TIB: Today I Bought (and Sold) - An Investors Journal #456 - South Africa, US Retail, Payments Technology, Cybersecurity, Airlines, Covered Calls, Ethereum

Markets got uncomfortable in the vacuum of Fed speak ahead of Jackson Hole. Soft days like this make a good opportunity to average down a few positions in surprising corners like cybersecuirty and payments and discount retail. Profits taken in European airline before it all falls over. And more covered calls written at good premiums.

Portfolio News

Market Selloff

Talk went back to the Federal Reserve and what Jay Powell may say at the upcoming Jackson Hole meetings. The recession word and the inverted yield curve come back into focus and stocks slide and yields fall.

Germany Grumbles

The Germany talk is also on the top of minds as soft GDP data points to the possibility of two soft quarters in a row = recession.

This time it was the German Bundesbank ringing the alarm bells citing drops in exports of steel and cars predicated on the US-China trade war. Talk of a 30 year German bond with zero interest rate does not help.

Given the increasingly fragile state of the global economy, the realisation of one or more risks could easily push the economy into a completely different scenario

I just spent a month travelling in Europe (UK and Netherlands). My observations were that the consumer seemed to be doing well enough and there was quite a bit of construction activity. There were a number of high streets that looked like the online shopping thing was winning, especially in the smaller towns I visited in the north of England and Netherlands.

https://www.theguardian.com/world/2019/aug/19/germany-likely-to-head-into-recession-bundesbank-warns

Bought

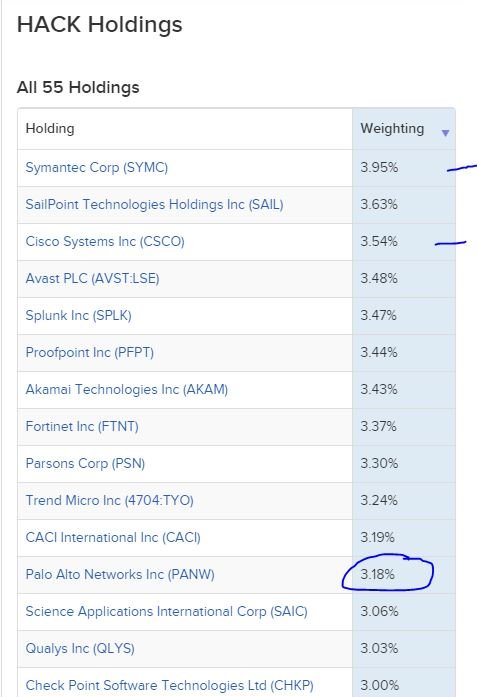

ETFMG Prime Cyber Security ETF (HACK): Cybersecurity. Jim Cramer added Palo Alto Networks (PANW) to the Action Plus portfolio. I had noticed that price on my holding in FireEye (FEYE) had been sliding. I decided to add a stock holding in this ETF which is an equal weighted ETF covering a range of cybersecurity stocks - this spreads the risk across multiple names.

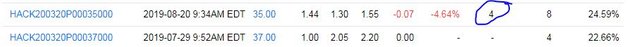

I also added in a March 2020 38/41/35 call spread risk reversal for a net premium of -$0.0425 per contract (i.e., I got paid). The call spread offers maximum profit potential of 114% on its own if price moves 8.4% from the $37.81 closing price. Risk in the trade is if price drops 8% below $35.

Let's look at the chart which shows the new trade as pink rays with the expiry the dotted pink line on the right margin. I have left in an existing trade in another portfolio which expires in December 2019.

First thing I like is the sold put (35) is below the recent trading range lows. Price has tested down to the lows of the last cycle which could well provide a support level. The old blue arrow price scenario did not quite work out with a big consolidation happening. I have put in a price scenario (pink arrow) based on the move out of the last consolidation. Get a repeat of that and this trade will hit the maximum (just before expiry) while the other trade will make it to breakeven. I can juice up the other trade by writing a put option below the trading range. Note: I was alone on the sold put trade

Square, Inc (SQ): Payments Technology. Averaged down entry price in one portfolio and rounded up to 100 shares so I can write covered calls again.

The TJX Companies, Inc (TJX): US Retail. Retail earnings season has been mixed with the discounters like Dollar Tree (DLTR) doing better than the mainline retailers. TJX were due to report and reported a little softer. Jim Cramer said in the pre-market he would be a buyer - I added a small parcel of stock as the market digested earnings down - price ended up from my purchase level. I liked the chart - testing the bottom of a cycle and holiday season to come.

Sold

Air France KLM (AF.PA): European Airline. European airline stocks have run quite well despite the pressures on GDP growth. I decided to take profits after a bit of a rebound for a 7% profit since November 2018 on stock and a modest profit on closing sold calls (December 2019 strike 14) which I had held after closing out bought leg of a bull call spread.

Income Trades

8 new covered calls written at an average premium of 1.36% with cover ratio of 10.25%. New trades on Cronos Group Inc. (CRON) and VanEck Vectors Rare Earth/Strategic Metals ETF (REMX). I did explore doing a call spread risk reversal on REMX but chose instead to write the covered call.

Cryptocurency

Bitcoin (BTCUSD): Price range for the day was $406 (3.7% of the high). Price squeaked to a new high and then gave away ground on a quiet day.

Ethereum (ETHUSD): Price range for the day was $8 (4% of the high). Price rejects the resistance at $201 and slides a little.

I was hoping to see a drive to get away from $201 with a pending order hit on a 1 hour reversal.

Ripple (XRPUSD): Price range for the day was $0.01245 (4.4% of the high). Price pushed further down from the $0.30 level. I looked during the day for reversal opportunities but none came along - I pulled a pending order off.

CryptoBots

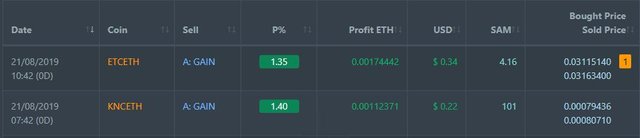

Profit Trailer Bot Two closed trades (1.38% profit) one from DCA bringing the position on the account to 9.56% profit (was 9.51%) (not accounting for open trades).

Dollar Cost Average (DCA) drops to 5 coins with ETC moving off and onto profit after one level of DCA.

New Trading Bot Trading out using Crypto Prophecy. No closed trades

Currency Trades

South African Rand (USDZAR): Last week a 12 month to expiry 14.268/17.773 bull call spread contract expired and I took delivery of a long position. I chose to close out the position for a 3% net profit in 12 months. Quick update of the chart

Price was following the blue arrow price scenario and halted when US yields started to slide. This made South African yields look attractive despite massive credit risk (around 7% yield with a 0.5% annual hedging cost). Price has moved in the last month as global growth fears rise and that credit risk becomes more apparent.

The best part of the trade is I did choose to put that sold leg in - that seller made a poor trade.

Outsourced MAM account No closed trades

Cautions: This is not financial advice. You need to consider your own financial position and take your own advice before you follow any of my ideas

Images: I own the rights to use and edit the Buy Sell image. News headlines come from Google Search. All other images are created using my various trading and charting platforms. They are all my own work

Tickers: I monitor my portfolios using Yahoo Finance. The ticker symbols used are Yahoo Finance tickers

Charts: http://mymark.mx/TradingView - this is a free charting package. I have a Pro subscription to get access to real time forex prices

Bitcoin: Get started with mining Bitcoin for as little as $25 http://mymark.mx/Galaxy

Trading: Binance offers a wide range of coins to trade, tight spreads and low fees if you use BNB to pay https://mymark.mx/Binance

Tracking: Keeping track of your crypto trades is a whole lot easier with CoinTracking.info. Get 10% off all your account upgrades https://mymark.mx/CoinTracking

August 20, 2019

It feels as though the “guardrails” are being put into place by Central Banks and governments to extend the bull market as much as they can. I also believe now that a long pullback across the economies of the S&P 500 which have pockets of ups and downs will not likely occur.

Posted using Partiko iOS

Nice description of what is going on. Even the Australian Reserve Bank is playing that game - they have till now been the most measured central bank focusing totally on the inflation mandate.

Hi, @carrinm!

You just got a 0.45% upvote from SteemPlus!

To get higher upvotes, earn more SteemPlus Points (SPP). On your Steemit wallet, check your SPP balance and click on "How to earn SPP?" to find out all the ways to earn.

If you're not using SteemPlus yet, please check our last posts in here to see the many ways in which SteemPlus can improve your Steem experience on Steemit and Busy.