Crucial Week For The Banks

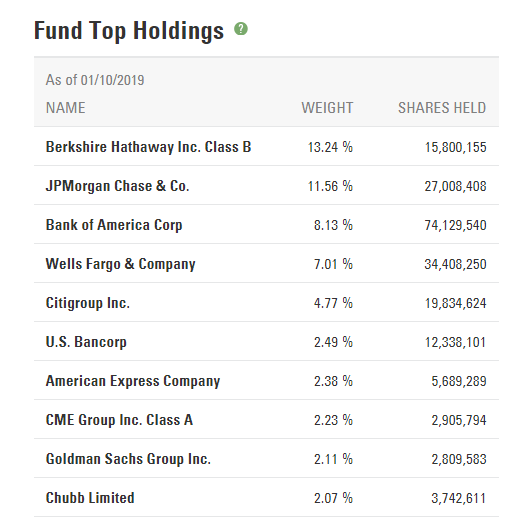

The Financial Select Sector SPDR® Fund seeks to provide precise exposure to companies in the diversified financial services; insurance; banks; capital markets; mortgage real estate investment trusts ("REITs"); consumer finance; and thrifts and mortgage finance industries. The top holdings include:

Raymond James downgraded 13 banks on Monday and lowered earnings estimates for most banks citing downward revisions to net interest margin and slowing loan growth.

Banks make loans to borrowers at a higher rate than non-performing assets such as savings accounts and CDs and profit from the difference.

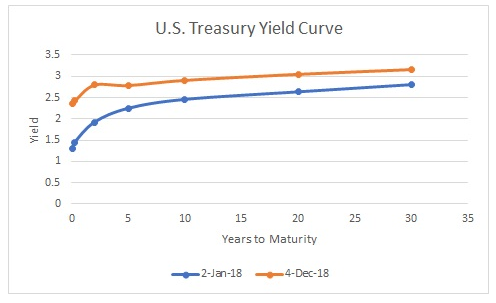

However, in an environment in which the yield curve is flattening, Banks' margins are adversely affected.

When interest rates rise or fall, it's the short term interest rates that are moving the most. When a Bank issues loans, they are issuing longer term interests rate loans. As short term interest rates rise, Bank margins come under pressure, which affects their profitability.

Also, on Tuesday, traders sold shares of Financial Select Sector SPDR Fund, XLF on strength during trading on Tuesday. $176.54 million flowed into the stock on the tick-up and $470.67 million flowed out of the stock on the tick-down, for a money net flow of $294.13 million out of the stock. Of all companies tracked, Financial Select Sector SPDR Fund had the 4th highest net out-flow for the day.

So with Citibank, JP Morgan, Wells Fargo and others on deck to announce their earnings next week, where is the XLF headed next? Lets go to the charts to find out.

Price formed a death cross back in October and in December broke the October lows.

NOTE: the death cross is a chart pattern indicating the potential for a major selloff. The death cross appears on a chart when a stock's short-term moving average crosses below its long-term moving average. Typically, the most common moving averages used in this pattern are the 50-day and 200-day moving averages.

What's important about this October lows, is that level also served as resistance back in March and Aug of 2017.

Thus, that level at $25 should serve as resistance again, if price makes it back to that level.

But because price is trending down, there is significant outflow in ETF, XLF and the economy is slowing down, the October lows which once served as support is now a major resistance. The chart suggests there is more downside risks in XLF, back down to the daily demand at $22 as a first target.

This post is my personal opinion. I’m not a financial advisor, this isn't financial advise. Do your own research before making investment decisions.

Earnings may help them out of the whole as they still have this last quarter of low tax rate comparables. Also, most of these banks make plenty in trading when markets are volatile so it may help offset what is still only the beginning of the margin pressures they will experience due to interest rates.

Posted using Partiko iOS

Agree...I think it's going to be about their forecast and interest rates moving forward, but I have a bearish bias on financials.