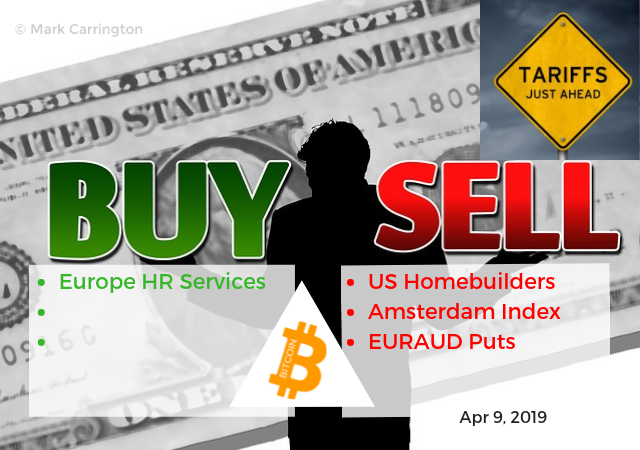

TIB: Today I Bought (and Sold) - An Investors Journal #396 - HR Services, Amsterdam Index, US Homebuilders, Australian Dollar

Markets slide a little as IMF rolls out its slowing growth story. Profits taken in Amsterdam and on Australian Dollar. For the rest trades are to fix finger trouble.

Portfolio News

Market Rally

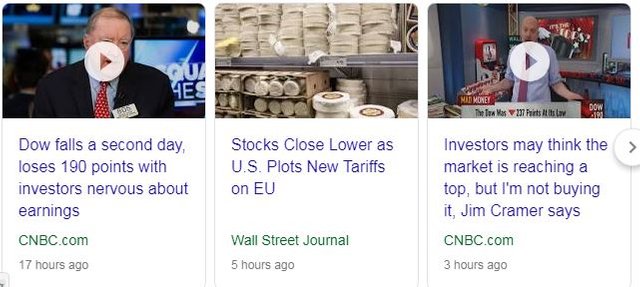

Markets took a breather citing concerns about slowing growth again

This mood was pushed along with another IMF forecast of reduced global growth. Well it was the same forecast as the week before but just given more headline space.

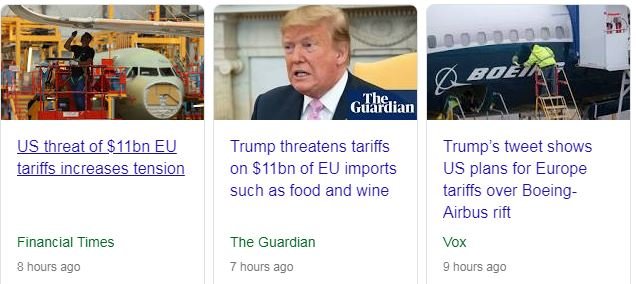

More disturbing are proposed US tariffs on a range of European goods (cheese and wine) in retaliation for subsidies from Europe for Airbus. The timing is not coincidental. 3 thoughts come to mind.

- Diverts attention away from Boeing

- China trade talks are progressing and Donald Trump goes back to his agenda. This worries me.

- Chinese Premier is in Europe having trade talks.

Bitcoin Mining

China announces thoughts to ban crypto mining.

There is a consultation period until May 7, 2019. The China view is that mining is wasteful on electricity resources and contributes unduly to pollution levels. The implications are wide ranging with China dominating something like 70% of Bitcoin mining, for example. The way price has reacted suggests that nobody believes that it will happen and/or China miners will redeploy their equipment elsewhere in good time. The decentralised nature of mining says the slack can be taken up elsewhere.

https://www.newsbtc.com/2019/04/09/china-bitcoin-mining-ban-crypto/

Bought

Randstad NV (RAND.AS): Europe HR Services. Noticed a trade error on covered calls written against this stock. In a portfolio that is not allowed to hold short positions, I somehow landed up with 2 contracts written with only enough stock to cover 1. Price has moved against the trade to buy the call back, so I bought the stock which is just out-the-money (€45.40 at trade time vs 46 strike). Price closed at €45.56 - this could well be assigned on expiry next week.

Sold

Amsterdam Index (AEX): Amsterdam Index. Sold December 2021 strike 500 call options for 11% profit since March 2017. Price has been above and below strike and just broke back into profits. I am holding strike 600 call options in this account. In this time, Euro has risen 13% against the Australian Dollar - more than double the stock move.

Quick look at the charts which shows the call just closed (500) as pink rays and the open call (600) as blue rays. The chart shows that the entry was well timed though the trade has only ever gone past breakeven (top pink ray) by relatively small margins each time.

Maybe it was an impatient exit BUT there are the 600 calls above which will move more than the 500's (as they are out-the-money). There are still 20 months to go to expiry BUT it does not look to me like price will even get to strike. I will add in one more reference point and compare this index to Europe top 100 stocks - quite an outperformance from Amsterdam = almost double. Why? Fewer financials in AEX and strong performance from Royal Dutch Shell and ASML.

Shorts

SPDR S&P Homebuilders ETF (XHB): US Homebuilders. Closed out trade error from Monday trades on June 2019 strike 38 call options. Booked 2% profit and covered trading costs.

Cryptocurency

Bitcoin (BTCUSD): Price range for the day was $152 (2.9% of the high). Price took a breather and made an inside bar with a close just below half way.

What is interesting is price did not budge on news that China are thinking about banning crypto mining.

Ethereum (ETHUSD): Price range for the day was $6 (3.3% of the high). Price also makes an inside bar and straddles the resistance level at $177.80. April 10 price has just pushed above the high of the prior day = looks like it wants to break higher.

CryptoBots

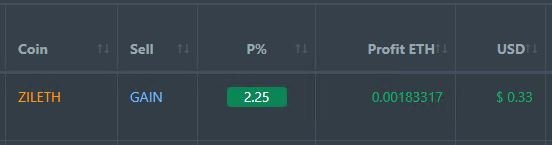

Profit Trailer Bot One closed PT Defender trade (2.25% profit) bringing the position on the account to 7.95% profit (was 7.92%) (not accounting for open trades).

New Trading Bot Trading out using Crypto Prophecy. No closed trades.

Currency Trades

Australian Dollar (EURAUD): Closed out a 3 month 1.61 put option for 42% profit. With expiry due on April 12, I did not want to manage a spot position. Then I read what I wrote when I set up the trade in TIB346. The trade was set up to hedge pension payments against a move in the Australian Dollar predicated on improving trade relations with US and China - i.e., the idea was to go to exercise.

Well the trade did go largely to plan. Here is the updated chart. Price certainly started out on the red arrow price scenario and has stalled 3 times as price works along a parallel channel.

The big question is should one go again and look for a break below the 1.58 level?

Outsourced MAM account Actions to Wealth closed out 3 trades on AUDNZD for 0.09% losses for the day. Trades open on AUDNZD (0.46% negative)

Cautions: This is not financial advice. You need to consider your own financial position and take your own advice before you follow any of my ideas

Images: I own the rights to use and edit the Buy Sell image. News headlines come from Google Search. All other images are created using my various trading and charting platforms. They are all my own work

Tickers: I monitor my portfolios using Yahoo Finance. The ticker symbols used are Yahoo Finance tickers

Charts: http://mymark.mx/TradingView - this is a free charting package. I have a Pro subscription to get access to real time forex prices

Bitcoin: Get started with mining Bitcoin for as little as $25 with mines based in US http://mymark.mx/Galaxy

April 9, 2019

I am surprised that investors are concerned on stock prices adter the sharp recovery we have seen and the uncertainties that remain. We have the Fed that seems to have given a put option to investors and while corporate profits may decrease, the fact is that they remain generating positive cash flows and returning capital. I feel that there is still something missing though but not sure what!

Posted using Partiko iOS

The last crash smashed investor psychology. The worst days are when there is no data and only opinions.

I watched the presentation by the IMF Chief Economist talking about the growth forecasts. My thought was she was not old enough to know a good forecast from a bad one. She is still working from the university textbooks. And that is what people have to listen to.

Tony Dwyer did a segment this week talking about earnings revisions. and actual results. His view is that the data will surprise as earnings work their way through and estimates will be raised during the cycle. Here is the link which will start when he discusses earnings