Every road leads to Japan

Everything in Japan is booming. Economy is on a recovery track due to various aggressive monetary policies. Smartphones, robots, name any technology, Japan was there first. Even bubbles tend to burst in Japan among the first.

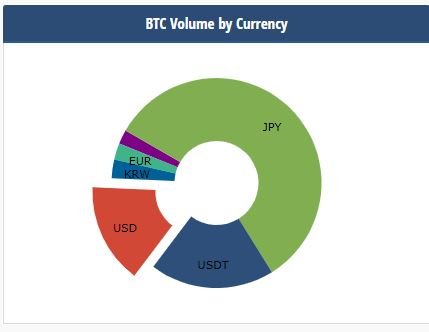

The cryptocurrency markets are no exception - they're on fire there:

As you see the JPY (the Japanese Yen) is taking up for the majority of the trade volume. My initial thought was perhaps it's due to the fact that the Yen's exchange rate is really low against other currencies, but looking at the 24h Bitcoin volume by currencies confirms it, Japan leads.

So what's happening in Japan? Well, out with the old and in with the new is the name of the game there.

HitBTC gets the boot

Not literally though. The SBD-pumping exchange, the one that was in the center of discussion everywhere yesterday, even in my post, cuts off access to their services for Japanese residents, due to them not being allowed to operate in Japan.

I wonder if japanese customers dropping off could contribute to various other pumps on HitBTC, due to lower liquidity now?

As bitcoin.com reports:

Hitbtc has suspended its services for Japanese residents to avoid any trouble with the country’s financial regulator since it is not authorized to operate in Japan. Users with Japanese IP addresses will be asked to provide their residency information within the exchange’s know-your-customer (KYC) procedure to prove they are not residents of Japan.

So if you are using a Japanese IP, ready your papers, as your documents will be needed to verify that you are not a resident of Japan.

Among others, Binance has been warned about operating in Japan without a license and in April, according to bitcoin.com, Kraken announced it's pullout from the country as well.

But not to worry - in with the new

Coinbase is looking to enter the Japanese market and take it in one cool swoop. Under a new fintech leader, Nao Kitazawa (you don't have to remember this name, i'm including it just for the sake of completion), they plan an incremental rollout and are closely cooperating with Japanese FSA (Financial Services Agency).

Coinbase itself offers just so-called "one-click" trading, but their proper exchange GDAX is a full suite, so hopefully that comes with the package.

Grab a quick rundown on Coinbase's plans and a short bio for Nao at their Medium blog, included on blog.coinbase.com

Materials:

washingtonpost.co

news.bitcoin.com

blog.coinbase.com

Still not selling your vote to Minnowbooster to earn SBD? Do it now

Title image from pixabay

Are you looking for Minnowbooster, Buildteam or Steemvoter support? Or are you looking to grow on Steemit or just chat? Check out Minnowbooster Discord Chat via the link below.

buildTeam.io

I'm surprised that Coinbase is working on international expansion right now... they don't even have a good grasp of the US market, lots of competition

I came here because you said Japan.

Me too :)

Same here...

Japan is really advanced country.

This just proves it

thanks for the roundup! interesting! go Coinbase.

I'm thinking about getting a visa to work on Japan and ease of turning crypto into yen is going to be a factor in decision.

I think you could hide your IP and still access banned exchanges? People in canada do it and sign up for south African Netflix....

Theoretically one could but the VPN providers are often under attack too in these situations. Not sure though

Like printing tons of fiat from thin air ;)

Abenomics three arrows ;)

No inflation will only devalue money

良い調子

I have coinbase account but i am not Japanese.

Nice read. I leave an upvote for this article thumbsup

Thanks for the informative article.