TIB: Today I Bought (and Sold) - An Investors Journal #429 - Semiconductors, Cloud Computing, US Telecom, Euro, India, Nasdaq Index, Australian Dollar, Ripple, Ethereum, Bitcoin

Markets hate the new round in the tariff war. For me it was time for bargain hunting in technology and telecom. The crypto carnival continues with tidy profits racked up. Forex trading in spot markets is not my friend but I do win in options.

Portfolio News

Tariff Tantrum

Markets hate the new tariffs

I wrote last week

Either this is a huge game of chicken or he does not have a clue.

In another post I used the words barking mad. When the only tool one has is a hammer, everything looks like a nail. Using tariffs as a weapon for achieving a social aim to stop illegal migrants is not normal = barking mad. Maybe the bigger problem should be fixed at home - kill the reasons for drugs. Even Jim Cramer was not very complimenetary about the idea

Yields take another tumble. Am sure pleased I started building up my bond positions when I did.

Bought

Jim Cramer was nibbling at semiconductor and cloud computing stocks to get average entry price lower. He chose Nvidia and Twilio. I added Xilinx to add to 5G capability. My positions are all small and are well below standard position size.

NVIDIA Corporation (NVDA): US Semiconductors.

Twilio Inc (TWLO): US Cloud Computing

Xilinx, Inc. (XLNX): US Semiconductors.

AT&T Inc. (T): US Telecom: CNBC Options Action team talked about AT&T in their show last week. I did not act then as I was already holding a January 2020 33/40 bull call spread in one portfolio. I added a Jan 2020 32/35 bull call spread. With prior closing price at $31.86, this is one strike out-the-money. Net premium of $0.81 offering maximum profit potential of 270% for a 14% price move from Friday closing price.

Quick update of the chart which shows the new trade as pink rays with the same expiry as the existing trade.

All price has to do is get back to pre-selloff highs to make the maximum profit. Of note is how much lower implied volatility was on this trade - a spread that is one third the size of the other trade is offering profit potential of 2/3rds

Shorts

ProShares UltraPro Short QQQ (SQQQ): Nasdaq Index. Interactive Brokers responded to my ticket about the options they liquidated in error following the 1:4 consolidation last week. They reinstated the trades on June 2019 strike 11 and strike 12 sold calls (equating to current price of $44 and $48). At Friday closing price the 11 calls are in-the-money and would be assigned. I did add to the covered calls on the other stock I bought last week.

Sold June 2019 strike 52 calls for 2.33% premium (2.45% to purchase price). Closing price $42.41 (new trade). Price needs to move another 22.6% to reach the sold strike (new trade). Should price pass the sold strike I book a 29% capital gain. As this is a hedging trade, I will not mind stock being called away at a profit

Expiring Options

Euro (EURUSD): Strike 1.16644 12 month put option exercised at maturity (May 23). Closed the spot position to bank 123% profit in 12 months (profit mix comes from the EURUSD trade and the decline in Australian Dollar over the last 12 months. Quick update of the chart shows the bought put option. Good to have a trade more right than wrong.

As the trade was exercised to a spot position, I could choose to manage the trade. I am concerned that the chart has formed a triple bottom and with talk of the Federal Reserve cutting rates next time, we could see a big rebound in the Euro. Time to bank the profits.

Income Trades

Wisdom Tree India Earnings Fund (EPI): India Index. Modi win in elections has propelled Indian stocks. Sold June 2019 strike 27 calls for 0.76% premium (0.95% to purchase price). Closing price $26.31 (new trade). Price needs to move another 2.6% to reach the sold strike (new trade). Should price pass the sold strike I book a 31% capital gain.

Cryptocurency

Bitcoin (BTCUSD): Price range for the weekend was $366 (4.5% of the low). Price wanted to test for buying support around $8400 and found buyers there to edge up towards the level above short of $8891.

1 trade closed with profits of $441.74 per contract (5.3%)

Ethereum (ETHUSD): Price range for the weekend was $36 (14% of the open). Price makes an inside bar following the huge engulfing bar from Thursday and then inches higher without wanting to test the resistance at $277.

Active weekend trading with 1 trade closed and one replaced on a 1 hour reversal. Profits were $8.20 per contract (3.2%)

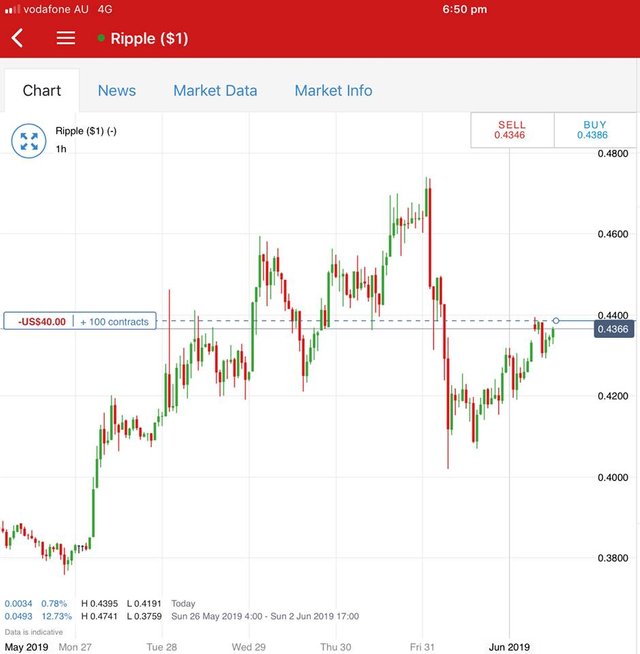

Ripple (XRPUSD): There has been a lot of chatter about Ripple with people wondering when it would catch the Bitcoin run up. Despite my misgivings about margin requirements on the trade, I opened one contract for 100 XRP. Watched the chart over the weekend and put on trailing stop this morning which was taken out for $0.0012 per contract profit (0.27%). I will not trade this again as I can trade Ethereum for larger value and lower margin.

To my eye, this chart looks remarkably like the Ethereum chart - no need to trade both.

CryptoBots

Profit Trailer Bot Seven closed trades (1.53% profit) bringing the position on the account to 8.50% profit (was 8.34%) (not accounting for open trades). Two of these trades came from DCA and two were with PTD closing trades.

PT Defender now defending 11 coins.

New Trading Bot Trading out using Crypto Prophecy. No closed trades

Currency Trades

Australian Dollar (AUDUSD): Trade stopped out for 1% loss. I was not wrong writing that trade could either way. Trade was basically taken in by the spread and never looked like winning as investors deserted the US Dollar.

Outsourced MAM account No Actions to Wealth closed trades. Trades open on AUDCAD (0.18% negative)

Cautions: This is not financial advice. You need to consider your own financial position and take your own advice before you follow any of my ideas

Images: I own the rights to use and edit the Buy Sell image. News headlines come from Google Search. Tweet comes from Twitter.com. All other images are created using my various trading and charting platforms. They are all my own work

Tickers: I monitor my portfolios using Yahoo Finance. The ticker symbols used are Yahoo Finance tickers

Charts: http://mymark.mx/TradingView - this is a free charting package. I have a Pro subscription to get access to real time forex prices

Bitcoin: Get started with mining Bitcoin for as little as $25 http://mymark.mx/Galaxy

May 31, 2019

It seems I will have a relatively cheap European vacation next week with the Euros weakness! Probably will take some time to think all this over as it doesn’t really look good from here!

Posted using Partiko iOS

I just paid for mine with that trade. Makes up for a few others

Posted using Partiko Android

Hi, @carrinm!

You just got a 0.43% upvote from SteemPlus!

To get higher upvotes, earn more SteemPlus Points (SPP). On your Steemit wallet, check your SPP balance and click on "How to earn SPP?" to find out all the ways to earn.

If you're not using SteemPlus yet, please check our last posts in here to see the many ways in which SteemPlus can improve your Steem experience on Steemit and Busy.