Crude Oil Analysis Report 9-16-18...I'm Bias To The Upside

Because Iraq delivered record-setting production and production from Libya rebounded, oil supplies hit a record 100 million barrels per day (BPD) in August, according to the latest oil market report from the International Energy Agency (IEA). For now, supplies are keeping up with demand, especially with the US - China trade wars continuing. However, I think the supply-demand oil equation is very fragile at this point.

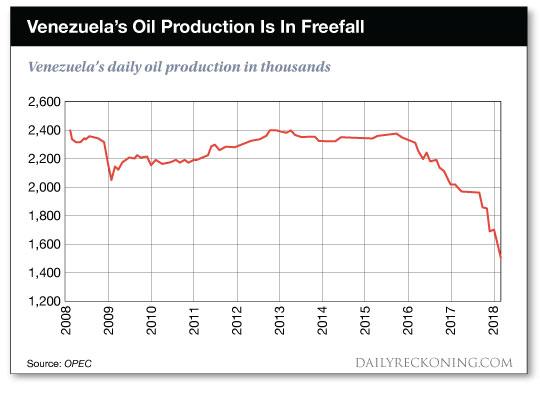

What if issues in Libya continue...OK...that is a what if? But what is real is the issues in Venezuela, the country is in complete turmoil. Venezuela citizens are fleeing the country, even the skilled oil field workers forcing the shutdown of oil wells. Venezuela has been losing around 50,000 bpd of production each month and thus, could loss another 150,000 to 200,000 bpd by the end of the year. Oil production is at the lowest point in almost 70 years.

Then there is the Iran sanctions by the US coming up in November. Oil exports from Iran have already started falling in anticipation of the sanctions as India, Japan and South Korea have already scaled back their oil purchases from Iran. Oil exports from Iran could potentially fall by as much as 2.5 million bpd, according to some analysts.

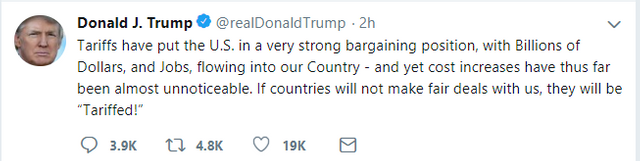

But the X-factor remains the continued US - China trade war. There is no sign that Trump is ready to back off the trade war with the pending fresh round of tariffs targeting about $200 billion in Chinese goods such as dishwashers and Fitbit fitness trackers. For example, here was a tweet from this morning:

However, I think at some point, things will get resolved and if resolved, we should see fresh demand for the black liquid stuff.

So based on all that, lets go to the charts to see where price might head next.

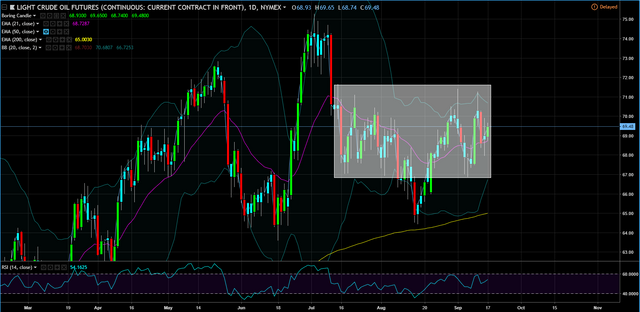

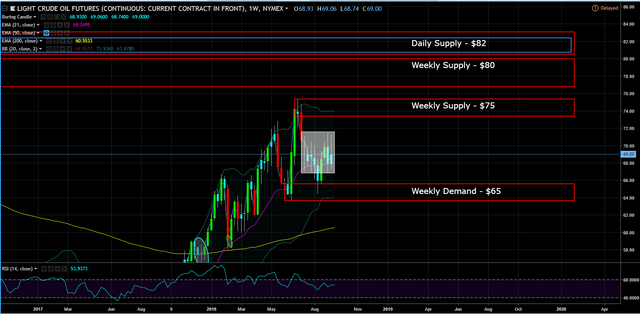

Since mid-July, price has been range bound.

With the exception of price dipping into the weekly demand at $65.

There is definitely evidence by the wicks that there are sellers at the $71 level, but at some point, all the unfilled sell orders will be absorbed.

Those sellers also represent sellers in the middle of the weekly curve or range. Price tends to want to go from one extreme to the next extreme. Thus, based on the news, the fundamentals and technicals, I think the $75 level is going to get retested before the end of the year because I think there are more supply concerns then their are demand concerns.

This post is my personal opinion. I’m not a financial advisor, this isn't financial advise. Do your own research before making investment decisions.

Published on

by rollandthomas

Inflationary pressures should also lead to higher prices as demand continue to stabilize. The supply issue has always put a floor on prices as well.

Agree, I think it's an inflationary play at this time.

There are so many macro factors at hand with the oil market at the moment, certainly interesting times. I see $100 a barrel by the end 2019.

Thanks for your post.

$100 oil isn't out of the question, this might be the last leg, before the downturn, since I think company earnings will slow down next year.

Nice read. I leave an upvote for this article thumbsup