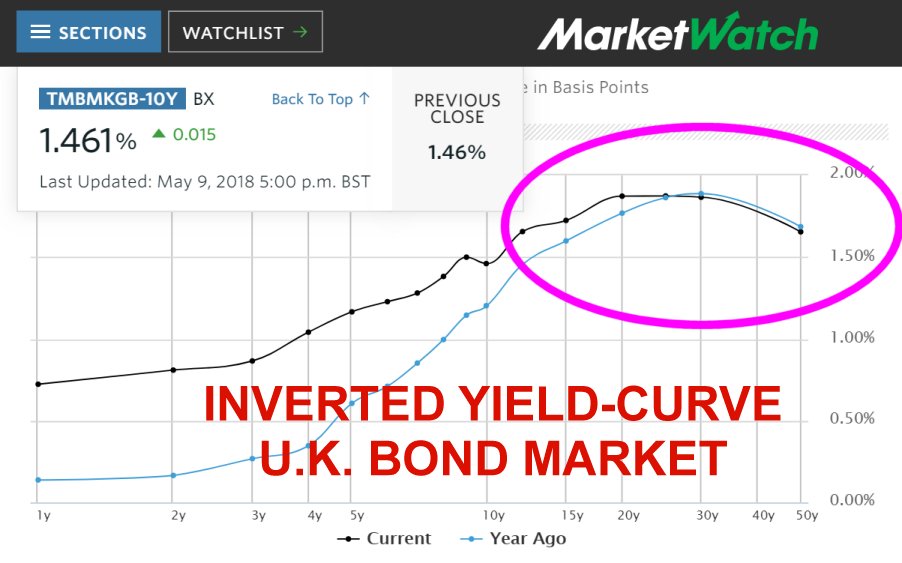

WARNING FOR INVESTORS: U.K. BOND MARKET SHOWING AN INVERTED YIELD-CURVE

"An inverted yield curve has predicted the last seven recessions dating back to the 1960's."

- Investopedia

Here's a picture of the U.K.'s Bond yield-curve from today:

Read more: The Inverted Yield Curve Guide to Recession | Investopedia

The U.S. Bond Market has also been "flattening out." Do you understand what this means? If not, this is one of the "Macro" trends which anyone who is investing or trading in the financial markets, of any kind, absolutely MUST understand and be aware of. I could tell you all about it, but I believe that would be doing you a disservice. You've got to research and understand this, for yourself.

If you don't know about this topic, don't do anything else today before you run a Google search on the term and ecudate yourself. Government Bond Markets are the bedrock of the world's financial markets. I look at the yield curve every day before I start trading anything.

DISCLAIMER: I am not a financial advisor. Anything in the above content is meant for educational/entertainment purposes only. Do not make trades based on this article. I am not responsible for any financial gains or losses you make in regards to this information.

Join CoinBase to Trade Cryptos

It's good to see you're still here Mark!

How do you think the crypto markets will respond if a recession does unfold ?

Do you think they'll get dragged down too or will some of the bigger players see crypto as a safe haven to ride out the storm?

Thank you for your continued support of SteemSilverGold

Hello! Good article! I'm interested in the them of ICO and crypto-currency, I'll subscribe to your channel. I hope you will also like my content and reviews of the most profitable bounties and ICO, subscribe to me @toni.crypto