Determining the intrinsic value of a stock.

We remember from previous posts that the EPS(Earnings Per Share) is basically the profit that the company has at it's disposal. The EPS can flow in two directions:

- Pay dividends

- Re-invest or pay debts

This is very important because when the company chooses option 2), this has an impact in the book value. Remember that book value is just:

assets - liabilities

Therefore companies that use their EPS to invest and pay debts will increase the book value. As part of our calculation we will calculate the average book value, based on the previous years. Let's have a look at an example:

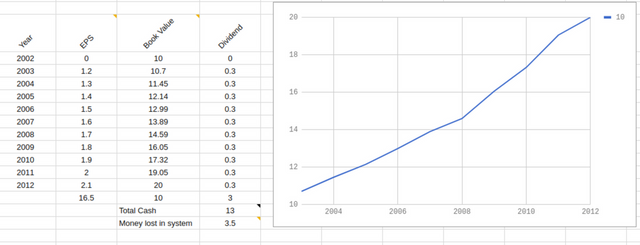

In the above table and chart we can see how a company had from year to year an increasing Book value and also a stable dividend. So this means that the EPS was used wisely by the leaders. The Graphic shows a nice upwards line representing the book value increase over time.

Note that in the above table under the last year in each column there are some numbers, that represent:

total EPS not counting first year

1.2 + 1.3 + 1.4 + 1.5 + 1.6 + 1.7 + 1.8 + 1.9 + 2 + 2.1 = 16.5book value increase over the years(last year - first year)

20 - 10 = 10Total dividend given away:

0.3 + 0.3 + 0.3 + 0.3 + 0.3 + 0.3 + 0.3 + 0.3 + 0.3 + 0.3 = 3

The value Total cash, is the result of adding the book value increase and the total dividend given away during the years.

10 + 3 = 13

The money lost in the system the result of subtracting the total EPS and the Total cash.

16.5 - 13 = 3.5

Side note: We learned that EPS can go into either dividend or re-investment. Therefore, why the total cash doesn't match the value of the EPS? The answer is that every system has some inefficiencies and some money is lost at some point. This should not be anything to worry but if it was extremely disproportionate the amount of money loss, then that company maybe is doing something suspicious.

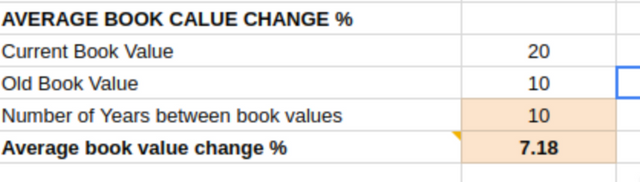

So now that we have observed the increase of Book Value over the years, it would extremely valuable as a prediction tool to find out what is it's average increase.

The formula used to determine the average book value change is:

Average Book Value change (%)= ((New BV / Old BV)^(1/Years)-1 ) * 100

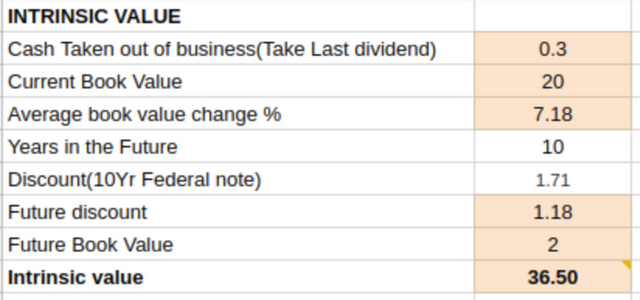

Now that we have the average book value change percentage I will collect the rest of the parameters to calculate the intrinsic value and I will explain how the intrinsic value is calculated.

To calculate the intrinsic value this is what we just needed to calculate the future discount and the future book value since the other parameters we already knew them.

Future discount = (1 + 10 Yr Federal Note / 100) ^ Years in the Future

Future Book Value = (1 + Average Book Value Change / 100) ^ Years in the Future

And finally, the intrinsic value is calculated this way:

Intrinsic Value = Last Dividend * (1-(1/Future Discount)) / (10 Yr Federal Note / 100) + (Current Book Value * Future Book Value) / Future Discount

I am a bit new to steemit, I have a very nice calculator in excel that can do this for you and i will be more than happy to share it. Do some of the readters know, how can I add a .xlsx attachment to the article?