The Only Reason Why The US Equity Markets Reversed Where It Did

Arthur D. Cashin, Jr. is a managing director of UBS Financial Services Inc. and the Director of Floor Operations for UBS Financial Services at the New York Stock Exchange is a well-respected figure on Wall Street.

Traders are trying to remain positive as stocks came off their sharp morning lows, veteran trader Art Cashin told CNBC on Wednesday.

“If we rolled over here and violated the morning lows, then it would really begin to be a problem,” said Cashin, UBS director of floor operations at the New York Stock Exchange. “For now, everybody is kind of crossing their fingers and whistling past the graveyard, saying, ‘OK, we tested Monday’s lows,’” he added, around midmorning as the worst of the sell-off was abating.

“The S&P held, so I guess we can be in good shape,” said Cashin, who predicted rocky markets for the next few weeks as global trade tensions mount. “I think volatility is here to stay.”

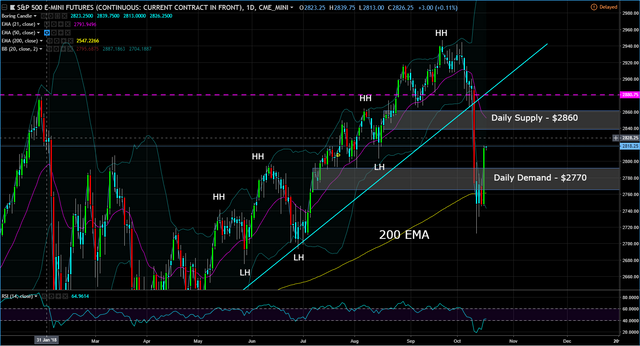

However, there is one reason and one reason only why the US equity markets are off the Monday lows.

The moving average is the most ubiquitous and simplest technical analysis tool used by discretionary and system traders, market analysts and those pestering algos. The 200 moving average, the king of moving averages is used on a daily chart to determining the overall long-term market trend over the last 40 weeks.

Discretionary and system traders, market analysts and those pestering algos also use moving averages for support and resistance. For example, in February and April of 2018, the 200 moving avg. (yellow line) served as support for the Market.

In October of 2018, the same thing happened.

And again this week,

Whether you trade cryptos, stocks, forex, but don’t have the 200 moving average on your daily chart, consider plotting it on your daily chart as it might offer you an additional edge to accompany your trading strategy.

This post is my personal opinion. I’m not a financial advisor, this isn't financial advise. Do your own research before making investment decisions.

Fabulous post i must confess,d world is digitally inclined now so i think it's really high time we look d crypto way, make the best use of this platforms and trade smartly

Thanks and I totally agree.

Posted using Partiko iOS

Awesome post. I've been learning a bit more about technical analysis from you. I've never been much of a TA guy myself, but I've always found it interesting to follow nonetheless... plus the charts always look so slick for some reason :)

Thanks, glad to contribute to the community. I’m primarily a supply and demand trader, but been picking up stuff from the community like support and resistance to incorporate into my trading to give me an additional edge.

Posted using Partiko iOS

I agree- lots of institutions love that 200 DMA, I use it too on dailys

Posted using Partiko Android

An easy way to know what the Smart Money is looking at and thinking.

Posted using Partiko iOS

Still think institutional money is still selling while retail investors buying the dip before the real damage happens!

Posted using Partiko iOS

It is very quite possible, I think it’s time for a COT report on the SPY.

Posted using Partiko iOS