TIB: Today I Bought (and Sold) - An Investors Journal #361 - US Semiconductors, Video Gaming, US Banks, US Beverages, Marijuana

Europe led the rally sentiment with US lagging a bit. Trade action is focused on a few earnings opportunities looking for the market to keep mispricing its assessments. One specific hedge put in place. Time to read more of The Second Leg Down which I bought last week.

Portfolio News

Market Rally Returns

US markets had a quiet day focused on earnings

The lead came from Europe which had a solid day. It did help sentiment that US delegation headed off to China to continue the trade talks.

Bought

Aurora Cannabis Inc (ACB.TO): Canadian Marijuana. Added a small parcel to average down entry price in two of my portfolios.

I had not even noticed the earnings announcement which showed solid revenues but week profits. Ballooning losses (journalist words) are not surprising for a growth industry though some of the cost moves are uncomfortable.

https://www.investors.com/news/marijuana-stocks-aurora-cannabis-stock-aurora-cannabis-earnings/

The Coca-Cola Company (KO): US Beverages. Coca Cola reports earnings this week. Analysts are expecting an earnings pop. CNBC Options Action trade idea was to buy call options and ride the pop. I chose to limit the exposure and bought a May 2019 50/52.5 bull call spread for a net premium of $0.90. This offers maximum profit potential of 177% if price moves 5.8% from the $49.61 close.

The chart shows shows the bought call (50) as a blue ray and the sold call (52.5) as a red ray with the expiry date the dotted green line on the right margin. The profit target is below a 1.27 Fibonacci extension - that feels doable though this does take the trade into new high territory.

NVIDIA Corporation (NVDA): US Semiconductor. CNBC Options Action idea trying to find a way to reduce cost of entry to buy into NVIDIA. Basic premise is the stock has been beaten up enough but it feels expensive to buy it at current levels. The trade is called a Call Spread Risk Reversal. With closing price of $146.45, first level of the trade is to buy a bull call spread one strike out-the-money. This opens up the upside for a move higher but caps the profit. The second level of the trade is to sell a put below the current price at a level one would be happy to enter the trade. This put funds a big slice of the premium paid for the bull call spread.

Bought April 2019 150/160 bull call spread for $3.62 net premium. This alone offers 176% profit potential if price advances 9.3% and reaches reaches $160 in a little over two months. The sold put reduced the net premium to $0.55 - if price reaches $160 the profit potential is 1718%. Of course if price lands up anywhere lower than $150 and above $130, the trade loses and I lose $55. If price is below $130, I get to buy the stock at $130. Let's look at the chart which shows the bought call (150) and 500% profit as blue rays and the sold call (160) as a red ray and the sold put (130) as a pink ray with the expiry date the dotted green line on the right margin.

All price has to do is get back to 2019 highs (which are well off 2018 highs to make the maximum. Risk in the trade lies in price dropping below the 2019 lows to the 2018 lows (130 vs 120). I would not be unhappy buying this stock for the long haul at the 2019 lows.

Take-Two Interactive Software, Inc (TTWO): Video Gaming. Markets have smashed video gaming after disappointing results principally from Electronic Arts (EA). Jim Cramer view is all stocks in the sector got tarred with the same brush - he likes Take Two.

I made a trade management decision to add to my position at lower strikes. I am holding January 2021 105/140 bull call spread. With price dropping to $97.14 last week, I was looking for a new spread. Monday proved to be another down day and price dropped more on Activision Blizzard earnings (ATVI) and closed at $93.44. I added a January 2021 95/115 bull call spread for a net premium of $7.37 offering maximum profit potential of 171%. Price has just under 2 years to recover half of the 47% it has lost in this selloff. The updated chart shows the new trade as pink rays with the bought call at the level of the 2018 lows.

I have left the price scenarios that I used last time in place. Get one of those blue arrows and both trades will reach maximum potential. See TIB324 for the initial trade rationale - betting on Red Dead Redemption II.

Shorts

Citigroup Inc (C): US Bank. Bought April 2019 60/50 bear put spread for net premium of $1.70 as a hedge trade for long positions I am holding. This offers maximum profit potential of 488% in the unlikely event that price drops 19% from the $61.61 close. A quick look at the chart which shows the bought put (60) and 100% profit as red rays and the sold put (50) as a blue ray with the expiry date the dotted green line on the right margin.

Price has just to get back to recent lows to make the maximum profit. Note: this is a hedging trade. I will be better off if the trade goes the other way as I am long the stock.

Expiring Options

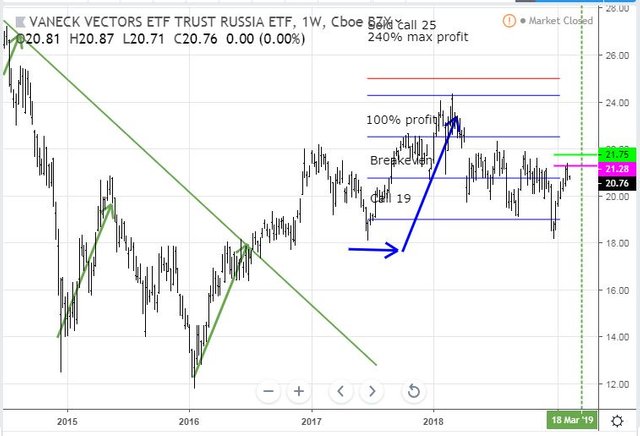

VanEck Vectors Russia ETF (RSX): Russia Index. Rolled out February expiry 20 strike call option to March 21 strike call option. This locks in 44% profit since the last roll up in Jan 2019. The roll up had passed $21.28 breakeven last week and then fallen back. This trade claws back $0.23 per share which is not enough to recover fully premiums paid thus far. Quick update on the chart which shows the first trade I am trying to manage out.

New breakeven is now $21.75 (green ray). I only rolled 2 of the 3 contracts that were open (in error). That trade breaks even at the pink ray. I will roll it up overnight to give the whole trade more time to get to 2019 highs which is where breakeven is.

Cryptocurency

Bitcoin (BTCUSD): Price range for the day was $74 (2% of the high). Price drifted off the highs and the whole trade feels like "no mans land"

Ethereum (ETHUSD): Price range for the day was $6 (5% of the high). Like Bitcoin, price drifted off the highs and the whole trade feels like "no mans land" comfortably above the short term support (yellow ray)

CryptoBots

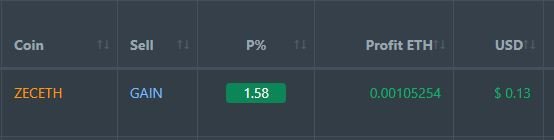

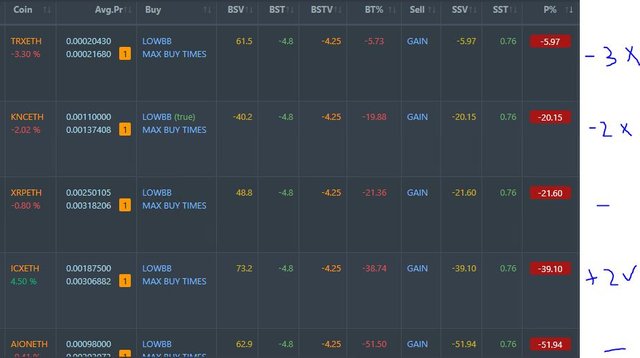

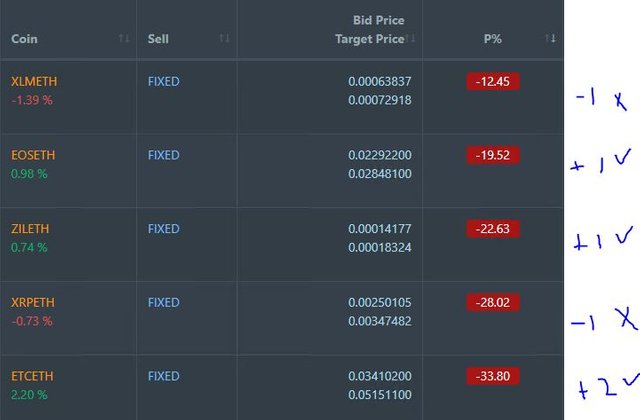

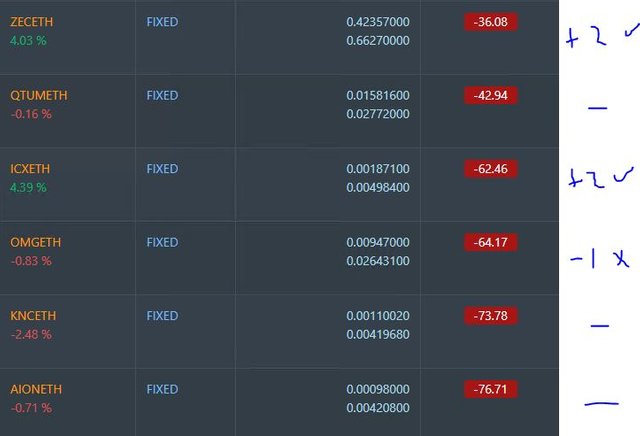

Profit Trailer Bot One closed trade (1.58% profit) bringing the position on the account to 5.65% profit (was 5.64%) (not accounting for open trades).

Dollar Cost Average (DCA) list remains at 5 coins - not much movement

Pending list remains at 11 coins with 5 coins improving, 3 coins trading flat and 3 worse.

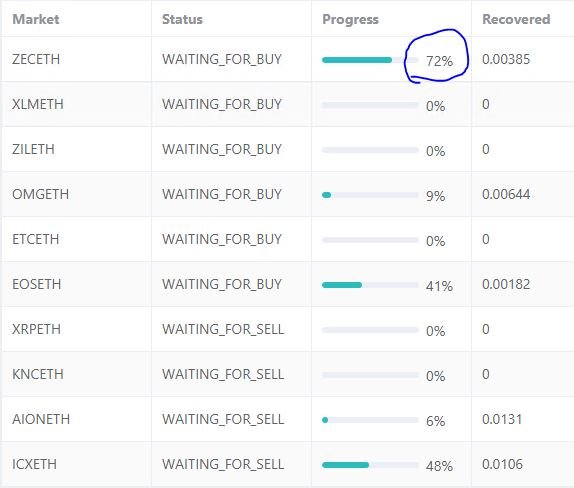

PT Defender continues defending 10 coins. One trade completed on ZEC.

New Trading Bot Trading out using Crypto Prophecy. No closed trades.

Currency Trades

Outsourced MAM account Actions to Wealth has 2 trades open on USDJPY (new pair) which are trading profitably.

Cautions: This is not financial advice. You need to consider your own financial position and take your own advice before you follow any of my ideas

Images: I own the rights to use and edit the Buy Sell image. News headlines come from Google Search. All other images are created using my various trading and charting platforms. They are all my own work

Tickers: I monitor my portfolios using Yahoo Finance. The ticker symbols used are Yahoo Finance tickers

Charts: http://mymark.mx/TradingView - this is a free charting package. I have a Pro subscription to get access to real time forex prices

February 11, 2019

Have you seen EA the last couple of days, wow they caught some bids?

Oh yes. I was supposed to sell it when I bought Take Two in November. Did not happen - so I have been watching it through earnings. Market sure is over reacting - and taking some time for the bottom fishers to come along. Quite a few of the practitioner talking heads talk about a 3 day rule. On EA on Monday, one said he was applying a one week rule. I guess the week is up

I like the Nvidia setup as it is a great risk/reward setup and “worst case” a good entry point for a solid Company.

Posted using Partiko iOS

Nvidia results prove the setup. Price moved in after hours above $160 - the sold call cap. I will close the 150/160 call spread out when market opens and leave the sold 130 put in place