sectors in Japan which are less prone to tariff action from US - though the price has suffered from the market falout. Financials show increasing revenues, a very low debt to equity ratio (too low in my view) and a 3.16% dividend yield, which is high by Japan standards

Sold

Medipal Holdings (7459.T): Japan Pharma. 39% profit since March 2017

NEC Corp (6701.T): Japan Electronics. 39% blended profit May/June 2016

Expiring Options

SPDR S&P Retail ETF (XRT): US Retail. Short term trade reached expiry date and expired worthless. Trade idea was to follow an idea that has worked for 33 years in a row. Buy Home Depot (HD) on the Thursday before Thanksgiving and hold for 10 days after. I set this up as a bull call spread for November 30 expiry (8 days after) using XRT on a Jim Cramer idea. One can just say that 1 year out of 34 is just bad luck. The options trade was not helped by a big selloff in low volume in the week of Thanksgiving. Price was never going to recover - see the updated chart. The trade was started at the start of the pink rays

Now I did rollout one portfolio's trade to December 6 - i.e., one more week for an additional $0.26 net premium. Looking at the updated chart, that was a dumb idea. It is going to need a miracle to prove a winner. Maybe the tariffs ceasefire is that miracle.

Cryptocurency

Bitcoin (BTCUSD): Price range for the weekend was $548 (12.5% of the high). I wrote "do not be surprised to see a retest of $4,000". Well price did do that twice on a 4 hour chart but made a lower high the 2nd time around. The sellers wanted to prevail and they pushed price back below the support level at $4032.

I have been holding off trading Bitcoin in my IG Markets account. I did trade the retest on a 4 hour chart and closed one trade for $67 per contract profit (1.6%) and opened another on the next retest. That trade is currently underwater. I have reduced trade size from what I was doing previously (0.2 BTC each now).

Ethereum (ETHUSD): Price range for the weekend was $14 (11.4% of the high). Price wandered around in the middle of "no mans land" between the sellers at $132 and the buyers at $100. Volatility was lower than Bitcoin which has happened now a few times in the last week.

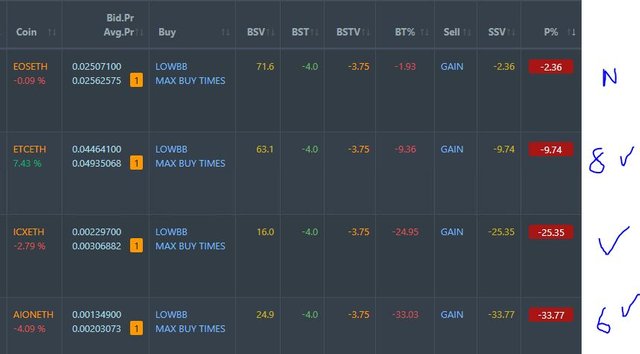

CryptoBots

Outsourced Bot No closed trades. (222 closed trades). Problem children remains at 19 coins. (>10% down) - ETH (-73%), ZEC (-64%), DASH (-70%), AE (-25%), LTC (-52%), BTS (-63%), ICX (-86%), ADA (-75%), PPT (-84%), DGD (-86%), GAS (-88%), SNT (-65%), STRAT (-78%), NEO (-85%), ETC (-65%), QTUM (-81%), BTG (-72%), XMR (-47%), OMG (-76%).

Coins moved in a tight band either side just up or just down. AE dropped 6. GAS (-88%) remains the worst coin. DASH (-70%) and AE (-25%) dropped a level each.

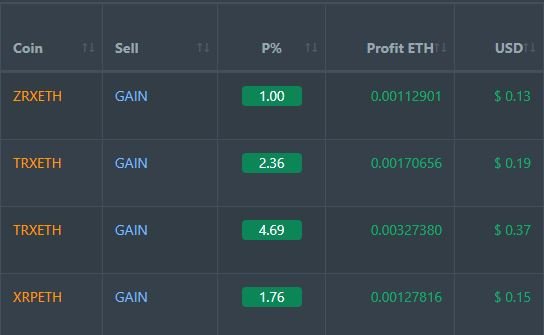

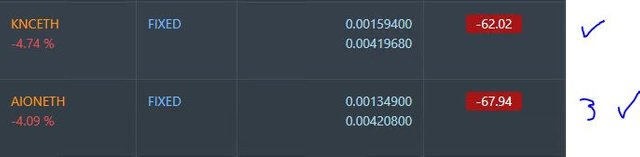

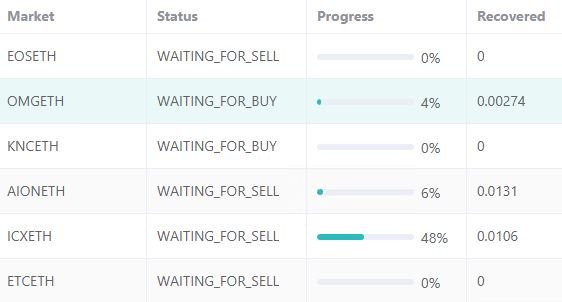

Profit Trailer Bot Four closed trades (2.45% profit) bringing the position on the account to 4.77% profit (was 4.64%) (not accounting for open trades).

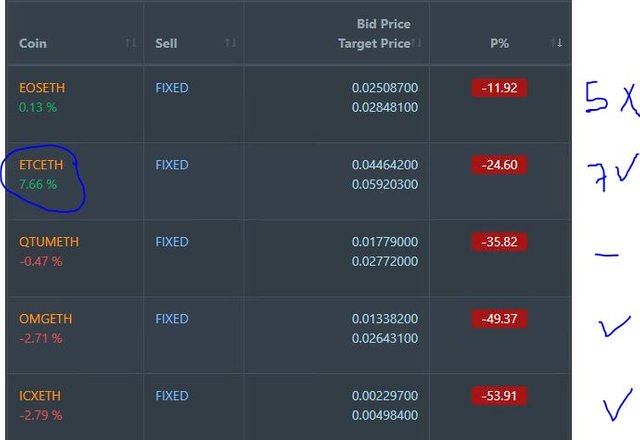

Dollar Cost Average (DCA) list increases to 4 with EOS added in on a PT Defender trade. Biggest move up was ETC (+8 points)

Pending list drops to 7 coins with BAT closed out for profit. 5 coins improving, 1 coin trading flat and 1 worse.

PT Defender is defending 6 coins with BAT completed on Nov 29. I have only one coin for which defence has not begun (QTUM). I will wait to clear a few more before I start that defence.

New Trading Bot Trading out using Crypto Prophecy. No closed trades

Currency Trades

Forex Robot closed 4 trades (0.13% profit) and is trading at a negative equity level of 3.7% (higher than prior 2.9%).

Outsourced MAM account Actions to Wealth closed out 2 trades for 0.2% profits

Cautions: This is not financial advice. You need to consider your own financial position and take your own advice before you follow any of my ideas

Images: I own the rights to use and edit the Buy Sell image. News headlines come from Google Search. All other images are created using my various trading and charting platforms. They are all my own work

Tickers: I monitor my portfolios using Yahoo Finance. The ticker symbols used are Yahoo Finance tickers

Charts: http://mymark.mx/TradingView - this is a free charting package. I have a Pro subscription to get access to real time forex prices

November 29-30, 2018

While I think that all the outstanding items will not be completely addressed, I believe that discussions are better than just taking action. Both leaders must have recognized that the path they were headed was not good for anyone.

Posted using Partiko iOS

Exactly right. I think we will see the normal Trump tactics playing out for each of the agenda points. This is good news as it is a specific list rather than the high level list of trade imbalances. The hard part is 90 days will whizz by and there is a lot more work than can be done in 90 days.

What's the rationale for Home Depot (HD) on the Thursday before Thanksgiving and hold for 10 days after.

Also, why do you think Bitcoin is a buy at the moment.

One of Jim Cramer's mates did a technical analysis of HD. In every year for 33 years it was higher 10 days after Thanksgiving from the Thursday before. That said, I did not go back to the charts to check. I relied on someone else doing the research.

The Bitcoin trade is based on the way traders have been relying on short term levels to do their trading. With price dropping below the last support level ($4000 from September 2017) there are no levels to $3000 from June 2017. I have observed that short term levels carry more weight than we see in other markets. Price bounced between $3600 (a short term level) and $4000 (a longer term level) for about 10 days. When it broke above $4000, I expected it to pull back and retest, which it did twice.

So the trade is purely technical. My long term view is Bitcoin is not going away - so I only trade it long. Risk in the trade is when the big banks and the central banks and fiat governments decide to close it down or restrict access. The weekend action by Binance to close down access to customers residing in "sanctioned countries" is an example of the risk.