Is Moody's WARNING Of A CRASH? - Massive Wave Of Junk Bond Defaults Ahead!

In this video, I talk with author and economic analyst John Sneisen @TheEconomicTruth about Moody's most recent warning as the credit rating agency claims there is likely a large wave of junk bond defaults ahead.

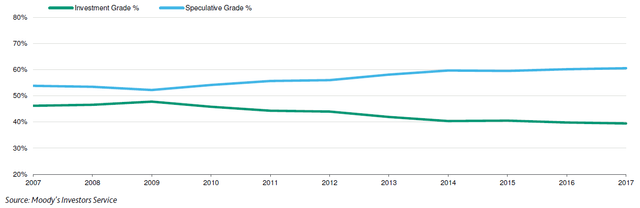

We have seen the level of global non-financial companies rated as speculative or junk rise 58% since 2009, the largest proportion in history! We've also seen a 49% increase in debt for U.S. companies as well as the rise of share buybacks which are becoming more prevalent and more risky by the day.

Moody's warnings should not be taken in stride. The agency only issues warnings when they absolutely have to and cannot put off the bad market sentiment any longer. They can only cover up so long until it becomes obvious. For their own good, they have to look like a serious credit rating agency when the markets tank, so they can say "I told you so."

According to Moody's, the low interest rates and obsession with yield has lead to companies issuing mounds of debt that in comparison offer low levels of protection for investors. They warn that when economic conditions worsen, the outlook won't be so benign.

We haven't seen this level of concern since 2008, and there's a reason for that. Nothing has changed since 2008. Well, actually scratch that... things have gotten WORSE since 2008. We never saw a recovery, we simply saw perpetuation. Putting off the crisis a bit longer, leading to far more pressure build-up and centralization run amok. Now, when it comes down, it'll come down that much harder and it'll be as if no one ever learned.

If we want to stop the circular havoc, we as individuals need to support the individual's demand of their currency, the free market. Not bank and government centralization leading to massive downfalls. How many times do we need to go through this.

Of course the fundamentals are off the table due to the level of manipulation in the monetary system as well as the markets, so we cannot put a date on the crash, but we know it has to happen inevitably and so we must prepare and understand the repeated problems.

Self sustainability and individual responsibility are simply the most necessary ways to protect ourselves against this market and monetary calamity. Individuals must do their own due diligence and come out of this problem, strong and independent.

See the FULL video report here:

Stay tuned for more from WAM! Don't forget to Upvote & Follow!

If you like what I do, you can donate to my Bitcoin, Dash or EOS addresses below! :)

Bitcoin:

Dash:

EOS:

This is big news! I’ve been a long time WAM follower from YouTube.

Joshy, keep up the good work my friend with the Viking.

LOL

Thanks for all the votes lately, it is always noticed and super appreciated bud.

I am still thinking how ironic it is your birthday is right around the time of both sides of the imaginary lines in the sand celebration day of the Upper 49th.

(:

Thanks for making us aware of the multiple risks that the general markets are ignoring, the moment of truth will eventually come to those that chose to ignore the obvious warning staring them in the face.

“Just watch the sports on the booby tube & don’t talk about these negative economics”

👆Literally the response I got last night from someone who complains about not having enough money. That’s the kind of attitude that got us where we are. So many distractions & abundant programming designed to make the individual feel they are not smart enough to study economic structure.

No sense wasting my time on deaf programmed ears. I very much appreciate the warnings you guys are giving based on history. Keep up the good work getting the message out

Sadly they started mixing their politics in with the sports and now those are unwatchable as well.

Sports culture has always been politically motivated. Finally became obvious last year

It's typically nationalistic, last year was counter to that. People who liked the nationalism were very turned off.

What a time to be alive...

The lesson from 2008 and all so called market crashes is not to sell during them, they are generally temporary and only those who sell at the bottom lose their money. The market will swing because those people with the really serious money profit from the swings and not steady growth.

If you are near retirement or want to take profits this is a great time to do so, otherwise you will have to wait until after the correction subsides.

Here comes the TSUNAMI ‼️