Think markets might crash? Here are some ways to trade it...

These are just ideas, not financial advice! All trades obviously carry risk, so do your own research before trading!!!

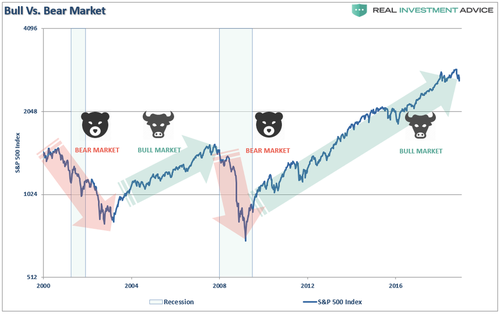

Picture credit: Lance Roberts at RealInvestmentAdvice.

https://realinvestmentadvice.com/technically-speaking-the-difference-between-a-bull-bear-market/

We may already be in a recession. Here are some reasons why. I am not going to summarize all of these because that's not the purpose of this article.

Quantitative Tightening:

http://www.fasanara.com/investment-outlook-25072017

Trade war:

https://www.zerohedge.com/news/2018-11-27/kudlow-trade-talks-china-havent-yielded-any-progress

Real war:

https://www.zerohedge.com/news/2018-11-27/china-ambassador-warns-dire-consequences-if-no-deal-hints-all-out-war

https://www.zerohedge.com/news/2018-11-27/ukraine-faces-full-scale-war-russia-warns-poroshenko-televised-interview

Fasanara Capital on how to measure proximity to a market crash:

http://www.fasanara.com/cookie-06112018

Fasanara correctly predicted the Volpocalypse that happened in Feb ahead of time, and wrote an article perfectly detailing exactly how it would happen. They have many articles on their home page that explain why we may be on the brink of a large market correction.

http://www.fasanara.com/

If you believe that a bear market is coming, one option is to sell all of your current holdings and just hold cash. This way you can wait out the drop and buy back in after the fact. The downsides of this include:

- The market might not actually crash. The downswings this year may have been a short term correction.

- It's difficult to predict the timing of a crash or bear market. The market may tread water for a whole year before dropping, or it might rise before crashing.

- Closing positions means paying capital gains tax on those transactions.

Another possibility is to buy Put options. Put options themselves are very risky, but can be useful to hedge an existing long position. Buying Puts is essentially buying insurance against the market dropping. Your position pays theta every day, but if there is a large drop, the position will make money.

A third possibility is to buy Straddles on a stock ETF such as SPY. Straddles involve buying a Call and a Put at the same strike price. An at-the-money straddle will have 0 delta. When the market rises, the position will become long delta. When the market falls, the position will become short delta. So effectively, the position makes money whether the market rises or falls, but loses money when the market sits still. If you believe the market might crash, but are not sure about the timing, you can buy Straddles. If the market dips, you become short delta, and can buy SPY stock to get back to 0 delta. If the market continues dropping, you will keep getting short delta and keep making money. If the market rises instead, you then become long delta and can sell your SPY stock at a profit. This strategy is called Gamma Scalping. The idea of Gamma Scalping is to use these transactions in the SPY stock to cover the theta cost of the straddle while you wait for a market crash.

Straddles are NOT riskless!!! If the market sits very still, you can lose the entire value of your option position because you will be unable to Gamma Scalp.

More info on Gamma Scalping: https://www.randomwalktrading.com/practical-gamma-scalping/