MACRO TRENDS IN THE ENERGY MARKET

INTRODUCTION

This report will focus on current advances in energy storage and how it will change the energy environment over the coming decades.

LITHIUM ION (LI-ION) BATTERIES

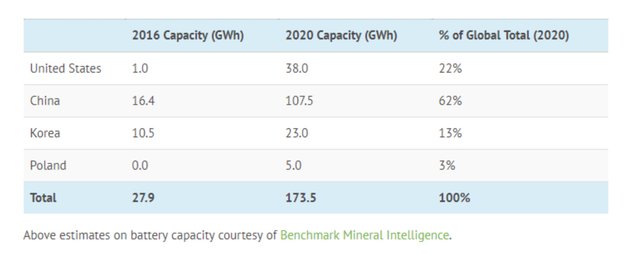

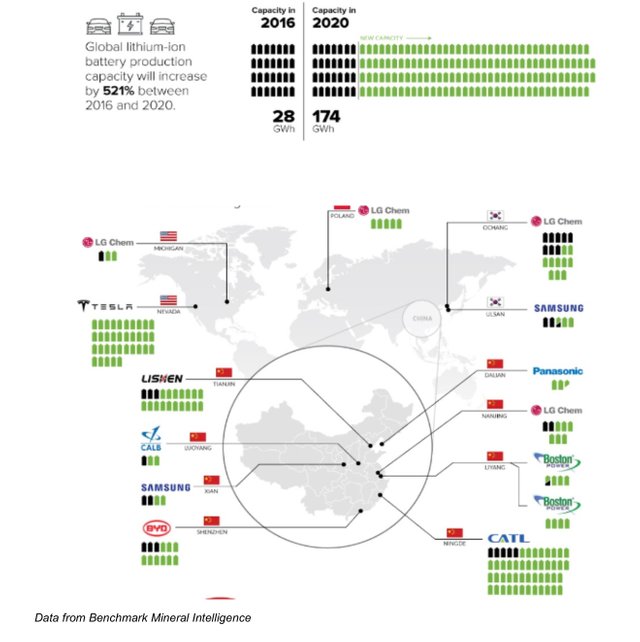

Gigafactories have just began production:

Over the next couple of years if all planned li-ion battery manufacturing facilities come online the world production will increase six fold.

The green in the following illustration shows the projected GWh coming into production in the next 3 years.

Capacity Up and Cost of Production Down:

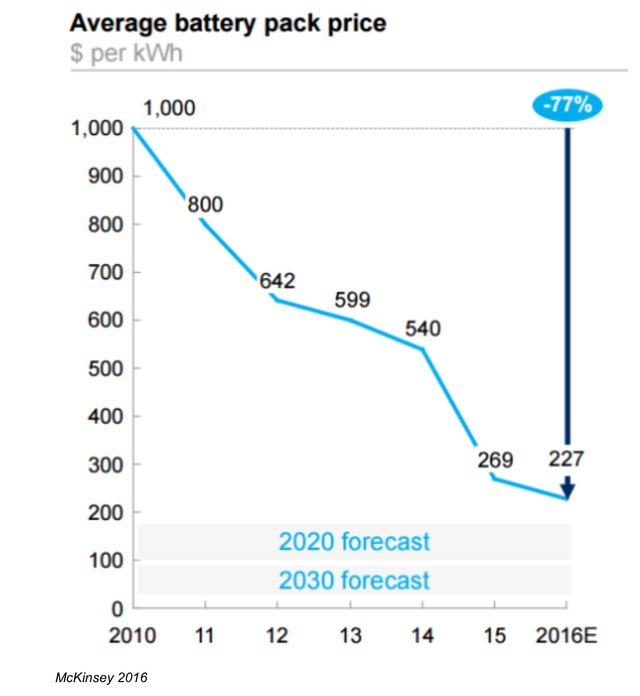

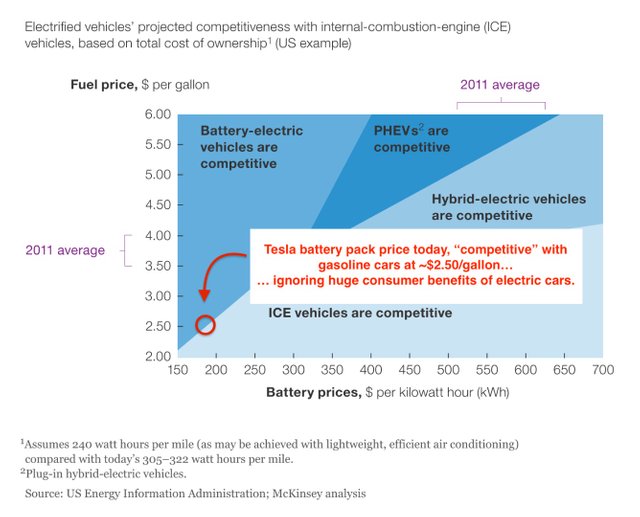

Battery costs has fallen from ~1,000 per kWh in 2010 to ~$227 per kWh in 2016, according to McKinsey.

The research organization estimates that by 2021, the cost of batteries will drop to $156 per kWh.

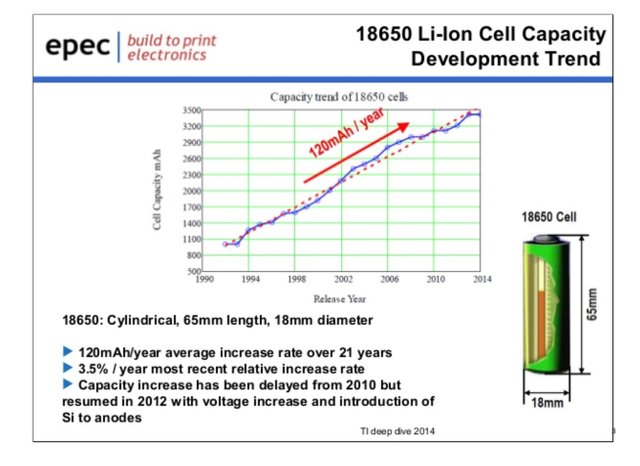

This next graph is a little old but the trend is still intact and with this current investment landscape in battery production absolutely dwarfing anything the world has seen in the past we will most likely see even greater gains.

WHAT MARKETS DOES THIS EFFECT?

Automobile:

Ian Callum, head of design for Jaguar, stated in April 2016: "Car design will change more in the next 15 years than it has in the past 100. Electrification will kick start the biggest change in automotive design in history.”

The main issue holding back the mainstream adoption of electric vehicles (EVs) has been the cost of batteries. With the cost of batteries decreasing, EV cost parity with internal combustion engine (ICE) automobiles will be reached in the next five years.

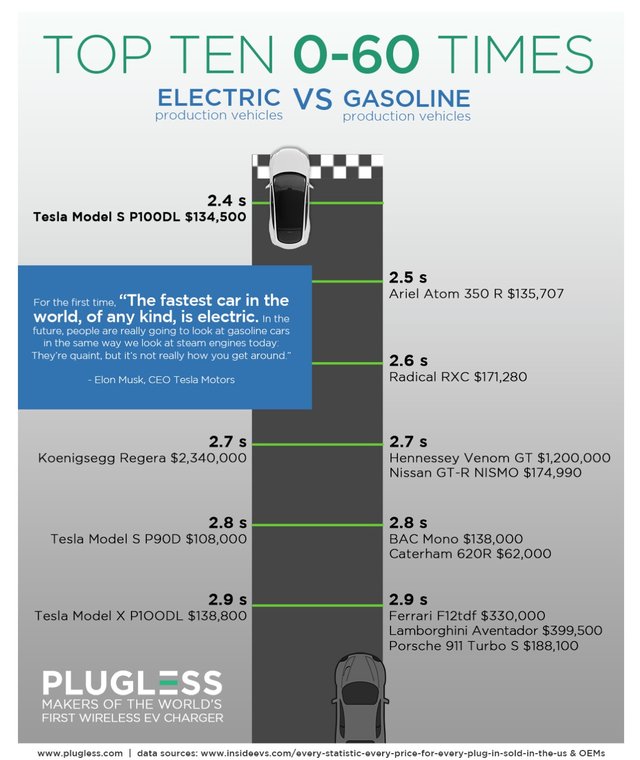

Automobile continued: EV vs ICE

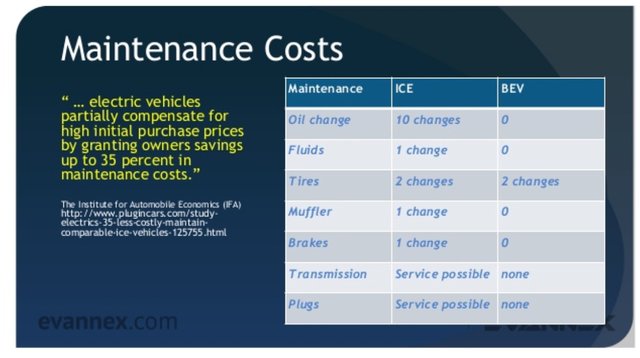

Less moving parts means less things to maintain.

In an ICE vehicle the force and power production is never uniform and the reciprocating components can cause mechanical balancing issues. Also, the engine is not self starting and many accessories are needed to sort out these issues (counterweights, flywheel, alternator, DC motor) which makes an ICE quite heavy. These issues are not present in an electric motor. EVs use an induction motor that can produce uniform power, speed output and is self started. For these reason an induction motor is much lighter than an ICE.

Both ICE and Induction motors require cooling. Both prime movers must reject the waste heat generated in order to keep the temperature within a certain limit, however it is worth noting that the waste heat generated by an induction motor is much lower than that of an ICE.

Another primary difference is that in an ICE car a complex exhaust gas treatment system is needed (catalytic converter, muffler) to keep pollutants and noise at statutory levels. This is not present in EVs.

EVs have inherent advantages when it comes to regenerative braking. The same induction motor acts as a generator here. In a petrol car in order to achieve regenerative braking you must install a separate BLDC motor and a battery pack.

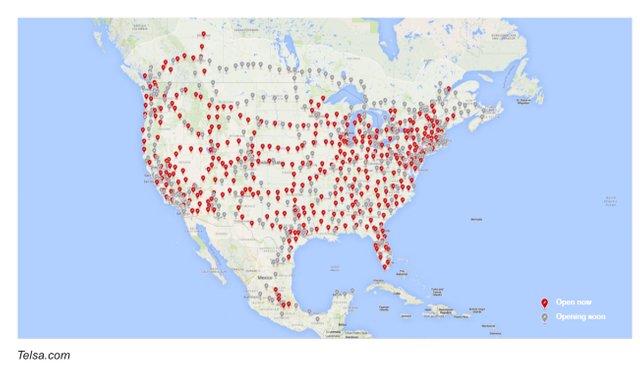

The main advantage of an ICE car is the ease with which it can be refueled. A petrol car can be refueled in five minutes or less while recharging EVs can take 30 minutes if you own a Tesla (only car capable of using the supercharging network which is described below) or up to 8 hours with the level II chargers that comes standard with all other EVs currently produced.

Currently Tesla is dominating the charging infrastructure. Their supercharger is a 480 Volt fast charging station that allows for long journeys. The chargers use a DC current that provides up to 120 kW of power per car, giving the 90 kWh Tesla Model S an additional 170 miles of range in about 30 minutes.

You can easily go from San Francisco to New York or to Los Angeles and back with no problem on this network.

Unfortunately, Tesla is the only car manufacture building EVs that uses the DC fast charging technology. The other car manufacturers use an AC 240 Volt charger, which takes between four to eight hours to get a full charge or ~20 miles per hour of charge. Compared to the ~170 mi charge in 30 minutes that the supercharging network provides. Until the automakers can standardize the fast charging network, this fractionation will hold back EV growth. Most likely the traditional automakers will have to quickly catch up to Tesla on this front or be left behind.

Another major advantage of petrol cars over EVs pertains to their high energy density. The energy density of current li-ion batteries (250 Wh/kg) is nowhere near to that of gasoline (12000 Wh/kg). The poor energy density of the battery produces a huge weight penalty to the EV. The huge weight of the car reduces the coefficient of friction between the tire and road considerably, making cornering difficult.

The battery pack also has huge heat generation issues. If you tear down the battery pack of an EV you will see that it is a collection of common li-ion cells that you find in most electronic products. Continuous liquid cooling is required to keep these cells at normal temperature levels. The removed heat is rejected to the atmosphere via a radiator. A petrol cars energy storage system does not require any such cooling mechanism.

The battery pack of electric cars does have advantages. Since the heavy battery pack is sitting very low to the ground, it lowers the center of gravity and increases car stability. The large battery pack is also spread across the floor offering structural rigidity against side collisions. Thus overall safety is increased.

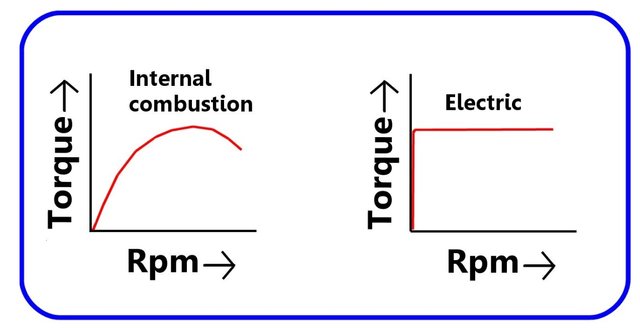

ICEs cannot be operated beyond a certain speed range. This necessitates the use of a complex and costly transmission mechanism for speed control. The electric motor can work efficiently in a wide speed range, so speed can be controlled directly from the motor with the use of an inverter and advanced software. As a result, a speed varying transmission is not required for an EV. The EVs can also produce greater torque even at the start whereas an ICE car will struggle at low rpms.

In an ICE a DC motor is needed to take the engine to the optimum rpm range at the start. Which an EV does not need. This leads to far superior traction control in EVs.

Which car is more economical? An EV is much costlier than an average petrol car. However to get the full picture, you must also compare the cost required to travel a mile. The calculation based on current US gas and electricity prices shows that EVs are almost one-third cheaper compared to petrol cars.

$2.6 (national average per gallon cost of gas)/22 mpg (national average fuel efficiency) = 11 cents per mile cost of ICE.

Compared to...

.12 cents (per kWh national average electricity cost)/ 3 (Tesla model S miles for every kWh) = 4 cents per mile for EVs.

With technological advancements in ICE almost saturated and rapid development of EVs taking place, one can see that EVs have an edge over ICE cars as the vehicle of the future.

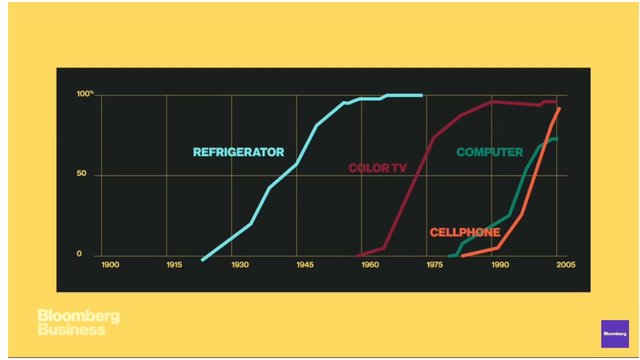

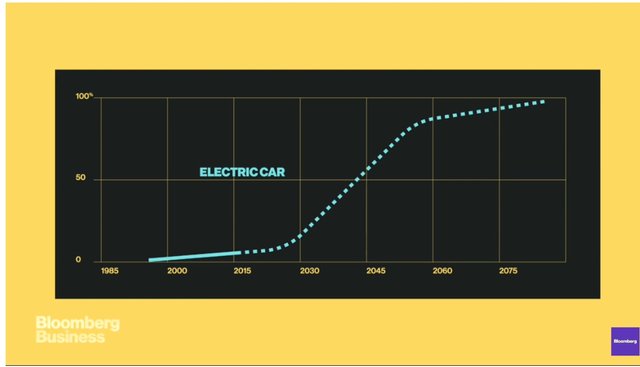

The adoption chart of new technologies usually takes the form of an S curve.

Will this happen with EVs?

Automobile continued: Current EV Investment Landscape of Automakers

Volkswagen Group says it will introduce on average three battery electric vehicles annually for the next 10 years and has committed to invest $84B into EVs ($50B of which will be in battery manufacturing). To put this into perspective, the total market value (how much the company is selling for on the stock market) is currently $85B. They are basically investing the entire value of their company into EVs and battery manufacturing. This usually doesn’t happen unless the economics of an industry are completely changing.

Volvo will only manufacture EVs or Hybrids by 2019 and wants to bring one million electrified vehicles to the roads by 2025. “We are determined to be the first premium car maker to move our entire portfolio of vehicles into electrification,” Said Håkan Samuelsson President and Chief Executive Officer. Their first all electric SUV and sedan will be available in 2019. The car will have a battery pack that supports up to 100 kWh and will enable over 300 miles of range. The price is expected to be between $35K and $40K.

Suzuki, the parent firm of India’s largest car-maker, Maruti Suzuki, announced its plan to set up a $600 million lithium ion-battery factory.

Mercedes benz is currently building a $562 million dollar battery manufacturing (projected completion is mid-2018) plant in Kamenz, Germany. They are also planning another $500M investment in other battery projects globally. That, in turn, represents just a small piece of the company's planned $11 billion budget for electric vehicle development over the next five years. Daimler didn’t give any projections for its factory’s potential capacity, but it did say that its investment would quadruple the size of an existing battery factory on the site.

This kind of investment is happening in most major car manufacturers globally.

GM announced they are working toward an all-electric, zero-emissions future. They are planning on releasing two new, fully electric models next year, then at least 18 more by 2023. “General Motors believes the future is all-electric,” says Mark Reuss, the company’s head of product. “We are far along in our plan to lead the way to that future world.”

BMW revealed that in the next eight years the they would offer a collection of 25 electrified vehicles.

The Renault-Nissan alliance’s "Drive the Future" plan will see the company field eight all electric models and 12 hybrids by 2022.

After 2019, all Maseratis will be electrified, according to Fiat Chrysler Automobiles (FCA) CEO Sergio Marchionne. It's part of a larger electrification strategy from FCA as a whole, which intends to have half of its fleet electrified by the end of its five-year plan through 2022, Marchionne said.

This pattern will accelerate as major automakers dedicate more of their research and development budgets and subsequently, lobbying funds to the EV transition. Since the first Tesla Roadster went on sale just nine years ago, Mitsubishi Motors was the only major car company to take the prospect of fully electric vehicles seriously. Now, every large automaker is working on battery powered cars, with even longstanding skeptics like FCA’s Sergio Marchionne and Maruti Suzuki India’s R.C. Bhargava announcing plans in recent weeks.

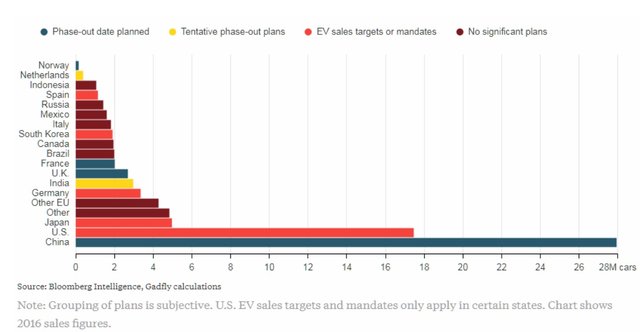

It is not only the car manufactures that are switching to electric. But countries as well.

Britain’s new clean air strategy, calls for sales of new gas and diesel cars and vans to end by 2040.

France will end sales of petrol and diesel vehicles by 2040 as part of their plan to meet its targets under the Paris climate accord.

China, which has vowed to cap its carbon emissions by 2030 and curb worsening air pollution, joins the U.K. and France in seeking a timetable for the elimination of vehicles using gasoline and diesel.

India, due to overtake Germany and then Japan as the world's third biggest auto market by 2020, is on a similar path. Spearheaded by Narendra Modi’s two trusted ministers Piyush Goyal and Nitin Gadkari, the Indian government aims to get electric vehicles to 44 percent of the fleet by 2030, and is aggressively favoring them with tax rates 31 percentage points below those on hybrids and internal combustion engine cars under its new harmonized GST sales tax.

California lawmakers also want to ban gas car sales. In January, assemblyman Phil Ting plans to introduce a bill that would ban the sale of new cars powered by ICE after 2040. “The market is moving this way. The entire world is moving this way,” Ting said. “At some point you need to set a goal and put a line in the sand.”

No automaker can compete globally without a compelling stable of electric cars.

Automobile continued: What about Trucks and Cargo Vans?

In April, 2017 Tesla CEO Elon Musk revealed that the Tesla pickup truck unveil will be in “18 to 24 months.”

Elon Musk said “powering EV pickup trucks is easy” and is more focused on producing a semi.

Tesla's very first freight truck, the Tesla Semi, is designed to be all-electric with a driving range of 200 to 300 miles when fully charged.

Although EV trucks and Cargo vans are not economical or available at the moment. The current investment landscape suggest we will see a competitively priced long range heavy duty pickup truck and cargo van within the next ten to fifteen years. This could create efficiencies and cost savings over the coming decades for forward looking fleet manager.

WHAT MARKETS DOES THIS EFFECT? CONTINUED...

Renewables:

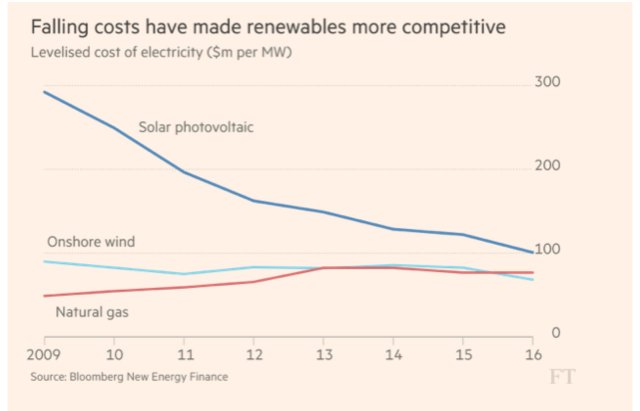

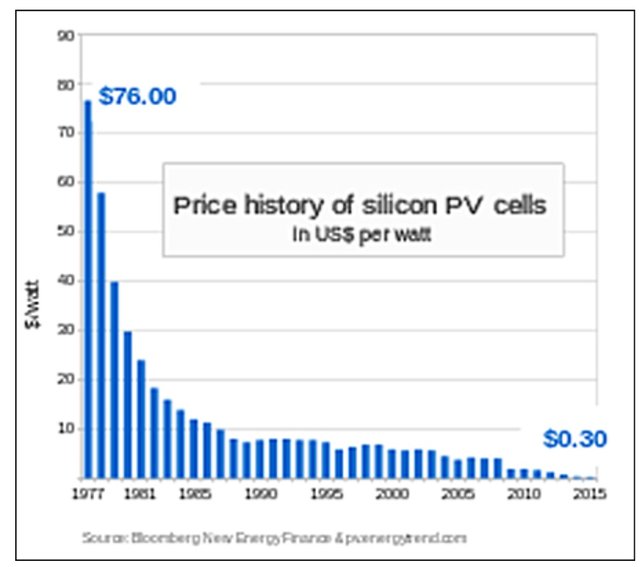

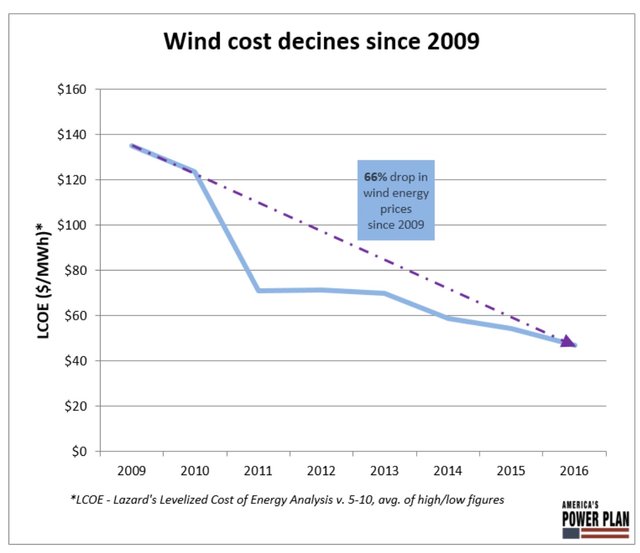

The cost of renewables such as wind and solar are dropping substantially. It will be very difficult for fossil fuels to compete in the near future if this trend continues.

Solar panel prices has dropped by a factor of 154x since 1970.

While wind turbine cost have fallen by 66% since 2009.

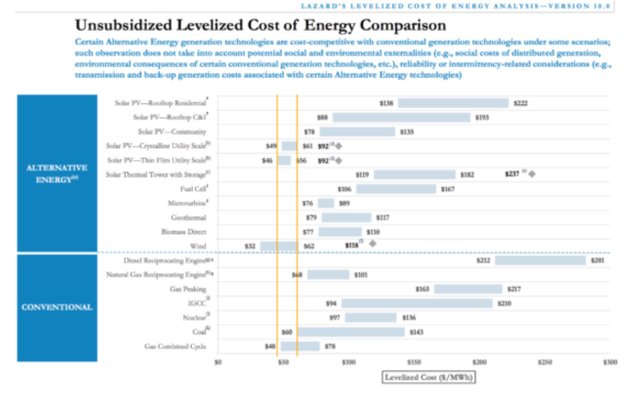

Utility Scale Renewables:

New wind and solar power plants are currently cheaper than new coal, natural gas or nuclear power plants under some circumstances. Even without government subsidies.

The orange lines show the low and high cost estimates for utility scale solar.

Solar power and wind power are each headed towards unsubsidized prices of 2-3 cents per kwh in their best areas, and perhaps 4 cents in more typical areas.

New natural gas costs around 7 cents per kwh. As solar and wind steal hours from natural gas plants (because they are cheaper when the sun is shining and the wind is blowing), natural gas plants will sit idle longer. As a result, the price of natural gas electricity will rise to perhaps 10 cents per kwh, as the upfront capital cost of natural gas plants is spread over fewer kwhs.

Renewables Continued: If this stuff is so much cheaper than fossil fuels, why hasn’t there been a more widespread adoption of this technology?

The problem has always been the intermittency and the high cost of batteries. Currently renewables with a battery storage system is not economical in most situations. But the tectonic plate shifting in the car industry is driving down the cost of energy storage.

To compete with fossils on a 24/7 basis, we need storage that costs no more than 5 or 6 cents per kwh, and ideally less.

In other words, we need to cut the price of energy storage by a factor of 5 or 6 from today’s prices.

We have already cut energy storage prices by a factor of 10 since the 1990s. If the current trajectory holds, within a decade or two, mass energy storage will be economically viable in most cases.

Batteries already economical in some situations

How can the current price of batteries (~25 cents per kwh) compete with wholesale natural gas electricity at 7 cents per kwh? Particularly when you also have to pay for electricity to go into those batteries.

The answer is that batteries don’t compete with baseload power generation alone. Batteries deployed by utilities allow them to reduce the use of (or entirely remove) expensive peaker plants that only run for a few hours a month. They allow utilities to reduce spending on new transmission and distribution lines that are built out for peak load and which sit idle the other hours.

To roughly estimate the value that batteries provide, look at the gap between the peak prices customers pay versus the cheapest retail power available throughout the day. In California, that’s a difference of almost 20 cents per kwh, from peak prices of more than 34 cents to night time power that is less than 14 cents.

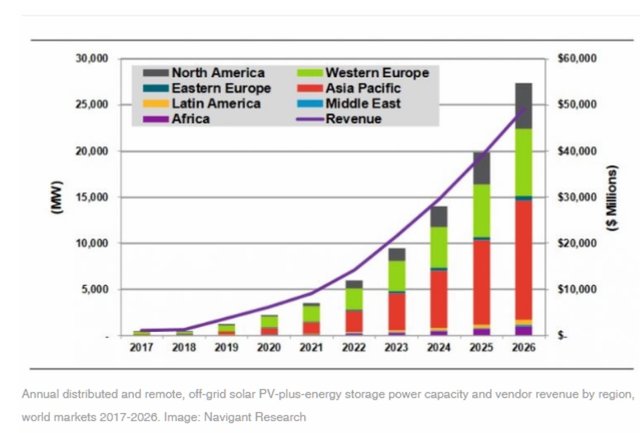

That difference is an opportunity for storage. And if prices keep dropping we should see other economic opportunities open up for storage. According to the International Renewable Energy Association battery storage in stationary applications is poised to grow at least seventeen fold by 2030.

California Residential Renewables and Storage:

As of the end of 2016, the average cost for solar panels in California was $3.39 per watt. Since the average system size in the U.S. is 5 kilowatts (5,000 watts), the average price for a solar panel system in CA is 5,000 x 3.39 = $16,950 before any local incentives or the federal tax rebate.

Back in 2011, the typical gross cost for a 4 kW solar system in California was over $34,000. That number has dropped to below $20,000, before incentives. It is evident that solar prices have been and are continuing to move down.

Currently the U.S. Energy Information Administration showed California households paying 17.97 cents per kWh for grid electricity.

Based on the average needs of 573 kWh/month x 17.97 cents per kWh = $102.96 cost per month x 12 months = $1,235.52 per year

Means the breakeven for a solar system today not including incentives or tax rebates is $16,950 (average cost for PV as shown above)/1235.52 = 13.71 years. Not great especially for a consumer that has to pay up front cost. This will have to come down a lot before consumers make this mainstream.

In the meantime, there has been a huge perception change toward solar and energy storage. Tesla has made it fashionable and desirable.

So there should be a bigger market for solar and storage with the affluent and environmentally conscious.

The powerwall batteries will also have to come down in price and up in capacity quite a bit before you can save on household cost and even charge your EV with it.

Currently, to fully charge a Tesla you will need 72 to 100 kWh. The latest powerwall only stores 7 to 14kWh.

These are not very economical at the moment but they are also the first generation residential Lit-ion batteries.

Recently Tesla has merged with SolarCity to help them install all the products being developed.

This move suggest that Tesla is expecting a large residential demand for these batteries in the future.

Tesla is not the only battery manufacturer to partner with a solar installer. Mercedes benz has partnered with Vivint Solar to start installing their products.

As prices come down there will be a need for installers.

CONCLUSION AND INTEGRATION TO ABOVE ANALYSIS:

We should see a major tipping point in the energy industry over the coming decades. There are some risks to this scenario such as cheap fossil fuels, recession, supply constraints, slow acceptance rate, changing technology and political risks but overall the analysis has a strong probability of coming to fruition.

Incorporating EVs and charging stations over the coming decade will help save on fleet cost and stay ahead of the curve to create a competitive advantage. Signs to look for prior to making this investment would be EVs that support a fast charging network (30 min or less) and are near total cost parity with comparable ICE vehicles.

The economic tailwinds could make starting a renewable and storage company viable. Or the astute investor might find opportunities in publicly traded battery installers or auto manufacturers.

Go here https://steemit.com/@a-a-a to get your post resteemed to over 72,000 followers.