TIB: Today I Bought (and Sold) - An Investors Journal #448 - Rare Earths, Semiconductors, Marijuana, Healthcare, payments, Gold Mining, South Africa, Interest Rates, Corn, Bitcoin

Massive selloff coincides with first week back In the trenches. My week spent banking some profits on the shorts and hedge trades and cherry picking at a few long term holdings but mostly staying quiet.

Portfolio News

Market Selloff

It was a quiet market time while I was travelling. All hell broke loose when the new China tariffs were announced on August 2.

I had an inkling that something was happening as agricultural commodity prices collapsed before the announcement. The tweet came out on August 2 but corn prices had already collapsed by 6% on July 31 and August 1.

The market knew that something was up in the trade discussions or they knew what was coming in the tweet storm. The supply side of corn is not looking good with the wet spring in the Mid West - price move had to come from the demand side (or fear)

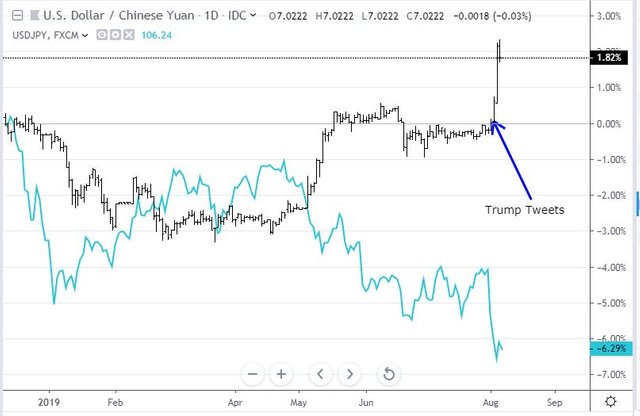

Now all the talk is about currency manipulation - we have seen this before. My view: As soon as there is an escalation in the trade war, capital wants to leave China. The reality of China is a lot of people have made substantial fortunes over the last 10 years. When things get rocky they want to escape their own currency. It is the way markets work. Just look at the Bitcoin price charts a little further on in the post. The next chart plots China currency (black bars) against the Japanese yen (blue line). Is this manipulation or massive moves of capital?

Currency manipulation is a standard way of using the media to stoke up the fear and the popular vote. These sorts of moves take a lot of capital.

Bought

Buying activity was mostly to do with cherry picking

Northern Minerals Limited (NTU.AX): Australian Rare Earths. Took up allocation on share purchase plan

Arafura Resources Limited (ARU.AX): Australian Rare Earths. Took up allocation on share purchase plan

Harvest One Cannabis Inc (HVT.V): Canadian Marijuana. Initiating position in one portfolio on day price in Aphria (APHA.TO) jumped on results.

Advanced Micro Devices, Inc (AMD): US Semiconductors. Replacing stock assigned on covered call on a pullback day.

Lam Research Corporation (LRCX): US Semiconductors. Averaging down on a pullback day.

Marvell Technology Group Ltd (MRVL): US Semiconductors. Averaging down on a pullback day.

Tilray, Inc (TLRY): Canadian Marijuana. Averaging down entry price on position in one portfolio on day price in Aphria (APHA.TO) jumped on results.

UnitedHealth Group Incorporated (UNH): US Healthcare. Averaging down on a pullback day.

Square, Inc (SQ): US Payments Provider. Sold stock ahead of earnings for 13% profit since June 2019 and bought back after earnings came out with entry 16% lower. Too bad I did not make the sale of my entire holding.

Sold

Bank of America Corporation (BAC): US Bank. Sold a January 2021 27/40 bull call spread for 25% profit since November 2017 so that I could start to write covered calls against the stock in one portfolio. With rates falling the price has no chance of reaching the sold call by expiry from the $29.49 close on trade day.

iShares 20+ Year Treasury Bond ETF (TLT): US Interest Rates. Sold September 2019 strike 132 call options for 52% profit since June 2019. This is the 2nd trade after one roll up. With price closing at $136.51 this was well in-the-money. I felt that yields could not fall much further - got that wrong as price since moved to $139.98 (August 6 close). Quick look at the chart - the trade is the pink ray setup. Price is not following the Elliot Wave zigzag. It is steaming ahead.

Textron Inc (TXT): US Defence Contractor. 11% loss since November 2018. Too bad I did not exit this holding when Jim Cramer did - his trade idea.

VanEck Vectors Gold Miners ETF (GDX): Gold Mining. Closed January 2021 22/25 bull call spread for 92% profit since early July 2019. I remain exposed through wider bull call spreads and through other gold and gold mining ETF's.

Yamana Gold Inc (AUY): Gold Mining. Closed January 2021 2/3 bull call spread for 85% profit since June 2019. I remain exposed through holdings in the stock and a January 201 2.5/4 bull call spread. With price closing at $3.45 this spread still has some way to go.

Corn Futures (CORN): Closed one contract for $5.30 per contract profit (1.3%). Remain exposed to 1.5 contracts opened in June 2019 currently under water.

Soybean Futures (SOYB): Closed two contracts for $18.60 (2.1%) and $6.20 (0.7%) per contract losses (1.3%). One contract closed for spread costs (1.5 basis points). Remain exposed to 1.5 contracts opened in June and August 2019 currently under water.

Shorts

iShares MSCI South Africa ETF (EZA): South Africa Index. Closed a October 2019 56/51 bear put spread for 59% profit since April 2019. Price has since dropped further closing at $48.97. I will look to enter a new spread as I have severe doubts about the South African economy even with a rising gold price (they do remain 2nd or 3rd largest producer of gold)

Euribor 3 Month Interest Rate Futures (IZ): 2 contracts closed for 32 and 35 basis points losses (0.3%) to release margin pressure in the account and to offer chance to re-enter short when market mood went normal again.

Invesco QQQ Trust (QQQ): Nasdaq Index. Bought a September 2019 182/173 ratio spread for a modest net premium ($0.03). Lowest price reached thus far in the selloff was $180.73 = more than 5%. The spread is a hedge trade covering a drop between 5 and 10%.

Income Trades

Covered calls written on Advanced Micro Devices, Inc (AMD), Bank of America Corporation (BAC) and Direxion Daily MSCI Real Estate Bear 3X Shares (DRV)

Cryptocurency

Bitcoin (BTCUSD): Price range for the week was $2,447 (24% of the low). Price ended July below resistance at $9954 and was propelled ahead by the China tariffs announcement to test through resistance at $11730 making a new higher high on this cycle but below the June and July highs.

Two trades closed for $415 (3.6%) and $763 (7.0%) per contract profit.

Ethereum (ETHUSD): Price range for the week was $29 (13% of the low). Like Bitcoin, price moved away from support at $201 and pushed through resistance above $222 before falling back to test that level again on August 6.

Ripple (XRPUSD): Price range for the week was $0.02228 (7% of the low). Price just does not want to break away from the range it is trading - despite the news flow about possible XRP tie up deals. All the crypto action is in Bitcoin and in the last few days Ethereum. This reinforces my thinking about the move being a China capital flight story and XRP is not a China crypto..

One trade closed for $0.0068 (2.1%) per contract profit.

CryptoBots

Profit Trailer Bot No closed trades

Currency Trades

Outsourced MAM account Actions to Wealth closed out 12 trades for 3.4% losses for the week. Biggest losses came on AUDNZD where trade sizes were much larger than normal. No open trades

Cautions: This is not financial advice. You need to consider your own financial position and take your own advice before you follow any of my ideas

Images: I own the rights to use and edit the Buy Sell image. News headlines come from Google Search. All other images are created using my various trading and charting platforms. They are all my own work

Tickers: I monitor my portfolios using Yahoo Finance. The ticker symbols used are Yahoo Finance tickers

Charts: http://mymark.mx/TradingView - this is a free charting package. I have a Pro subscription to get access to real time forex prices

August 1 - 6, 2019

I still think volatility is cheap and needs to be reset to a higher base but still unsure how to play it which is why I remain on the sidelines. Puts seem to be the first to reprice making them expensive quickly.

Posted using Partiko iOS

I am still on a steep learning curve on how to get best results trading short. I am certainly noticing that winning put trades do less well than winning call trades. Maybe it is time to go back to basics and focus on implied volatility data at trade set up time - especially time decay. The biggest challenge I find is choosing time frames. In The Second Leg Down, Hari Krishnaian favours using weekly options. There may be merit in that approach. I am currently going out two months at a time - do not have time to do weekly. Maybe the spread model is to sell the closer in puts and buy the further out puts.

In the portfolio, that I cannot hold short positions what is working quite well is buying Inverse ETF's (like SQQQ) and then writing covered calls against that - say 10 or even 20% out-the-money. By their nature, those are short term in nature - so one is actively wanting those sold calls to be assigned

Ultimately what is working best right now is call options on Gold and Silver ETFs (GDX and SLV are what I am holding)

Have not seen you in a while, welcome back, miss your analysis.

Thanks. Took a month off for holidays - decided to make it a full month off.

Hi, @carrinm!

You just got a 0.45% upvote from SteemPlus!

To get higher upvotes, earn more SteemPlus Points (SPP). On your Steemit wallet, check your SPP balance and click on "How to earn SPP?" to find out all the ways to earn.

If you're not using SteemPlus yet, please check our last posts in here to see the many ways in which SteemPlus can improve your Steem experience on Steemit and Busy.

Congratulations @carrinm! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!