Bond Analysis Report 10-7-18...More Pain In Store For TLT

On Wednesday, the 10-year yield gained more than on any day since the November 2016 presidential election. On Thursday, yield on the US 10-year Treasury rose above 3.2% Thursday morning. That's the highest it's been since July 2011.

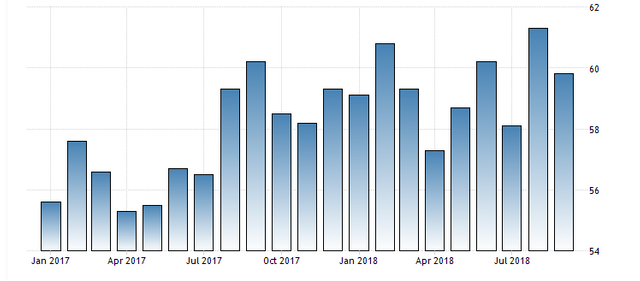

Although the Institute for Supply Management’s Manufacturing PMI in the US fell to 59.8 in September of 2018 from 61.3 in August and the non-farm payroll numbers for September fell to its lowest level in a year, the economy is still strong.

As a result, the expectation on Wall Street is the Federal Reserve will stick to a program of steady, gradual rate increases. This was confirmed Powell he spoke at a moderated discussion hosted by the Atlantic in Washington on Wednesday, when he said Powell said the U.S. economy is “a long way from neutral,” meaning expect more rate hikes. This past Thursday, yield on the US 10-year Treasury rose above 3.2%, the highest it's been since July 2011.

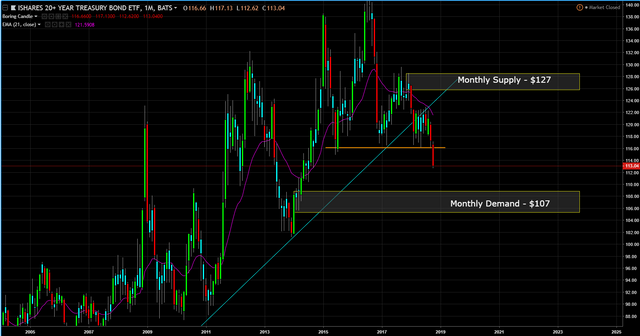

Thus, I expect more pain for bond prices, how much pain, lets look at the EFT, TLT, iShares 20+ Year Treasury Bond.

Monthly Chart (Curve Timeframe) - monthly demand is at $107 and monthly supply is at $127. More importantly, price broke though monthly support line at $116 that was established in mid 2015.

Weekly Chart (Trend and Entry Timeframe) – price is definitely in a downtrend based on lower highs and lower lows. The most recent lower low was formed when price broke through the monthly support line. With the 10 yr note yield clearly above 3% now, the momentum on TLT is to the downside. The chart suggest if price pulls back to the weekly supply at $117.50, short it down to at least the $109.50 level.

Published on

by rollandthomas

I guess I have to start looking at my TBT position... I think this could still bleed a bit though as it finds its footing.

Or consider selling calls against your holdings to ease the blow.