TIB: Today I Bought (and Sold) - An Investors Journal #466 - Marijuana, US Industrials, 56 Percent Club Update

Markets cheer the planned resumption of China trade talks. Crowded trade in Treasuries takes a smack. Maybe marijuana stocks have seen the bottom? Time to have a look see

Portfolio News

Market Rally

US and China announce talks will continue in October => market rises

Biggest beneficiaries are again technology stocks, especially semiconductors. Lurking underneath the radar are marijuana stocks with Tilray (TLRY) up 7% and Cronos (CRON) up 4%.

Biggest move of the day is however in Treasury yields with the word rout being bandied about by the talking heads. This is what happens to the crowded trades when the market decides to move.

I did write a little while ago that the risk in the Silver trade was if US-China pull off a trade deal. Talk about talks knocks 5% off the iShares Silver ETF (SLV)

Bought

Watched the segment on CNBC about the launch of the Cannabis Inc show - market is at a key nexus were the words. I have long had the view that marijuana is going to be an important segment. In one portfolio, my overall investment is small at 1.7%. - I chose to double my holdings to 3.4%. I spread the new investments across 4 existing stocks I am holding. My investing thesis is to invest in markets where marijuana has been legalised and focused more on the added value side rather than growing only. As I cannot predict who will be winners and losers, I diversify across a few counters.

Aurora Cannabis Inc (ACB.TO): Canadian Marijuana. Aurora is the largest producer but lags behind Canopy Growth in market capitalisation. Its share price has been recovering better than Canopy Growth.

https://www.fool.com/investing/2019/09/05/3-reasons-aurora-cannabis-will-dethrone-canopy-gro.aspx

Aphria Inc (APHA.TO): Canadian Marijuana. A large grower but also adding value in medicinal marijuana. Recently acquired CC Pharma giving them distribution access in Germany.

https://marijuanastocks.com/these-pot-stocks-are-ready-for-some-upward-momentum/

Harvest One Cannabis Inc (HVT.V): Canadian Marijuana. Harvest One is a diversified producer covering growing and also medicinal products and also spread more geographically beyond Canada.

In the news with the appointment of an ex-Coca Cola marketing executive is Chief Commercial Officer.

Namaste Technologies Inc (N.V): Canadian Marijuana. Namaste is an online retail distributor for cannabis and accessories. Price has been recovering in the last few days following major corporate restructuring effort. It feels like the bottom has been found.

This revival of interest got me to make a step back (after I did the purchases) to look at the stocks I just bought in the context of the industry. First chart shows Canopy Growth (WEED.TO) since the top of the last cycle in May 2019. I pick Canopy Growth as it is the largest market capitalisation business. Price has halved since the top

I have drawn in two trend lines using daily closes (convert chart to a line chart and join the tops). Price has tried to break out of the downtrend twice. The last price move may be why the talking heads started looking at it again. We cannot really say that this is a confirmed break out until we see a retest.

Next chart then stacks the 4 stocks I just bought. Now choosing the timeline for stacking charts is critical - I have chosen to show the cycle from the previous cycle high (May 2019) to now.

This shows Canopy Growth (WEED.TO - black bars) has under-perfomred all. Aurora Cannabis (ACB.TO - blue line) and Harvest One (HVT.V - yellow line) are level pegging. Namaste Technologies (N.V - red line) has recovered from its restructuring woes but lags leader Aphria (APHA.TO - green line)

Note: these are all Canadian listings - so all in Canadian Dollars)

What this chart tells me that a solid play could well be Canopy Growth. I might just add that to a portfolio. Last chart comes from TIB237 - shows how Canopy Growth (orange line) was way ahead of the pack then.

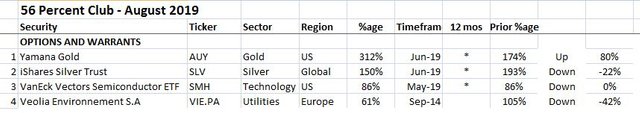

56 Percent Club

Update for month of August.

Each month, I review all my portfolios and tabulate the 56 percent movers from all time and highlighting the ones from the last 12 months. I review stocks and options separately. Why 56%? A friend was spruiking an investment scheme on Facebook and asked if anybody could point to a 56% investment - yup - I have a few.

First is the table of stocks. I have also marked up whether they have gone up or down since last time. New entrants marked in yellow

What stands out

- Change at the top with two Australian payments technology companies supplanting Bank of America (BAC). Leader and biggest riser is again EML Payments (EML.AX)

- One newcomer in Yamana Gold (AUY) with average holdings up 53% but individual best is 79% on an averaging purchase.

- Dropping off the list is Wisdom Tree Japan Small Caps ETF (DFJ) (8 vs 8)

- European Mid Caps still features

- Two Australian payments providers, EML Payments and Afterpay (APT.AX) were bought in the last 12 months.

On the options side same deal - no new entrants

- Quite some change here with only 4 stocks left (4 vs 7)

- All 3 off the list were rolled up - Europe Insurer Allianz SE (ALV.DE), US Telecom giant AT&T (T), and Van Eck Gold Mining ETF (GDX)

- Surging gold price propels Yamana Gold (AUY) to the top of the list. Last time leader iShares Silver ETF (SLV) drops as the particular holding was sold - this is the next holding down in the rankings.

Income Trades

One covered call written on old dog GE.

General Electric Company (GE): US Industrial. Sold September 2019 strike 9.5 calls for 1.36% premium (0.78% to purchase price). Closing price $8.80 (new trade). Price needs to move another 8% to reach the sold strike (new trade). Should price pass the sold strike I book a 38% capital loss.

Cryptocurency

Bitcoin (BTCUSD): Price range for the day was $203 (1.9% of the high). A quiet and somewhat indecisive day after 4 strong days with price forming an inside bar

Ethereum (ETHUSD): Price range for the day was $5 (2.9% of the high). Price pushes lower again to trade steadily below the $177 resistance level

Ripple (XRPUSD): Price range for the day was $0.00645 (2.5% of the high). Price also pushes lower away from that $0.26 level. Hard to say which way it wants to go.

CryptoBots

Profit Trailer Bot No closed trades

New Trading Bot Trading out using Crypto Prophecy. No closed trades

Currency Trades

Outsourced MAM account Actions to Wealth closed out 2 trades on USDCHF for 0.21% profits for the day. Trades open on USDJPY short (0.79% negative)

Cautions: This is not financial advice. You need to consider your own financial position and take your own advice before you follow any of my ideas

Images: I own the rights to use and edit the Buy Sell image. News headlines come from Google Search. All other images are created using my various trading and charting platforms. They are all my own work

Tickers: I monitor my portfolios using Yahoo Finance. The ticker symbols used are Yahoo Finance tickers

Charts: http://mymark.mx/TradingView - this is a free charting package. I have a Pro subscription to get access to real time forex prices

September 5, 2019

Silver drop was expected as it has been a while since visiting the $20 handle. Looks like a good opportunity to get some though as I highly doubt that any trade deal is a done deal in the short term.

Posted using Partiko iOS

Any good news on the China discussions will pull silver and gold down. Ultimately this trade is a view about the likelihood of a recession coming along. It is too hard to try to guess the timing.

Hi, @carrinm!

You just got a 0.43% upvote from SteemPlus!

To get higher upvotes, earn more SteemPlus Points (SPP). On your Steemit wallet, check your SPP balance and click on "How to earn SPP?" to find out all the ways to earn.

If you're not using SteemPlus yet, please check our last posts in here to see the many ways in which SteemPlus can improve your Steem experience on Steemit and Busy.