Simon Property Group Isn't Really A Buy, But Needs To Be A Buy To Short It

Simon Property Group (NYSE: SPG) is a global leader in the ownership of premier shopping, dining, entertainment and mixed-use destinations and an S&P 100 company (Simon Property Group, NYSE: SPG). Their properties span across North America, Europe and Asia provide community gathering places for millions of people every day and generate billions in annual sales.

The company has spent ~$5 billion on development projects over the last five years already, The largest US-based mall owner and operator announced a massive $4 billion investment plan in May to transform its properties (goodbye Sears, hello trendy retail stores) into restaurants, hotels, fitness centers and luxury stores order to drive foot traffic at its malls. They are even converting some of these “out with the old, in with the new” places to residential spaces.

This redeployment of spaces has allowed Simon to have the highest sales / sq. ft in the company’s history recently. But their debt to equity is crazy. Simon had a debt-to-equity ratio of about 7X, which is also 7X higher than the industry average, while their direct competition is anyway from 1X to 2X. Nevertheless, the company feels it’s generating enough income to pay down the debt, especially if they are able to refinance the debt.

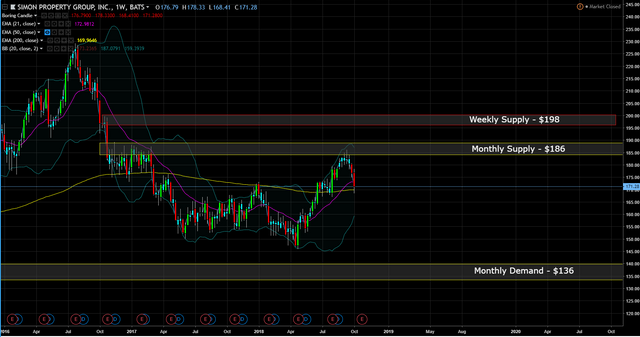

Maybe this is why JPMorgan, analyst Anthony Paolone upgraded Simon Property Group to Overweight with an unchanged price target of $198 today. Anthony views the shares as "cheap" on an absolute and relative basis compared to other REITs. Further, he believes Simon has a "good runway" to generate growth over the near-to-intermediate term

Simon has been on my short watch list for over a year. I even missed my opportunity recently to short the stock because I’m good with setting alerts.

SIDE NOTE: one day I will learn to set alerts religiously.

Now I would say I disagree with JP Morgan, but how else is price expected to get to a level to short at. This is how the game works…catalysts just make prices get to the levels quicker. So the thesis is this, Amazon / E-commerce continues to take market share from traditional retail, while interest rates continue to rise, increase the cost of debt that consumers have to pay, lowering their discretionary spending.

Thus, the trade set-up is if price is able to get back to $198, wait for confirmation that price wants to go lower and short Simon with a target at $136.

Published on

by rollandthomas

I remember shorting this one leading into the Financial Crisis (along with HOG) as their leverage was so high and short term financing was not available for the bridge loans they had open at the time. It worked out well for me even thiugh they ultimately survived, it shows that there are always short term opportunities despite the ending being different...

Unfortunately, there will be a lot more companies to short when things turn, it's going to get really ugly 1-2 yrs from now.