Cyprus Cooperative Bank BAILIN Or BAILOUT? New BANK FAILURE In Cyprus!

It has come to my attention from journalists in Cyprus that Cyprus Cooperative Central Bank has failed. It used to be a coop bank but now is 77% state-owned. After the 2013 Bail In and banking restructuring back in 2013 in the aftermath of the financial crisis in the country that ended up with depositors losing substantial amounts of currency when the Cyprus Central Bank and the European Stability Mechanism a group under the ECB used to manipulate and keep the banking system from complete failure.

As of current, it looks like the CCB bank will be sold to Hellenic for next to nothing and the €9.7 billion in deposits "will be safe" at Hellenic bank. As of Current €70 million has been withdrawn from the bank as the bank run intensifies and the Government and Central Bank is trying to tell the population that there is nothing to fear as they did in 2012-2013 as well. They always lie, and it is only to look at the track record of other central bankers saying that everything is okay right before it collapses.

Remember it is all trust game banksters and the governments that force you to use their legal tender currency tries to force you and then believe that their currency is the best possible medium of exchange.

Let's get back to Cyprus and the CCP bank problem. How come the run on the bank started? Rumours had spread around Cyprus that The Co-op Bank has been split into a good “bank” and "sold off" to Hellenic Bank on what are deemed to be very generous terms while the bad “bank” will be transferred to a special purpose entity that will be set up and governed, from what we have been informed, by professionals who know about distressed debt management.

So there is nothing to worry about as the bad debt is in good hands that will fix the problem. Bad debt is never a problem anymore as usually the Central Bank scoop them up with printed currency leaving the bad debt on their balance sheets and there is no worry as they will sell off the bad debt as the FED is currently doing. The real problem here is that debt when it hits an oversaturation of a market it becomes impossible to pay back as there are no more people to indebt to pay off the interest that does not exist in the currency supply in that sector of the economy which is in Cyprus mostly personal debts and first housing debt.

Here is an exert from an article someone sent me to understand what has happened in Cyprus from the start to current date:

Cyprus is not alone in having such a problem with bad lending practices at co-op movements. We have seen the same in the UK and Spain. In the UK the Co-op Bank was bailed in with bond creditors paying up for the losses. In Spain, though the co-ops were bailed out with state funds provided by the SSM and the co-ops were completely restructured. The same problems existed as in Cyprus, especially the bad governance and political interference, but the solution in Spain was different in that the non-performing loans were moved off the balance sheets of the co-ops.

When we come to the events of the banking crisis in 2013, there was a complete lack of appreciation of the problem with the co-ops by the government, the Central Bank and the European Central Bank (ECB). The loans on the Co-op balance sheets were toxic. Post-2013 there were probably two asset quality reviews (AQR) to determine the level of capital and provisions required for all systemic banks in Cyprus. It is thus crucial when judging who to blame to look at the results of these AQRs.

What did the repeated AQRs show about the values of the collateral and who approved these asset reviews? Was the ECB not aware of the need for very high provisions when the first funding support was provided and the subsequent equity injection of €175 million? If the European Security Mechanism (ESM) lenders had done their job correctly, early intervention would have taken place; instead, there was a five-year wait.

The banking landscape in the EU regarding non-performing loan management was only going to change for the worse, and there were several warnings.

Some pointed out this was going to happen and were not heeded and then came the dreaded IRFS 9 which changed the treatment of NPLs. It was as predictable as night follows day but not much was done to move NPLs off the balance sheet of the Co-op Bank. Instead, we heard that the Co-op was overcharging borrowers using its base rate instead of Euribor and this cost the Co-op €110m. Worse was bound to follow since the ECB/EBA went ahead with changes to how NPLs would be treated and how quickly banks would have to provide if these loans were deemed non-recoverable. No one can say we did not know.

So, in fact, instead of the Central Bank/ECB and the finance ministry pushing the Co-op to take more drastic action, time was wasted trying to sell part of the Co-op.

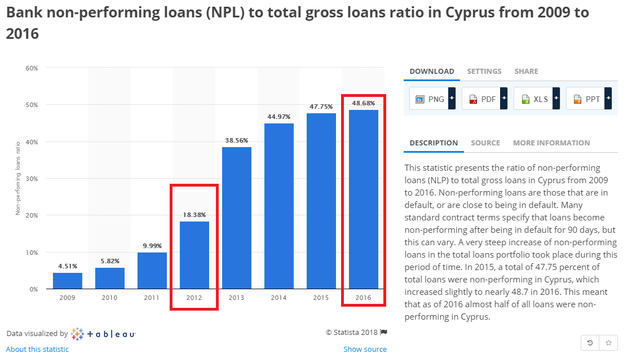

It was a hopeless effort since the Co-op had an NPL ratio of nearly 60 percent, lower provisions that were necessary and no business model could make the bank profitable. The next step was to try and give 25 percent as a gift to existing depositors which was not in line with the MoU signed with the troika as the government had committed to selling the Co-op Bank when rehabilitated at the highest price the government could achieve.

The Coop bank was sitting on almost 60% of bad loans, and that makes it difficult. I do not only see this problem with CCP but also with the Cyprus banking sector as a whole. Take a look at the stats since 2013 Bailin. The banks were recapitalized, but it did not fix the more significant problem that the monetary system of the fractional reserve has that it will expand with debt and it'll look like everyone is rich but at the tail end when the debt-driven system comes to a holt with debt saturation and no one left to indebt.

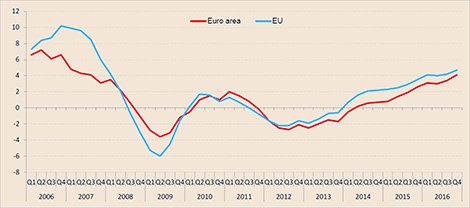

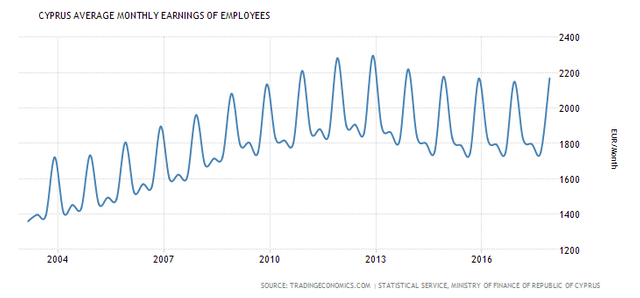

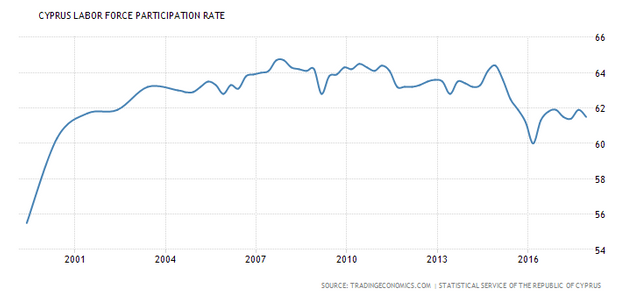

The other primary reason for such rapid growth of loans in distress and foreclosure is dropping house prices so many mortgages are in negative equity, but also stagnate wages and fewer people in the labour force forcing them to fail to pay back their debts. The country has had a slight deflation and a depression that has not been dealt with as the banksters keep being propped up as the politicians are trying to protect the people that did not understand their house is not an asset. People are enraged as they are losing their homes, but you got to remember they shouldn't have gotten a loan in the first place.

Before I go into solutions for Cyprus, I wanted to take a look at the real issues with the banking system itself. First I want to explain the difference between cash and deposits at the central bank.

Regulation D requires commercial banks to have reserves of a certain percentage of all of their demand deposits (meaning a percentage of the total balance of checking accounts). The reserves can be actual physical currency, or (and in practice mostly) on deposit with a branch of the Federal Reserve.

Their accounts at the Fed are also sometimes used for transactions with other banks, clearing checks from other banks, transactions with the Fed itself (such as buying government bonds for a customer) etc.

You can find the 210-page explanation of the regulatory framework here or go to sleep after reading four pages :D

https://www.philadelphiafed.org/-/media/bank-resources/financial-regulatory-reporting/regulations/regulation_d.pdf

In more straightforward terms mostly the so-called central bank deposits are electronic money and not real hard cash.

What I will do with the Cyprus banks is look at their latest consolidated financial statements, and give you an overview of their cash to deposit ratios with and without the Central Bank deposit. The CB deposits are most likely not to be cash but can be printed into existence by and transferred from electronic currency to notes and coinage the FED or in this case the Cyprus Central Bank in a panic so I'll give you the numbers. I don't think this will ever happen as banks will first and foremost put in capital control or if they get their way to imprison you in a cashless system without any cash to stop runs on the banks.

Okay back to the numbers:

Hellenic Bank

Cash: 65,037,000

Cash + Central Bank and Other Deposits: 2,294,000,000

Deposits: 5,808,000,000

Cash to deposit ratio: -98.88%

Cash + Central Bank and Other Deposits ratio: -60.50%

https://www.hellenicbank.com/portalserver/content/atom/ba122ca0-b615-4054-878e-cf272e6e3254/content/Results%202017/Preliminary%20Financial%20Results%20of%20the%20Hellenic%20Bank%20Group%20for%20the%20year%20ended%2031%20December%202017.pdf?id=e2d24f52-a2a6-45aa-8c6c-a8ba685f4c84

Cyprus Cooperative Bank

NOTE: 2017 June 30th numbers - 70,000,000 Withdrawn CCB Got very low on cash almost running out and therefore had to be consolidated with Hellenic which does not show cash ratios as its post on Financial Statement.

Cash: 108,759,000

Cash + Central Bank and Other Deposits: 3,432,601,000

Deposits: 12,245,551,000

Cash to deposit ratio: -99.11%

Cash + Central Bank and Other Deposits ratio: -71.96%

https://www.ccb.coop/userfiles/f8ce1af3-1709-4976-a785-1a5a8d552da1/Financial-Statements-six-months-ended-30062017.pdf

Bank of Cyprus

Cash: N/A Unfortunately they are hiding Cash reserves by combining it with the balance sheet with CB deposits.

Cash + Central Bank and Other Deposits: 1,446,851,000

Deposits: 8,750,919,000

Cash to deposit ratio: N/A Unfortunately they are hiding Cash reserves by combining it with the balance sheet with CB deposits.

Cash + Central Bank and Other Deposits ratio: -83.46%

http://www.bankofcyprus.com/globalassets/investor-relations/annual-reports/english/boch-annual-report-2017-eng-signed.pdf

Alpha Bank Cyprus

.jpg)

Cash: N/A Could not find Cash holdings as a post on their financial statement.

Cash + Central Bank and Other Deposits: 774,882

Deposits: 30,255,030

Cash to deposit ratio: N/A Could not find Cash holdings as a post on their financial statement.

Cash + Central Bank and Other Deposits ratio: -97.43%

https://www.alpha.gr/files/investorrelations/BOOK2017%CE%A44_Eng.pdf

Eurobank Cyprus

Cash: N/A Could not find Cash holdings as a post on their financial statement.

Cash + Central Bank and Other Deposits: 1,524,000

Deposits: 33,843,000

Cash to deposit ratio: N/A Could not find Cash holdings as a post on their financial statement.

Cash + Central Bank and Other Deposits ratio: -95.49%

https://www.eurobank.gr/-/media/eurobank/omilos/enimerosi-ependuton/enimerosi-metoxon-eurobank/oikonomika-apotelesmata-part-01/2017/full-year-2017/consol-ar-en-2017-290318.pdf

Astrobank

Cash: N/A Could not find Cash holdings as a post on their financial statement.

Cash + Central Bank and Other Deposits: 326,932,139

Deposits: 1,103,199,997

Cash to deposit ratio: N/A Could not find Cash holdings as a post on their financial statement.

Cash + Central Bank and Other Deposits ratio: -70.36%

https://www.astrobank.com/Images/AstroBank%20Limited%20Consolidated%20financial%20statements%202017%20.pdf

USB Bank

Cash: N/A Could not find Cash holdings as a post on their financial statement.

Cash + Central Bank and Other Deposits: 67,337,327

Deposits: 603,544,238

Cash to deposit ratio: N/A Could not find Cash holdings as a post on their financial statement.

Cash + Central Bank and Other Deposits ratio: -88.84%

http://www.usbbank.com.cy/data/articles/annualreports/Annual_Report16en.pdf

RCB Bank

Cash: N/A Could not find Cash holdings as a post on their financial statement.

Cash + Central Bank and Other Deposits: Cash: 1,041,617,000

Deposits: 7,931,902,000

Cash to deposit ratio: N/A Could not find Cash holdings as a post on their financial statement.

Cash + Central Bank and Other Deposits ratio: -86.86%

http://www.rcbcy.com/en/about-rcb/disclosure/financial-reports/financial-report-2016/RCB-Report-and-Financial-Statement-2016.pdf

CDB Bank

Cash: N/A Could not find Cash holdings as a post on their financial statement.

Cash + Central Bank and Other Deposits: Cash: 96,853,000

Deposits: 480,638,000

Cash to deposit ratio: N/A Could not find Cash holdings as a post on their financial statement.

Cash + Central Bank and Other Deposits ratio: -79.84%

https://www.cdb.com.cy/uploads/originals/1/cdb-annual-financial-report-2017.pdf

Looking at these numbers, it becomes clear that the banking system in Cyprus is in trouble. The thing is there are problems with all banks around the world. The reason I look at Cash to Deposit ratios is that is how fast a bank run can start when people start withdrawing what they thought they owned and had as deposits in the bank. The problem almost no one understands is that when your money is in the bank, it is not yours! It is a loan to the bank and therefore is a liability on the bank's balance sheet. If you don't believe me. Take a look at the link to a banks balance sheet.

Before I finish my report, I wanted to give you an approximate of how "solid the newly merged bank" The "Good" CCB bank and the Hellenic bank would look like. And the last warning that banks are a Ponzi scheme! Also, I couldn't find any numbers on the so-called Cypriot deposit insurance fund. But here is a link to their webpage. https://www.cysec.gov.cy/en-GB/complaints/tae/

New proposed Hellenic/CCB Bank

NOTE: Numbers are not 100% accurate as most of these numbers are 2017, but they most likely haven't changed a lot.

Cash: 173,796,000

Cash + Central Bank and Other Deposits: 5,726,601,000

Deposits: 19,808,000,000

Cash to deposit ratio: -99.12%

Cash + Central Bank and Other Deposits ratio: -71.08%

Peace, Love and Voluntaryism,

John S

great article, well researched.

Very in depth analysis. Scary.

Long time since you posted something about the prediction of crypto, I am curious on your view on Steem

Congratulations @theeconomictruth! You have received a personal award!

Click on the badge to view your Board of Honor.