Russia Raises Rates to Raise Stability

2018 has not been kind to the Russian Ruble. Despite a improving macroeconomic statistics and a widening positive balance of trade the Ruble has lost more than 10% versus the dollar so far this year.

So, the recent decision by the Bank of Russia to surprise everyone and raise interest rates 0.25% seems like a typical move by an emerging market economy under capital flight stress from a falling currency.

But, it isn’t. It is, in fact, a statement of the exact opposite. Inflation hit 3.1% in August, still well below the Bank of Russia’s 4% target but the sharp up-tick was likely an excuse for it to announce their willingness to address the incessant hybrid war attack on capital inflow into Russia, which hit a 5 year high in Q1 at $33.47 billion.

Russia’s current account surplus is hot with high oil prices and total external debt of the Russian Federation dropped to just $485 billion (from $524 billion) in Q2 as the country both divests and is forced to divest from dollar-denominated assets.

Through July, Russia has seen a 63% rise in its trade surplus, year-over-year to $104 billion thanks to higher oil prices. So with numbers like these it’s pretty obvious that the ruble should have been strengthening over most of 2018.

)

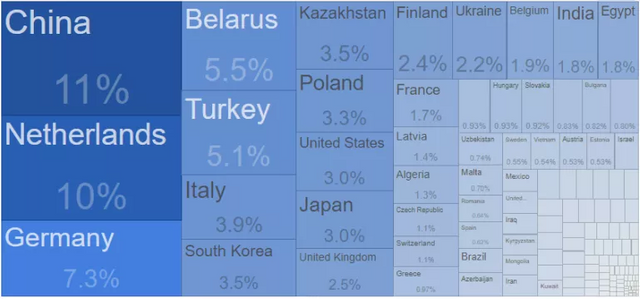

)Russia’s Exports Broken Down by Country

The endless parade of sanctions by the U.S. against companies, countries and individuals are designed to keep the political risk of investing in Russia high to retard these positive growth numbers by forcing divestment.

The Ruble has been in the cross-hairs of the U.S. political establishment’s war on all things Russia as a means to tie President Trump’s hands and arrest any fundamental shift in foreign policy.

Widely seen as still a tool of Western financial and political influence the Bank of Russia should always be viewed with skepticism. I’ve openly criticized it for being too slow in its lowering rates over the past three years and I stand by that.

If the benchmark rate had been dropped to 6.5% or even 6% then the yield curve would have normalized much earlier and the domestic currency portion of Russia’s financial system would be more robust today.

It would also give the BoR a lot more policy wiggle room to affect the kind of stability the ruble has lacked for decades and is in strong need of today and into the future.

The Russians since the ruble crisis of late 2014 have worked diligently to ensure that such a crisis never happens again. What has kept The Russian ruble and ruble-denominated debt from becoming an investible asset class is, in a word, volatility.

And that volatility has been a policy imperative of the United States.

The source of much of the ruble’s volatility comes from the U.S. hybrid war on Russia and U.S. policy unpredictability. This stems from a deep fear in Washington D.C. of Russia’s obstinance as an existential threat to U.S. primacy in all things political and financial the world over.

The mere idea of Russia standing up to the U.S. on foreign policy objectives in Ukraine and Syria while saying “Nyet!” to being a slave to gunboat dollar diplomacy is what drives neoconservatives on K-Street and their pets in Congress and the Deep State apoplectic.

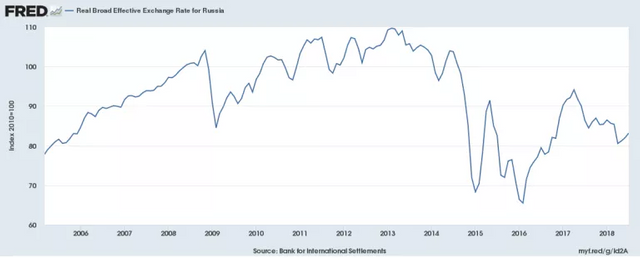

Here’s the long-term chart of the ruble’s real-effective-exchange-rate or REER as calculated by the Federal Reserve:

Not the very model of a modern major currency is it?

So, if you want to know why the U.S. financial elites are so set on their course to sanction Russia at every turn it is right there in that chart. The key to creating central Asian stability comes from having a dominant trade currency that can act as a node of stability relative to the outside world.

This is the fundamental problem with the unipolar dollar reserve standard. It creates the veneer of stability via the deep and liquid U.S. financial markets but gives the stewards of those markets untold power to push and pull the world economy wherever they want it to go.

And that’s a power no one willingly gives up.

Any attempt by a country to extricate themselves from the volatility of the dollar is met with extreme opposition from the U.S. Russia is not allowed to set independent monetary policy, nor is it allowed to pursue its national interests without our approval.

This is the point of the recent screed by U.S. Energy Secretary Rick Perry speaking about Iran.

The message to the Iranian government is clear: if you cannot … participate as a reasonable citizen, there will be sanctions that will cost you, Perry said, adding that “the United States is in a position today to send a message to countries that do not participate in a civilized way that they will be punished.”

Make no mistake he was talking to Russia.

So, that’s where we are today.

The financial and political elites in the U.S./U.K. and Europe want their Unipolar moment back. And they are willing to lie, cheat, sanction, invade and flat-out steal (called ‘asset seizure’) to get their way.

Rick Perry might as well have been wearing a set of Saudi sheik robes when he made that announcement because that on whose behalf he was speaking. But, the Saudis are the ones in the precarious position caught between the Scylla of rising U.S. oil production and the Carybdis of Russia’s vast oil and gas reserves which can overwhelm them on price in the long run.

To stay alive the Saudis stick with the U.S. dollar, using the U.S. as its partner in fomenting chaos in its regional competitors in both oil markets and regional politics: Iran, Iraq and Russia.

But, the U.S. dollar will not be the currency of central Asia as time moves forward. Russia and China’s massive diplomatic and economic investments into all of the countries of the region, from the former Soviet ‘Stans to India is what will drive demand for those countries’ currencies locally, driving out the U.S. dollar where it now dominates.

And that means the central bank acting in such a way to build relative stability of the ruble and that’s not going to happen if Russia is constantly reacting to Washington. Because what’s happened over the last year cannot be allowed to continue if Russia is serious about de-dollarizing its economy.

The ruble has to begin acting as the regional reserve currency starting with the countries under the worst attack by the U.S., Turkey and Iran. But to that list I would add Pakistan, India and Iraq now that the U.S.-backed government has fallen.

The calls for Russia to completely dump the dollar in foreign trade are growing louder but that means providing the right infrastructure for people to be willing to hold rubles over time. This is one of the major themes of this year’s Eastern Economic Forum in Vladivostok.

The conditions are ripe for this shift in investor sentiment. Political turmoil in the U.S. and Europe will call into question the strength of their institutions and undermine the currencies.

The weakness of the Ruble today will be its strength in the future as the incentives to invest in Russia’s expansion have widened thanks to the cheap currency. The Bank of Russia defying the analysts here is a tentative statement that it believes in that expansion enough to raise rates and hold the line on the ruble.

To support more work like this and get access to exclusive commentary, stock picks and analysis tailored to your needs join my more than 170 Patrons on Patreon and see if I have what it takes to help you navigate a world going slowly mad.

Curated for #informationwar (by @commonlaw)

Our purpose is to encourage posts discussing Information War, Propaganda, Disinformation and other false narratives. We currently have over 8,000 Steem Power and 20+ people following the curation trail to support our mission.

Join our discord and chat with 200+ fellow Informationwar Activists.

Join our brand new reddit! and start sharing your Steemit posts directly to The_IW!

Connect with fellow Informationwar writers in our Roll Call! InformationWar - Contributing Writers/Supporters: Roll Call Pt 11

Ways you can help the @informationwar