Gold Smart Money Sentiment 8/11/18 – Smart Money Sentiment Continues To Decline

It's been almost two weeks, since I last spoke about gold,

At this time, price action continues to base near the the psychological level of $1200. If the reversal is going to happen, it must take out the sellers at $1245 first. That level is also known as a "FLIP ZONE" where previous demand is now supply.

But wouldn't it be great if we had one more piece of evidence as to where price may head next...well we do and it's called the Gold Smart Money Sentiment?

The Commitments of Traders (COT) is a weekly market report issued by the Commodity Futures Trading Commission (CFTC) listing the positions held by commercial traders and the “Smart Money”, the hedge funds and bank institutions in various futures markets in the United States. Since the COT measures the net long and short positions held by speculative traders and commercial traders, it is a great resource to gauge sentiment in the Markets.

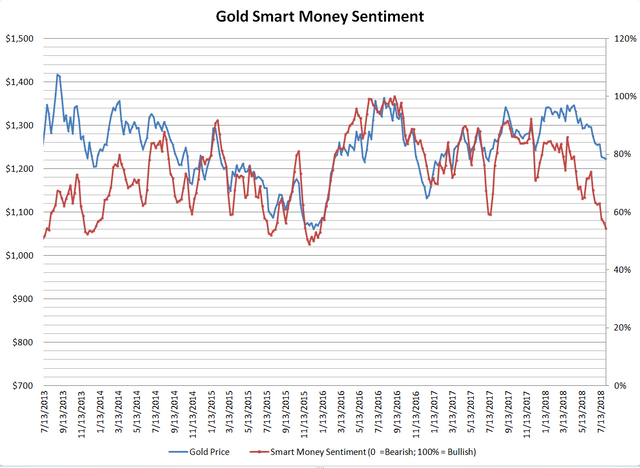

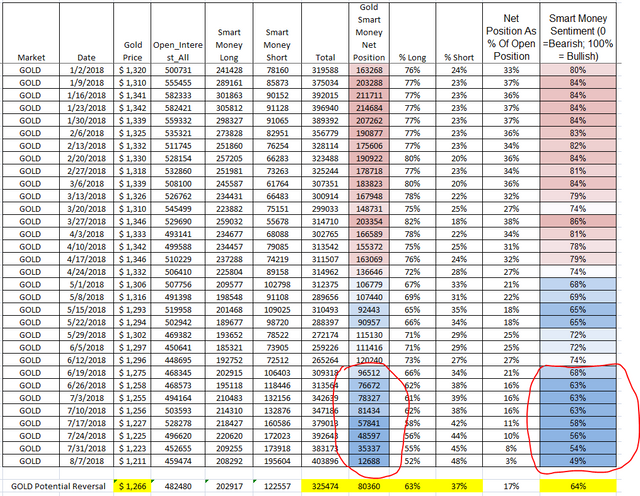

The Gold Smart Money Sentiment is approaching levels it hasn't seen since 2015. The last time the sentiment got this low, price reversed.

However, the table below shows the sentiment is still bearish and has not reversed yet, meaning the bottom in sentiment has not been reached yet.

The fact that the sentiment is still bearish implies to me that the Smart Money hasn't started to accumulate their long positions yet, thus the distribution phase continues.

This post is my personal opinion. I’m not a financial advisor, this isn't financial advise. Do your own research before making investment decisions.

Published on

by rollandthomas

Will be interesting to see how the Turkey Lira situation plays out and its impact on gold...

Yeah, I'm hoping we don't have another Greece on our hands.

Last week there was a major capitulation. Vanguard killed their Gold and Silver fund due to extended poor performance. They relaunched it as something like Cyclic Segments and only have a 20% allocation to gold/silver now. In June $2B flowed out of Gold/silver ETF's. At resource conferences the investors are depressed. I would say we are very close to a bottom.

Interesting! So how low do we go? I'm assuming not much lower or it will just be trading sideways until the bull run begins.

If $1200 breaks, the next level to watch is $1140.