Retail supply chains look to benefit from blockchain

When it comes to real-world use of blockchain, no sector exemplifies what the distributed ledger technology can do better than the retail supply chain. As KPMG puts it, at the very least, blockchain has the ability to transform an organisation’s processes.

Blockchain is not the mother of all solutions it cannot as Coinbase’s co-founder Fred Ehrsam claims rework corporate structure to such an extent that a centralised organisation will become defunct.

But blockchain’s inherent capabilities for immutability, transparency and security make it the mother of invention when it comes to applications for those in the retail industry. Retail is responsive to the technology’s possibilities because the industry is undergoing seismic change facing a host of threats to its competitiveness.

The global retail landscape is ruptured. Nikki Baird, VP of Retail Innovation, Aptos tells us in an email the top three challenges confronting the industry:

Changing consumer behaviours (impelled by consumer technology and shifting trends in customer spend driven by rising housing & healthcare costs, and a shift to online entertainment alongside growing demand for “experiences” over “things”)

Past engines of growth becoming unreliable (success in the North American or European market alone is not enough – and stores as the engine of retail growth have become much more unreliable)

Massive changes in enterprise technologies, with a whole influx of new technologies like microservices, IoT and AI combining and driving change in traditional enterprise solutions like merchandising and customer experience.

Blockchain and supply chain are match made

A recent KPMG survey of 530 global consumer and retail executives backs up Baird’s analysis and it cites the seven most significant challenges are:

- New competitors with disruptive models 31%

- Demand for speed and efficiency 26%

- Rapid growth of new technology 25%

- Retailers creating their own products 24%

- Competition from platform companies 24%

- Shifting demographics and expectations 24%

- Convergence of industry sectors 23%

- Source: 2018 Top of Mind survey

- Embracing change

Source: 2018 Top of Mind survey

Embracing change

Jeremy Rossell, lead retail architect, Deloitte

It is not surprising that technological change ranks among the top three disruptive trends and while it is a challenge it is also the industry’s lifeline. The retail supply chain is one area where there is great opportunity for technological change to deliver benefits, albeit in a slow wave rather than a tsunami.

Retail executives won’t dive headlong into the new age but in the next 10 years things will look different in the sector. Management knows the pace of change has to quicken and requires action now, but in line with strategic aims.

Jeremy Rossell, lead retail architect at Deloitte confirms “a number of organisations have already identified the potential use and benefits of blockchain technology to solve complex problems and generate business opportunities. All of which is leading to investment in the technology.”

Rossell cites a survey where 42% of executives in the consumer products and manufacturing industries say they are planning to invest at least $5m into blockchain in the coming year.

The retail supply industry has had to deal with decades long issues revolving around a lack of trust, security and transparency. Blockchains, which are distributed ledgers that create an unchangeable and shared record of every transaction associated with an asset, allows for an unbroken chain of trust from source to consumer.

Each record is time-stamped and attached to the preceding event making the technology ideal to not only manage inter-enterprise processes, but also to add visibility, efficiency and trust. Deloitte’s Steve Larke, a technology consulting partner, says that retail is well poised to take advantage.

However, although blockchain is the next big thing for the industry, he advises decision makers not only understand which areas of the value chain will benefit most from the new technology but also how easy it will be to implement.

From farm to fork

One area where the impact of blockchain may be felt sooner is counteracting fraud particularly in high-end consumer goods, such as clothing, textile, footwear, cosmetics, handbags, and watches. The Global Brand Counterfeiting Report 2018 estimates losses of global online counterfeiting of $323bn with luxury brands accounting for losses of $33.3bn in 2017.

Blockchain could counteract counterfeiting because it provides greater traceability and therefore allows companies to ensure product authenticity and safety and of course limit fraud.

Baird says, “This has applications like making it harder to pass off that Hermes or Louis Vuitton bag as ‘genuine’ when it’s not. It makes country of origin labelling and product safety tracking easier in things like the food supply chain, where blockchain makes it possible to record every touchpoint in the lifespan of a product as it moves through the supply chain, from farm to fork.”

Proof of origin

Nikki Baird, VP of Retail Innovation, Aptos Source: Aptos

She adds, “Blockchain makes it possible for every legitimate touch in a supply chain – from a supplier to a manufacturer to a shipper – to add a verifiable record to an item’s pedigree.” The greatest benefit Baird sees for non-food retailers is to eliminate losses due to counterfeits being sold, or diversions where stolen product can be sold into grey markets.

Customers now like to know where their food and product originates and product provenance is another area where blockchain could demonstrate value “by proving a product is real and wasn’t diverted or counterfeit.”

Suppliers may also see other benefits in the ability to trace stock and to lessen any over or under-stocking problems. Deloitte calls the process having a ‘Connected Supply Chain’ providing a seamless end-to-end ledger from manufacturing to fulfilment. Its ’Authenticity & Provenance’ solution, on the other hand, can verify the genuineness of a product, while protecting businesses and consumers from counterfeiting.

These are areas that Deloitte say are most attractive in terms of the value they offer but add a caveat: ”They are heavily influenced by external factors and are also considered the highest risk option. To be able to deliver on these projects it may be necessary to belong to a consortium and businesses that pursue these opportunities are likely to be part of one.”

Larke notes that the industry will probably have to trial projects and explore opportunities in order to determine the complexity of implementing such solutions. He surmises: “Without question, there are some areas that will see rapid value gains based on relatively simple implementation.”

Customer is king

Much about the positive impacts from the ability to track, trace and authenticate products or to record contracts and transactions in retail supply will pass through to the customer in the form of savings notes Deloitte.

And there are other side benefits for consumers too, as their trust and confidence will increase if they receive safer, higher-quality products and are assured of provenance. It also has implications for the resale market.

Baird agrees that customers are getting pass through benefits and says the technology speaks to customer demands for better information about the products they buy. A more streamlined process makes it easier for retailers to provide the kind of information consumers are looking for, such as country of origin, data about how long has it been in the supply chain and where it may have passed through to get to the local grocer and so forth.

Equally, Deloitte outlines the potential case use when it comes to the retailer experience such as ever smarter loyalty programmes through more personalised customer targeting, greater consumer participation from secure surveys, research and competitions and even the potential for locating stolen goods with greater ease as customers can verify authenticity and activate tagged products within a system making it easier locate if stolen or goes missing.

Back to basics

Moving products around the globe is another area that could improve significantly using blockchain tech treatment. IBM estimates that the impacts of lack of supply chain visibility are around $300bn globally, with even greater top and bottom-line impact due to out-of-stocks and transportation inefficiencies.

The ability to speed up the export/import supply chain and reduce the amount of paperwork needed to move products across borders would make it easier to do business and could produce substantial savings and benefits.

The ability of blockchain to provide an end‐to‐end supply‐chain solution would allow manufacturers to order or sell, trace and pay for goods once they arrive at their destination seamlessly.

The “paper trail” would become a thing of the past. As Deloitte’s use case for supply chain suggests documentation would be created, updated, viewed or verified by parties on blockchain who could confirm receipt of goods once receive, such as by port authorities.

Manufacturers could track their shipment. Payments could also be initiated seamlessly between parties throughout the process, based upon agreements, such as between seller and customs authorities, seller and shipping company and between seller and buyer.

As an extension, connected internet of things (IoT) sensors and smart devices could measure the condition of containers and other information that can be recorded on blockchain and inform final settlements, especially if goods have been damaged.

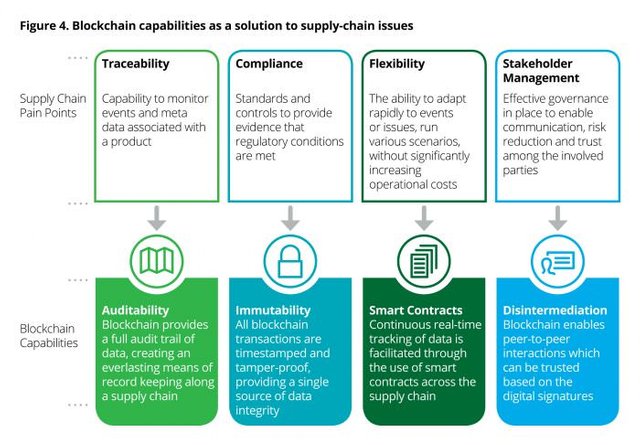

Supply Chain Pain Points: Source: Deloitte New tech on the Block

Don’t make blockchain a hammer in search of a nail

These are just a few of the potential solutions addressing critical business issues and opening up significant growth opportunities. As Rossell writes in a recent blog, “Digital disruption and changing consumer behaviour is revolutionising the retail industry. The pace of technology change and shifting consumer expectations means that in 10 years, the industry will be markedly different from what we see today.”

Baird reflects that the bottom line for retailers is that blockchain is not going anywhere and opines that “some other applications of blockchain to retail seem to feel more like a hammer in search of a nail, but in supply chain I would say that is definitely not the case.”

She adds, “The supply chain is the area of blockchain and retail that has the most promise. Out of all of the opportunities for retail and blockchain, this one will mature the fastest, just because it’s a well-defined need and blockchain isn’t just ‘a way’ of solving the problem, but actually a really good way.”

Deloitte predicts similar and writes that blockchain technology will reach a tipping point in the next five years, moving from a fringe technology associated with dubious cryptocurrency investments and get rich quick stories to a standard operational technology across the financial, manufacturing and consumer industries.”

There are pioneers such as Walmart, which is doing early stage piloting and filing patents around blockchain in the supply chain, paving the way for widespread adoption of the technology.

Blockchain is certain to face significant challenges on its way to mainstream adoption but Amber Baldet, co-founder and CEO of Clovyr raised autions in her testimony before the US House of Representatives Committee on Agriculture.

“Of the myriad applications currently under development, it’s hard to tell what’s going to take off and what will be most transformative. Nonetheless, the sheer number of people globally working on these projects make it likely that it’s only a matter of time until they are no longer considered experimental,” she said.

Deloitte agrees too that investment in blockchain will be expensive and resource heavy and require a cultural change within a business but a head-in-the-sand approach means a company could be at risk at falling behind. It says, “If done correctly, the investment could be transformational.”

Text by Claire Hunte

Source: https://dex.openledger.io/retail-supply-chains-look-to-benefit-from-blockchain/

Follow OpenLedger!