Is CoinMarketCap Maliciously Suppressing The True STEEM Price? Or Is It Just incompetence? - A Perfect Free Market Solution Revealed

"Great power comes with great responsibility" (and Spider-Man is my favorite superhero). But I am not one of those people who think power corrupts. power only reveals things. Power is a magnifying glass. Some people are just corrupt and they gain power and some people simply just gain too much power and become unable to handle it. So power is a lot like money. It is a neutral enabler that reveal, make and break individuals.

Let's Get To CMC

https://coinmarketcap.com is a very basic and easy to use site where most crypto enthusiasts get their price feeds. CMC is basically Google for Cryptocurrency prices. There are even many witnesses who are simply feeding the STEEM blockchain the price they find on CMC. But how accurate and fair these prices are?

In most cases the numbers on the site are accurate and very well represent the real state of affairs. But then it comes down to things like this:

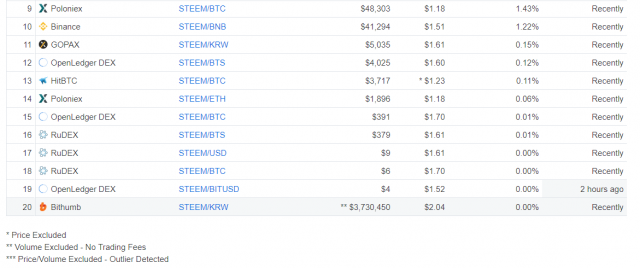

Bithumb's STEEM/KRW pair has 4 times more volume compared to the 2nd highest volume pair which is STEEM/USDT on Huobi. But the Bitthumb price and trading volume is excluded. If you look at the trading volume, Bithumb's volume is higher than the volume of rest of the exchanges combined. Yet the price is exculded. This is madness!

Hanlon's Razor

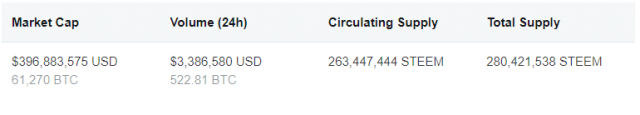

The end result is true STEEM price is getting suppressed and a fair system of price calculation would put STEEM at a 15%-20% higher value allowing content creators to reap much more rewards which can star a spiral of prosperity making the STEEM eco-system more active. But I won't be making consipiracy theories about CMC and I won't even be calling them malicious anit-STEEM or anything. I just think the site has some intelligently-stupid witless heads behind it.

Inspired by Occam's razor, the aphorism was popularized in this form and under this name by the Jargon File, a glossary of computer programmer slang. In 1990, it appeared in the Jargon File described as a "'murphyism' parallel to Occam's Razor". Later that same year, the Jargon File editors noted lack of knowledge about the term's derivation and the existence of a similar epigram by William James. In 1996, the Jargon File entry on Hanlon's Razor noted the existence of a similar quotation in Robert A. Heinlein's short story "Logic of Empire" (1941), with speculation that Hanlon's Razor might be a corruption of "Heinlein's Razor". (A character in Heinlein's story described the "devil theory" fallacy, explaining, "You have attributed conditions to villainy that simply result from stupidity.")

"Heinlein's Razor" has since been defined as variations on "Never attribute to malice that which can be adequately explained by stupidity, but don't rule out malice."

The Grand Ingenious Solution

Belive in the free market and the spontaneous order. Take some time to read Human Action by The Great Ludwig von Mises and stop regulating truth. Do you think something is an outlier? Great, try keeping that to yourself and see if how the market is giving signals. Crypto markets are in early days and most projects have their valuations completely wrong. Pump & Dumps happen all the time.

But They Too Are "Human Action"

So stick to your job of reporting. Trow away whatever the complex algorithms that are being used to detect these outliers. Just chill and use volume based weighted averages for the price. I mean it is so simple I could do that with pen and paper. Learn to love and appreciate that Occam's Razor.

Keep it simple and keep it efficient. Never exclude a price feed calling it an outlier. Let the volume be the judge. If more people are buying/selling at a certain price, that's what the market is signaling to be the truth. That is the free market evaluation. Have some respect for that and step down from complicated ivory towers and try some simple solutions that make the perceived problems cease to exist in the first place.

CMC has been known to remove outliers from their calculations so prices don't get affected by the pump and dumps on certain exchanges. We've seen this with Dent and SBD in the past. Do you know why the ** is next to the trade volumes?

*Price Excluded

** Volume Excluded - No Trading Fees

*** Price/Volume Excluded - Outlier Detected

Resteemed upvoted