Are state-backed cryptocurrencies the future?

China has clamped down on bitcoin trading: Shutterstock

The world’s two biggest economies are still wary of cryptocurrencies, although a growing number of their citizens are investing in bitcoin and its peers. China’s enthusiasm for blockchain technology is offset by an equal hostility towards digital currencies. A year ago Chinese authorities slapped a ban on initial coin offerings (ICOs) and recently the crackdown on cryptocurrency-related activities has intensified.

Yet despite the official line, the People’s Bank of China (PBOC) has reportedly been exploring whether a national digital currency could prove successful in a country where mobile payments and mobile wallets are increasingly common. China could therefore pursue the possibility of a totally cashless society, with cryptocurrency not just an option but a replacement for notes and coins.

While the US is less hostile to bitcoin and its peers, the country’s regulatory framework for crypto has been unclear for some time and there’s little evidence of any drive to rectify it. The Securities and Exchange Commission (SEC) has adopted a hard line in crypto companies whose marketing it regards as misleading and this week a New York federal judge ruled that US securities law can be used to prosecute fraud cases over crypto offerings.

The Winklevoss brothers have just launched the Gemini dollar: Shutterstock

Despite this lack of encouragement Tyler and Cameron Winklevoss, owners of digital exchange Gemini Trust Company, have just launched the Gemini dollar, a regulated stablecoin that allows users to send and receive US dollars on the Ethereum cryptocurrency network. The Gemini dollar has won approval from the New York Department of Financial Services and aims to maintain a value one on one with the greenback.

While some analysts think the growing US debt burden will one day cause the collapse of the dollar and pave the way for a crypto dollar, the US authorities aren’t going to encourage the process. It’s a similar story across the Atlantic.

While London is keen to maintain its status post-Brexit as one of the world’s major financial centres, the UK is less keen than many major economies for a digital version of its currency. A survey by market researcher D-CYFOR published in April found that 60% of Britons polled didn’t support the introduction of a Bank of England (BoE)-supported cryptocurrency.

Europe focus on Switzerland?

Mark Carney has played down the idea of a BoE-backed crypto: Shutterstock

The BoE’s governor, Mark Carney, also poured cold water on the idea earlier this year. In a speech given last February, he commented: “Bitcoin has pretty much failed thus far on the traditional aspects of money. It is not a store of value because it is all over the map. Nobody uses it as a medium of exchange.”

Carney added that a BoE-backed digital currency would create “fundamental problems” but spoke more positively about blockchain technology, noting its strengths as a vehicle for verifying financial instruments in a decentralised way.

The European Union is also wary of any crypto version of the euro, although a recent study of the fintech sector by the European Parliament Committee on Economic and Monetary Affairs (ECON) acknowledged that it was quite possible that crypto could function as an alternative to fiat currency in various applications. The report also noted the growing number of Europeans using cryptocurrencies.

Euro and bitcoin – no early union is expected: Shutterstock

Despite this, the official line of institutions such as the European Central Bank (ECB) is that cryptocurrencies pose a major threat to financial stability. While the prospect of an officially-sanctioned crypto euro could well become a reality over time, it’s unlikely to happen in the near future.

As a country outside of the EU, Switzerland could be the European country to break ranks however and embrace a state-backed crypto. In May this year, Swiss lawmaker Cedric Wermuth, president the country’s Social Democratic Party called for a report on the risks and opportunities that would be presented by an e-franc. The Swiss government, or Federal Council, backed the proposal.

Not everyone is as keen. Swiss National Bank governor Andrea Maechler has said the SNB believes private sector digital currencies are a better and less risky alternative than any version that might be devised by a central bank.

Nonetheless, if the report is positive a study on an official e-franc will be produced by the Swiss finance ministry

.

Switzerland has already established itself as one of the world’s leading fintech hubs and the home to several major cryptocurrencies, so the e-franc could well progress beyond the concept stage.

Another special case is Sweden, which has been an EU member since 1995 but chose not to adopt the euro and retains its own currency, the krona.

Swedish krona – ready for conversion?: Shutterstock

Sweden is one of the countries heading the move towards a fully cashless society. As its citizens abandon notes and coins for cards and electronic payments, it is ready to launch the e-krona as a state-backed crypto. The one potential obstacle is that the country’s bankers don’t share the central Sveriges Riksbank’s enthusiasm for such a move, which they fear will undermine their business.

Estonia thwarted

Another centre of state-backed cryptocurrency activity in Europe has been Estonia, which in August 2017 announced plans to issue a state-backed crypto called Estcoin. This followed an initiative on the country’s blockchain-based residency registration called e-Residency. Estonian officials also announced that the country would pioneer the world’s first state-backed initial coin offering (ICO).

These ambitions have run up against obstacles created by Estonia’s membership of the EU. It means the country is restricted by the monetary policies of the European Central Bank (ECB), whose president Mario Draghi and other banking authorities were critical of Estonia’s plans.

So it was reported in June this year that the planned ICO has now been shelved and ambitions for the Estcoin will be scaled back. Siim Sikkut, head of Estonia’s IT strategy, said that the digital coin will be used only as an incentive for e-residents – foreigners who move to the country to set up companies and remotely sign administrative documents. The e-residency programme has seen around 35,000 foreigners – mostly from Russia, Finland and Ukraine – issued with digital ID cards.

Mention should also be made of the tiny ‘Free State of Liberland’, wedged between Serbia and Croatia, which was set up in 2015 with bitcoin as its designated national currency and also accepts bitcoin cash and ethereum.

Japan blows hot and cold

Outside of Europe, while a state-backed cryptocurrency is an unlikely near-term development in the world’s two biggest economies the concept is being actively pursued in a growing number of countries.

A year ago the world’s third-largest economy, Japan, appeared to be one of the most enthusiastic on the prospect of a state-backed yen. Reports suggested that plans were underway to create a cryptocurrency that would be called J-Coin and pegged to the Japanese yen.

Users would store and spend the new digital currency using their mobile device and the plan envisaged the launch taking place in time for the 2020 Olympic Games in Tokyo.

But more recent pronouncement suggest this enthusiasm may since have cooled – possibly due in part to the sharp retreats in the price of bitcoin and its peers since the start of this year from the heights reached in late 2017.

In April this year, the Bank of Japan’s (BoJ) deputy governor, Masayoshi Amamiya, told the audience at a fintech conference that the bank had no plans to issue its own crypto and that a national digital coin could potentially threaten the traditional financial system established in developed countries.

Amamiya was concerned that central bank digital currencies would give households and businesses direct access to central bank accounts. “This may have a large impact on the two-tiered currency system and private banks’ financial intermediation,” he warned. The BoJ currently allows direct access to its accounts only to a select few, such as private banks.

However, Amamiya added that central banks should heed ongoing innovation and follow technological advances in order to provide societies with the best financial infrastructure. BOJ recognised the importance of understanding innovative technologies, both for maintaining stability and also for seeking their application in the future.

Turkey and Asia Pacific front runners

The battered Turkish lira makes a crypto alternative attractive: Shutterstock

Cryptocurrencies are increasingly popular with Turkey’s citizens, a trend further encouraged by the lira’s recent collapse against the US dollar and the country’s rising inflation rate. ING Bank reported earlier this year that 18% of the population owned a cryptocurrency, against 8% of US citizens.

Turks appear undeterred by the country’s lawmakers, who have decreed that bitcoin is incompatible with Islam as it lies beyond government control while its speculative nature means trading in the crypto is not appropriate for Muslims.

Despite this, Venezuela’s launch of oil-backed cryptocurrency the petro has persuaded the Turkish government to explore the concept of its own state-backed crypto. Last February, Turkey’s Nationalist Movement Party (MHP) deputy chair Ahmet Kenan Tanrikulu revealed plans for a “national bitcoin” called the Turkcoin in his report on regulating the crypto market, which has the backing of deputy prime minister Mehmet Simse.

In June a separate initiative, the ‘Turcoin’ – advertised by its creators as Turkey’s “national cryptocurrency” – was exposed as a Ponzi scheme.

While some Apac countries appear to have cooled of late in their enthusiasm for a state-backed crypto, Thailand is one of the key Apac economies pushing ahead. In late August, the central Bank of Thailand (BoT) announced plans to issue a state-issued crypto on tech consortium R3’s Corda blockchain.

Bank of Thailand supports Project Inthanon: Shutterstock

However the plan – dubbed Project Inthanon – falls short of mass adoption by the populace. BoT refers to the protocol as a “wholesale” central bank digital currency (CBDC), to be limited to financial institutions and related markets.

Inthanon has many similarities to similar projects launched by the central banks of Canada, Hong Kong and Singapore but is less radical than a state-controlled cryptocurrency for the citizens, or a “retail CBDC”, which some had been expecting. A people’s crypto appears to be on the back burner for now.

As one of the region’s major fintech hubs, hopes were high that Singapore would be a pioneer of state-backed cryptos. The city state launched Project Ubin in November 2016, which developed a tokenised version of the Singapore dollar (SGD) on an Ethereum-based blockchain. Ubin aimed to create a replacement for its interbank payments network via tokenisation and blockchain.

MAS is ‘not opposed’ to cryptos but remains cool: Shutterstock

In January, the Monetary Authority of Singapore’s (MAS) managing director, Ravi Menon, said that MAS was not opposed to cryptocurrencies and was examining their use for interbank transfers as well as fundraising via ICOs.

However Menon said this wouldn’t extend to replacing a fiat currency such as the Singapore dollar with a crypto, commenting: “Why would the central bank want to do that? If there’s any sense of nervousness about the banks, you will have a bank run; everybody is going to go into the central bank [with their deposits], and, if people placed their deposits with central banks, who’s going to extend credit?

“In practical terms, I think, that’s a long way off, one of the last things you’d want to think about doing.”

In October 2017 the former Soviet republic of Kazakhstan revealed detailed plans to enter the cryptocurrency market with its own fiat-backed digital asset. The country’s government-supported Astana International Finance Centre (AIFC) announced it had signed a deal of cooperation with Maltese firm Exante, a “next generation investment company”, to develop Kazakhstan’s untapped cryptocurrency market. There has, though, been little subsequent news on how the initiative is progressing.

DAD’s progress in Australia

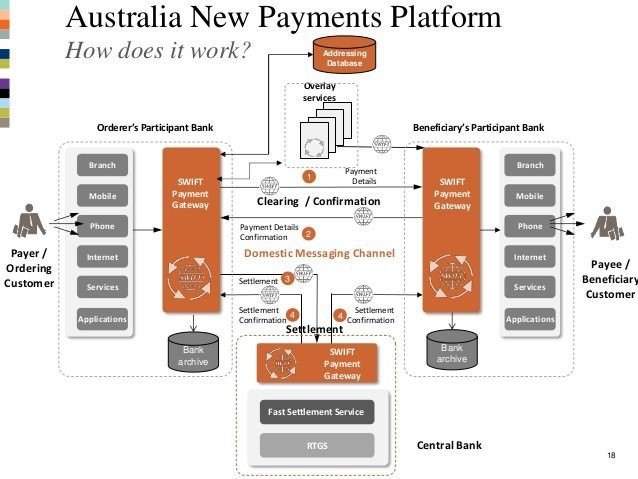

Australia’s New Payments Platform launched in March

As a country that could have become entirely cashless by the end of 2020, Australia is one of the front runners in developing a state-backed crypto. The recently-launched new payments platform (NPP), supported by the Reserve Bank of Australia (RBA) and 12 other founding financial institutions, enables instant payments to be made 24/7.

Both the Australian government and the RBA have received various proposals from fintech start-ups keen to create a state-backed Digital Australian Dollar, or DAD. The government is attracted by the potential of a cheaper electronic currency system that it would be able to fully regulate, but wants assurance on issues such as security and consumer protection.

However, as with Japan the buzz of late 2017 has cooled down more recently. RBA governor Dr Philp Lowe has suggested that cryptocurrencies are a relatively inefficient means of payment, with high transaction costs and requiring a lot of energy in order to mine them.

“When thought of purely as a payment instrument, it seems more likely to be attractive to those who want to make transactions in the black or illegal economy, rather than everyday transactions,” he commented. “So the current fascination with these currencies feels more like a speculative mania than it has to do with their use as an efficient and convenient form of electronic payment.”

Middle East initiatives

Israel’s government likes the concept of a crypto shekel: Shutterstock

In the Middle East, Israel’s thriving cryptocurrency sector persuaded the Bank of Israel and the country’s Finance Ministry to begin exploring the potential for a state-backed crypto some time ago and work on developing a suitable legal framework began at the start of this year.

Proponents of a state-backed shekel believe it will reduce the number of cash transactions and give impetus to the crackdown on tax evasion and money laundering.

A Bloomberg poll ranked Israel as the world’s 10th most innovative currency for tech innovation and a number of initiatives could pave the way for a digital shekel, such as Bank of Hapoalim’s partnership with Microsoft Azure to digitise financial assets using blockchain technology.

Israel has possibly partly been motivated by last October’s announcement by Lebanon’s central bank, the Banque du Liban (BDL) that it would develop a digital currency. BDL governor Riad Salaeh said that the crypto Lebanese pound would be governed by the country’s laws and monitored by the central bank, but his speech was otherwise light on detail.

Dubai’s EmCash has enjoyed a successful first year

Dubai has enjoyed rather more success with EmCash, which marks its first anniversary shortly. Using near field communication (NFC)-supported smartphones, consumers can use EmCash to pay “for various government and non-government services, from their daily coffee and children’s school fee to utility charges and money transfers,” to quote Ali Ibrahim, deputy director general of Dubai Economy.

Iran, which until recently actively discouraged its citizens from using bitcoin, has had a change of heart as US sanctions re-imposed by the Trump administration start to bite. The country recently announced that it will develop a state-backed crypto as a means of circumventing the sanctions while also crimping the growth of bitcoin. Reports suggest that it will have the backing of Russia, which shares the same aims.

Latin America

Some countries have pushed ahead with the introduction of a state-backed cryptocurrency driven by desperation more than innovation. A classic example is Venezuela, where president Nicolas Maduro’s oil-backed petro is an attempt to rein back the country’s mega-inflation rate. Yet despite a presidential mandate that the country’s banks must accept the commodity-backed crypto, the petro has met with little uptake since its launch last February.

Dash is increasingly used in Venezuela: Shutterstock

Instead, with the bolivar recently devalued by 95% in an attempt to rein in hyperinflation, Venezuelans are increasingly using Dash (DASH), currently the world’s 14th-biggest cryptocurrency, as a store of value rather than the petro or bitcoin. Around 200 of the country’s retailers are signing up to Dash each month.

“We are seeing tens of thousands of wallet downloads from the country each month,” Dash’s CEO, Ryan Taylor, reported last month. “Earlier this year, Venezuela became our second-biggest market – even ahead of China and Russia, which are of course huge into cryptocurrency right now.”

Ecuador is another of the region’s unique cases. Back in September 2000, the Ecuadorian sucres became obsolete and was replaced as the national currency. In early 2015, the government introduced digital cash with the launch of the state-run Sistema de Dinero Electrónico (electronic money system). This has been rolled out the country’s 16m inhabitants, although the scheme supports rather than replaces the dollar-based monetary system.

And elsewhere….

Finally, mention should be made of the African nations of Tunisia and Senegal, which both have national digital currencies on the blockchain. Tunisia decided back in 2015 to boost its eDinar digital currency using the blockchain, using contracting platform Monetas.

The eDinar can be used to make money transfers, pay for goods and services like bills, and manage official government identification documents. Senegal followed its lead in June 2017 with the launch of the eCFA, developed via a joint partnership between eCurrency Mint and the Banque Régionale de Marchés (BRM).

The Bahamas, which reportedly nurses ambitions to become “the Silicon Valley of the Caribbean”, has indicated a wish to develop its own digital currency as the island currently uses two fiat currencies – the Bahamian dollar and the US dollar. However, as the local dollar is pegged to the value of the greenback in a 1:1 ratio a digital version would give the Bahamas a degree of independence that reflected the island’s US$9bn GDP.

Meanwhile the tiny Pacific republic of the Marshall Islands, whose 60,000 inhabitants also use the US dollar, plans to adopt a digital currency, the Sovereign, via an ICO later this year. The International Monetary Fund (IMF) is warning against the move, which it says will backfire as the lack of anti- money laundering measures could see the islands lose their one remaining US dollar correspondent banking relationship (CBR) with a US-based bank.

Story by Graham Buck

Source: https://dex.openledger.io/are-state-backed-cryptocurrencies-the-future/

To the question in your title, my Magic 8-Ball says:

Hi! I'm a bot, and this answer was posted automatically. Check this post out for more information.

Congratulations @bloggersclub! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

Click on the badge to view your Board of Honor.

If you no longer want to receive notifications, reply to this comment with the word

STOP