Plan Your Trade, Trade Your Plan

Several days ago, I posted about not having a trading plan for option trading and explained what this did to me mentally and the results on the trade.

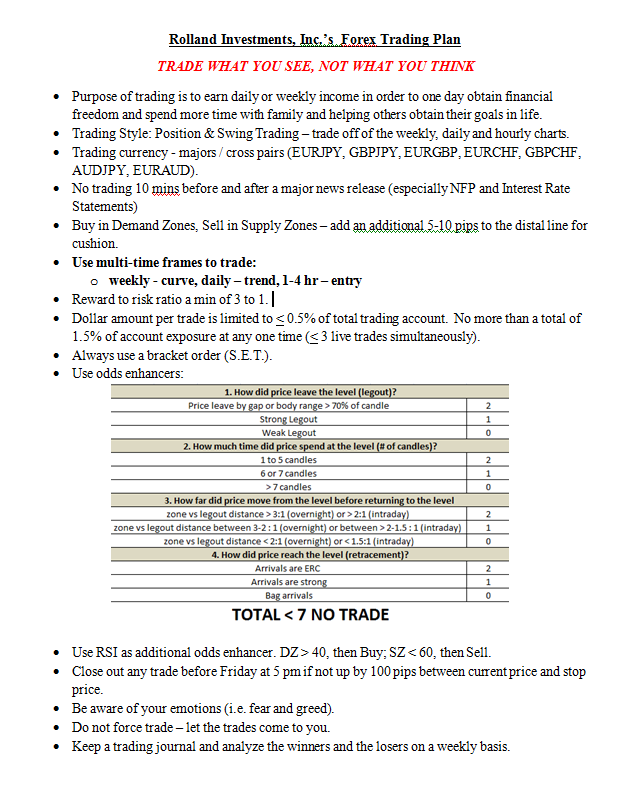

A trading plan gives any trader the opportunity to be successful, but you will be surprised by the number of traders that don’t have a trading plan. Case in point, me…I don’t have any plan for trading options. Good, bad or indifferent, trading plans at a minimal provide consistency to assess whether you have a viable edge over the Markets. A trading plan doesn’t have to be a book, a couple of pages max. After several iterations, I managed to get my Forex trading plan down to one page

Whether you are a new trader or a consistently profitable trader, all trading plans have a few crucial things in common:

- TRADING METHODOLOGY & RISK MANAGEMENT. Trendlines, moving averages, Fibonacci levels, fundamentals can be used to determine trading set-ups...to enter trades, manage the trade and take profits or losses. For example, I’m looking for pull backs to join the trend and usually won’t risk more than 1% of my capital on any one trade and if I reach a certain daily loss limit, I’m done for the day.

WHAT MARKETS TO TRADE & TIME FRAMES. Every market has their own personality and if you try to trade them all, you will never get to know the nuances of a particular market to exploit its tendencies to your advantage. Specifying time frames (or volume charts, etc) and type of trading such as day trading or swing trading is important as well. For example I swing trade Forex, but day trade, futures, specifically the Nasdaq and Crude Oil.

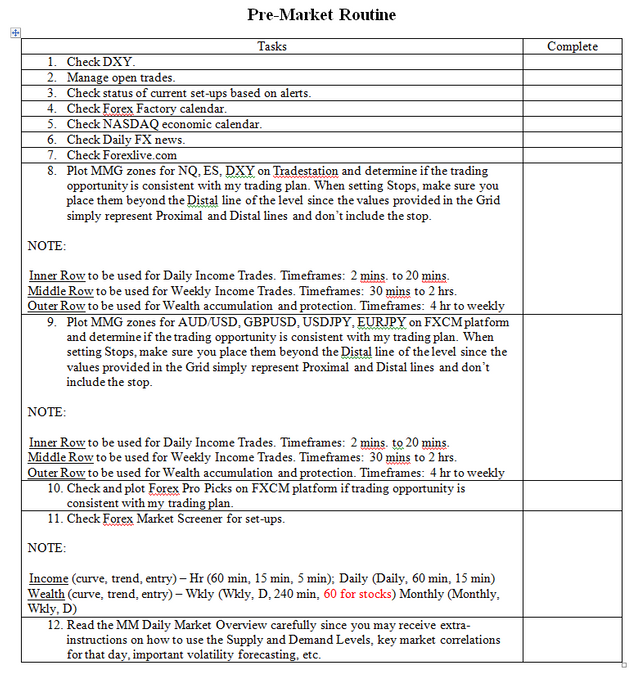

DAILY ROUTINE. The most successful traders do the same thing over and over again and that’s before they even place their first trade of the day. For example, I created a daily routine a couple of years ago, which has since evolved over time.

- REVIEWING TRADES. Some traders usually have a morning routine, but more important is what’s done after the trade has closed. Whether you review your trades at the end of the day or at the end of the week, this process ensure you are following the process you have outlined in your plan and it imperative in becoming a better trader.

Regardless of what you do, have a game/trading plan and be consistent.

This post is my personal opinion. I’m not a financial advisor, this isn't financial advise. Do your own research before making investment decisions.

Published on

by rollandthomas

This is great and key for most successful traders. Discipline seems easier than it really is given the emotions that sometimes interfere with decision making in investing. Great examples to share! Thanks!

Thanks @newageinv

great job!!

Thanks @xoxoone9

Great post Rolland.

Thanks @workin2005

Thanks for sharing.

I would like to know if you use any specific method/tool to review your trades you can recommend.

You are welcome. I just take screenshot before and after trade and use excel to analyze my trades quantitatively.