LIQUIDITY-Highly scalable decentralized off-chain soluition

There have been evolution of technologies generations after generations, decades after decades and from existing version to futuristic version etc. When we talk about technologies, then Blockchain is one of the most wonderful technology of 21st century which was invented in the year 2009. The fundamental feature of Blockchain technology is its spirit of decentralization. The traditional centralized model of business is a third party oriented business model, where as the business model based upon Blockchain technology eliminates a third party and make the business happen through distributed nodes.

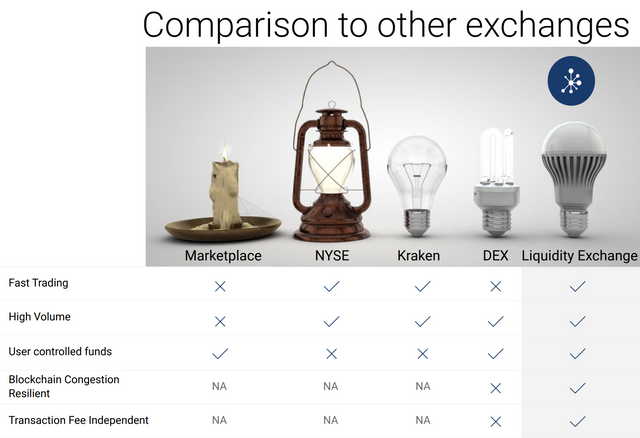

The Blockchain technology tends to make a world-wide disruptive technology. Even after having such a wonderful technology, it is having a very limited application when we talk about it in 2019. The reasons are many, some of the them are confined to the scalability issue, some are the high transaction cost , some are related to cross-chain transactions, some are related to centralized mode of transaction during an exchange where security is not decentralized. So unless the module of application is scalable, cost effective, easy, wide open and being able to fit to the requirement and suitability of an end user, mass adoption and commercial grade application of Blockchain technology will be far from reality.

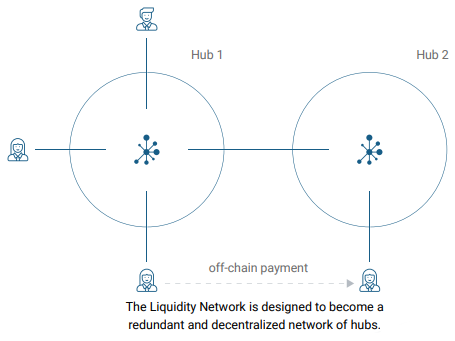

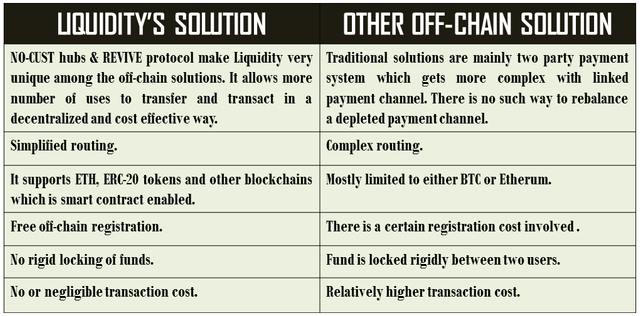

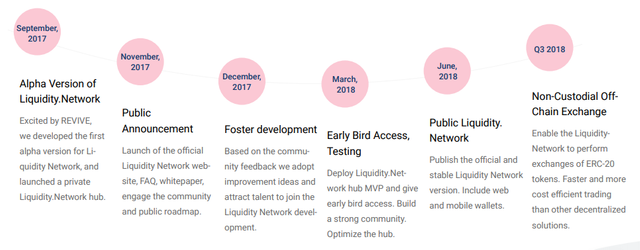

In this segment, we will discuss about an off-chain solution for Blockchain technology called LIQUIDITY NETWORK which is decentralized, scalable with capacity as high as 10000 tps and aims to offer a better solution than the existing off-chain solution by offering features like NO-CUST payment hubs, REVIVE protocol to rebalance the collateral and provides a solution so that the individual/businesses can find it adaptable because of the cost-effective and scalable off-chain solution by LIQUIDITY NETWORK and it will help to bridge the gap between the real world and Blockchain technology.

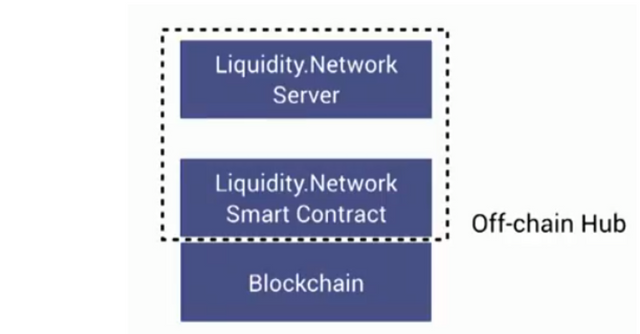

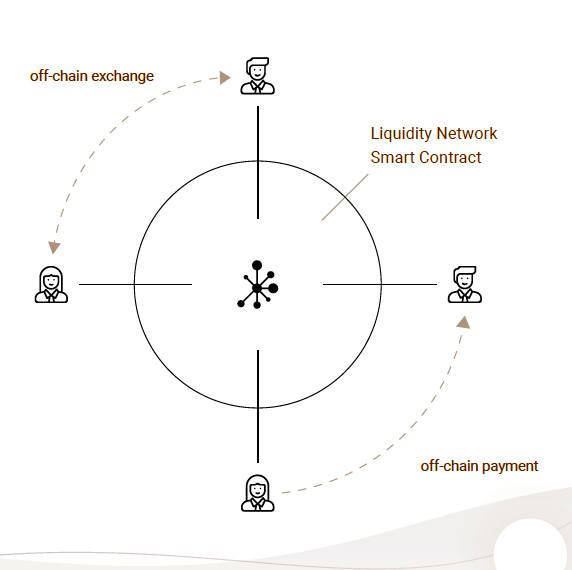

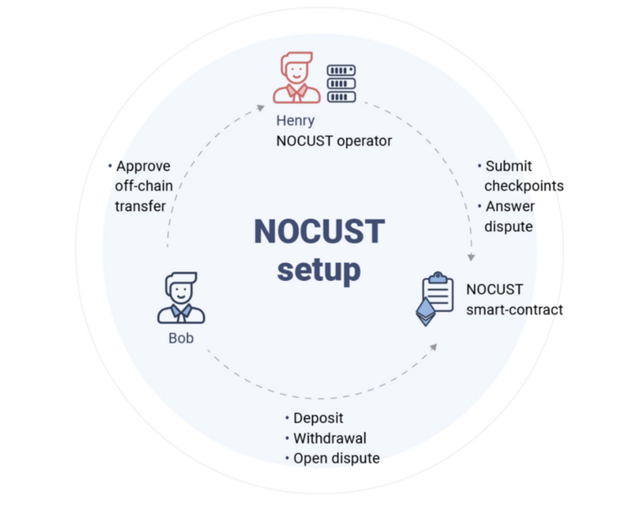

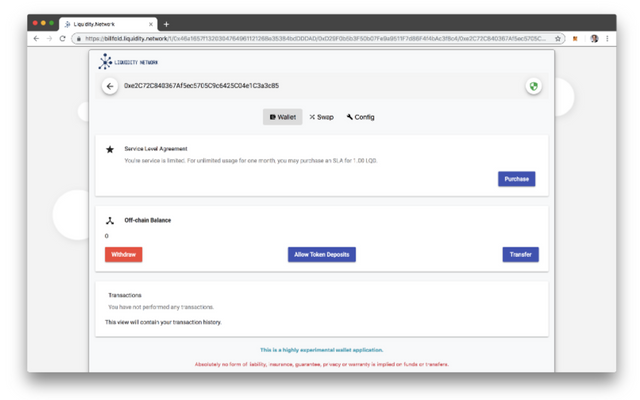

Liquidity Network consists of decentralized blockchain technology for security of fund, a smart contract to operate through payment hub, various payment hubs, interconnection between the payment hubs & the mode of communication within the network.

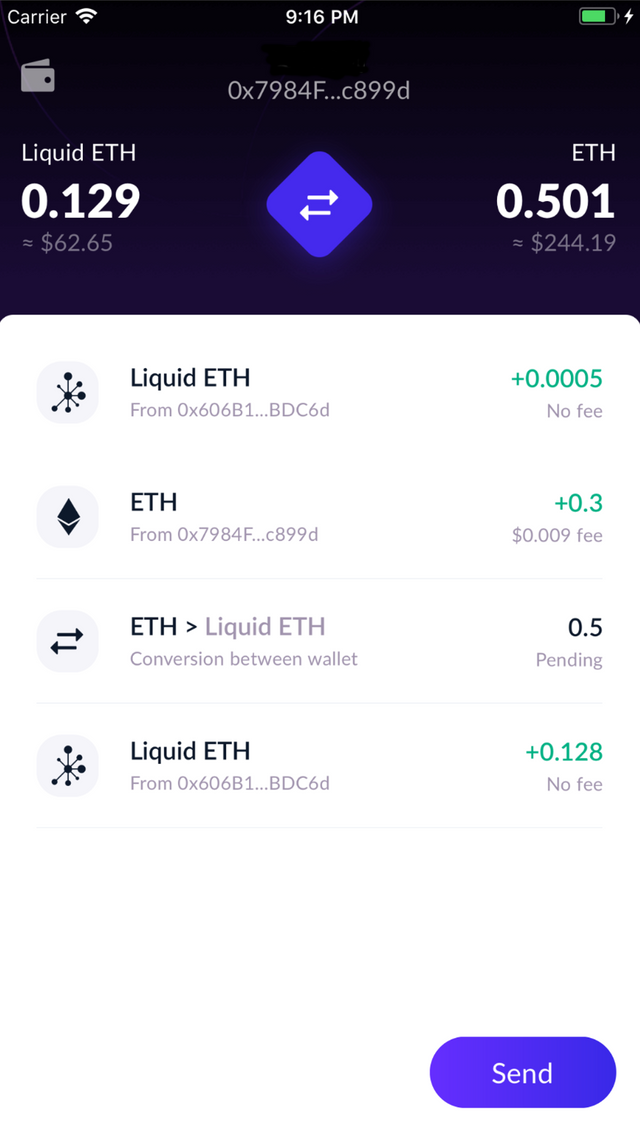

Liquidity Network is an off-chain solution to offer better scalability, transparency and keeping value of decentralization in its payment gateway where millions of users can join the network and can transfer cryptocurrencies with each other instantly and with zero transaction cost. For commercial purposes there is very minimal transaction cost and that is much lower as compared to on-chain transaction as well as other available off-chain solutions. None the less Liquidity Network provides that infrastructure and subsidize the merchants from time to time who offer free peer to peer transaction for personal purposes.

This is built on Etherum Network and it has ERC-20 token which is known as LQD token. It takes the benefits of centralized server for computation of transaction so as to offer better availability and also it makes the transaction secured through blockchain technology. In other words the fund management is done through decentralization & computation is done through centralized server with low latency so that user can experience instant transaction facility. The ownership of the fund always lies with the user and neither the payment hub nor any other user can have the access to the fund of a user.

Any blockchain which supports smart contract can work with Liquidity Network. Unlike any other solution where the payment channel is mostly confined to 2-party type, here in Liquidity Network it offers more than 2-party, that is why it called as n-party payment hub in Liquidity Network. Many users can join the payment hub and they can also choose the payment hub of their choice. They can also choose their choice of payment channel.

The NO-CUST payment hub is the most attractive component of Liquidity Network. In other available solutions during the transfer the role of a custodian comes into picture and also there are issues like locking up of funds between two users, time out transaction etc, those things are eliminated in Liquidity Network and it offers a simplified solution where users can freely register to the payment hub, choose their payment hub and can transfer to another user in the network free of cost and instantly. This is most important as it lowers barrier of entry cost. The retail users are more benefited by this system. The merchants will also find it cheaper than any other available solution.

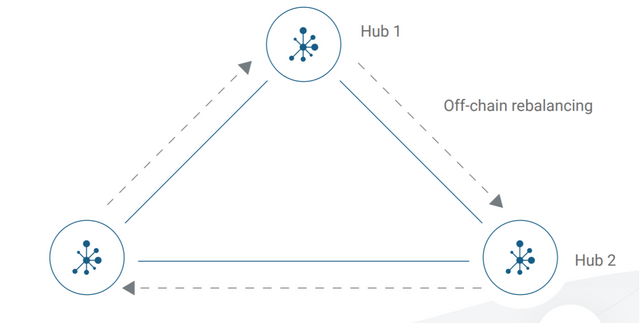

Unlike any other solution, Liquidity network offers rebalancing solution. The opening & closing of payment channel is always an hectic and costly task. Liquidtiy offers a Revive protocol through which any user or group of users can shift their credit of balance of a particular channel to other depleted channel to revive that channel so that the longer route of payment can be taken through a short route and make the transfer cost effective and congestion free.

The application of Blockchain technology has been very limited when it comes to retail users or enterprise/business level adoption of Blockchain technology and there are several issues and problem interface which is hindering the development and mass adoption of Blockchain technology. With recent development to improve scalability has also not yet produced a general sense of scalability for the crypto market. The existing off-chain solutions are also having their own issue. In this context the problems/issues are broadly categorized into the following:-

- Performance (Scalability & Inter-operability)

- Transaction cost

- Custody of fund by a third party during a transfer

- Limited option like 2-party payment channel

- Congestion of the Network

- Complex routing design

- Problem of depleted payment channel & no rebalancing solution

- Security of fund during a transfer

In this article we will discuss about each of the above problem and the role of "LIQUIDITY NETWORK" to each of the above problem interface, how it will mitigate those issues/problems, where does Liquidity Network stand against those issues and how it can bridge the gap between retail users, businesses/merchants and Blockchain technology and make a way for mass adoption.

When it comes to high-performance, then the centralized servers used to have upper hand over decentralized nodes. The reason is scalability and inter-operability. Most of the existing blockchain technology are still not being scalable and not being able to interact between different heterogeneous blockchain(inter-operability). So there is a need of a solution when the decentralized technology like Blockchain technology should be able to scale higher number transaction per second and also should be able to make the transaction/interaction happen between two different chains(cross-chain transactions), so that the performance of Blockchain can be at par with the centralized technology and this can bridge the gap between businesses/enterprises and Blockchain technology.

Liquidity offers a better scaling solution. The average scaling capacity of the most of the blockchain is still under 100 tps, wheres the same figure for Liquidity stands at 10000 transactions per second. The reason being it uses the centralized server for computation of transaction yet the fund management still remain decentralized. As for inter-operability, it can function with other blockchains too which supports smart contract. Not only the scaling capacity is much better for Liquidity but also it is better in terms of handling number of users in the network. At the moment it is dealing with ETH & ERC-20 tokens for transfer through payment hubs but as per its technical design it supports other blockchains too which can interact with a smart contract. The progress is still on and in future we may be able to see payment hubs supporting cryptocurrencies other than ETH.

One of the most highlighted problem of crypto market is the transaction cost. Everybody knows how costly it is particularly if a user is dealing with small amount of transaction. If you calculate that transaction cost in percentages for small value transaction then it may be like 10% or so. For high amount it is not a matter of concern. But if the blockchain technology and the solutions would want to become a subject of mass adoption then transaction cost has to be reasonable and a cost effective solution has to be developed particularly for small traders who deal with small value transaction very frequently. Never the less the percentage of such users are more in any domain of business.

Liquidity has given due attention to this issue in its module of off-chain solution. It is no brainer that the off-chain solution by default are much cheaper than on-chain transaction. But within the off-chain solutions Liquidity has made it absolutely free of cost for retail users who do a transaction for personal use. For commercial purpose there is a small fee and in comparison to other solutions it is even more cheaper. So Liquidity has pioneered the solution in offering zero transaction cost to users connected to the Liquidity Network.

The traditional practice of an exchange and transfer has always been through a custodian and this custodian is a matter of concern for a user while making a transfer. The fund gets locked for a certain time for the two users and this locked up time is a hectic thing for a user. The role of custodian and the process of validation keeps a user in the same page where the user has been constantly looking for a better solution. So from a user's perspective it has to be with no-custodian as well as no waiting time solution.

Liquidity has designed the NO-CUST hub specifically to eliminate the role of a custodian during a transfer. There are off-chain hubs where many users can connect to the hub and perform a transfer operation with other users and the transfer happens momentarily. It is cost effective too as there is no transaction cost for retail users.

The traditional solution is basically 2-party payment channel system. In 2-party payment channel system it is either uni-directional type, bi-directional type or linked type. In this type of system one can not render a service to more number of users at a time and it may also result in complex topology if additional payment channels will be created to cater service to more number of users. So a more viable solution is due.

Liquidity offers 2-party as well as n-party payment solutions. The n-party payment solutions is specifically designed to render service to more number of users and that to in a simplified topology. Any number of users can be connected to a payment hub and various payment hubs are connected through payment channels. So more number of user means more liquidity and more liquidity means more easy way to find a channel and send a transaction to another user in Liquidity Network.

On-chain solution are not just costly, most of the time congested too. If the number of users suddenly increases in the chain and if there are more number of dapps, then it is likely to get congested as more computation will be done on-chain. So alternative solution is needed to make the blockchain congestion free.

Liquidity is an off-chain solution and it is primarily designed to offer users an off-chain solution which is cost effective as well as without any congestion. It uses centralized server for computation and here the transfer in itself is done off-chain, so no question of over burden of a blockchain.

Normally as long as the transfer is within two users, then the payment channels and its connectivity is simple. No problem with that. But when more number of users join each other and open new payment channel, then the connectivity becomes complex. It must also be noted that all those payment channels may not be used frequently. Some will be dead also after one or two transaction. That makes the connectivity and the topology even more complex. It must also be noted that these payment channel also need resources and it is not that free. So the connectivity and the topology has to be simple so that the resources can be properly utilized.

Liquidity right from the beginning relies on simplex topology. The connectivity is quite efficient. As it has brought the concept of payment hubs which can be connected with multiple users and further these hubs will be connected to other hubs and this hub to hub connectivity in the entire network makes the topology quite simpler and any user can suitably find the channel route to make a payment to another user in the Liquidity Network. the unnecessary creation of payment channel is eliminated with the structure of Liquidity Network.

The creation of a payment channel require resources and it requires on-chain transaction to refund a payment channel. Normally the pattern of transfer is not uniform in nature and that depends on the requirement & suitability of a user. Some users may not transfer again through the same channel after one payment or two payment. After some time the channel will be dead. In order to reactivate that again it will require on-chain transaction which is a costly task always. So a solution is needed to sort out such issues so that the depleted channel can be managed efficiently in the network too.

The Liquidity Network is unique in addressing this particular issue and none of the other available solution has this technique. Liquidity's REVIVE algorithm is an effective solution to depleted channel management. With this algorithm the deposit or collateral by a user in a particular payment channel can be converted in to credit and that credit can be shifted to any other payment channel of the user to revive a depleted channel so that the costly reactivating process can be eliminated and this algorithm will work best for honest users and for users with malicious intention this algorithm will impose penalty. So if a user is honest then the it safe and secured for him.

Security and true authority of the fund is the essence of blockchain technology. So the dealing of cryptocurrency has to be in line with this spirit. If any use case of a cryptocurrency if happening with centralization or with a third party then the use of cryptocurrency is just like a fiat currency. No difference from security point of view. It is generally observed that most of the time people risk their cryptocurrency while dealing with a transfer or exchange through centralized means. Therefore a solution particularly during transfer should ensure security of fund through blockchain and not by any third party.

It is true that Liquidity does computation through centralized server. But it is also true that it secures the fund through blockchain technology. So fund management in liquidity is completely decentralized. No one other than the user can access the fund of the user in Liquidity Network. So during a transfer in Liquidity Network, the fund is secured and safe and it is decentralized.

The limited transaction throughput in blockchain technology generally results in loss of opportunity cost also. The best way to demonstrate this would be the volatile crypto market in 2017-18, when every minute the price was faluctuating significantly. In such circumstances the limited transaction throughput does not bode well for a user's point of view. If a user has to wait like one hour or more to realize a transaction, then by that time the price might have moved to a different level, which might not execute the strategy of a user or trader. This is also true for institutional players dealing with blockchain.

So the off-chain solution can be the remedy for such a case. The off-chain solution should be such that it should keep the core principles of blockchain technology intact. That means it should be secured against double spending just like the blockchain does. It should make sure that the custody & security of the fund lies with the user and not any other party.

The off-chain solution can leverage on smart contract enabled decentralized public ledger to enable users to transact with others. The NO-CUST hub of Liquidity supports multiple users, secures the fund against double spending, does not take the custody of the fund at any point of operation, offers better utility, cheaper operation cost & resources & makes the enrollment leaner. For personal purpose it is free of cost to register & transfer. For business purpose a small cost is involved but that is also cheaper than others.

The two party payment channel perform a transaction without recording it on blockchain and they are guaranteed to claim their rightful ownership of fund. This method generally reduce the load on blockchain. The two party sometimes also rout a payment through a linked channel if they are not directly connected. This makes the transaction more costly. The system gets complex if there will be more linked channels in between two parties. Apart from this, the two party payment system has the following demerits-

- Creation of payment channel always requires on-chain transaction which is expensive in general.

- The routing topology is more complex in case of linked payments.

- Without a rebalacning method, the two party payment channels can not utilize the collateral in an efficient way.

- It is subjected to misbehavior by parties and some parties may try to abuse, so it requires to remain vigil throughout the the operation.

Liquidity's NO-CUST hub is designed to achieve a similar goal as that of two party payment channel but at a lower cost & with a simplified topology. If a user wants to transact with another user then a new payment channel need not have to be created. The users can simply connect to a payment hub to perform a transaction. There is no registration fee to connect to a payment hub. The various hubs within Liquidity Network are connected to each other, so the users do not have to create a new payment channel which can save a lot of cost because channel creation is always expensive in nature.

The transaction volume takes the count from n-party, so the system is more liquid than the traditional system. The disputable time window to stake an amount of collateral eliminates the ephemeral counter party risks. This makes the network more reliable & ensures the integrity of payment hub in Liquidity Network.

The benefits of NO-CUST hubs are:-

- It is n-party system, so many users can join the NO-CUST hub.

- It does not involve expensive creation of payment channel between two users.

- It has a simplified topology.

- Additional locked up fund is not required if additional users join.

- Routing cost is reduced.

- Users are the custodian of their fund, No third party has the access. So it is decentralized.

In order to solve the transaction cost and scalability, the off-chain solutions or second layer solutions have been developed. But within the off-chain solutions, there are micro challenges and it is not that simpler as is drawn in a piece of paper. The two party duplex payment channels are deigned to offer an off-chain transaction between two users. However in most of the cases the transaction are uni-directional which results in depletion of payment channel after a transaction. So in such cases the channel has to be closed and renewed to allow a new transaction. This renewal process is quite expensive.

In order to mitigate this problem Liquidity has introduced REVIVE algorithm with the help of which the users making multiple payment can make use of the revive algorithm to rebalance a poor funded payment channel. So this will not require any on-chain transaction to renew a payment channel. The user's deposit in a particular payment channel can be assigned with a credit by revive algorithm and that credit a user can use to shift and renew a poorly funded payment channel and also the user can opt the shortest possible route to transfer in a cost effective and simplest possible way.

The user is free to set the preference of the channels and can use revive algorithm as per his suitability. The honest users will not have any problem by using revive algorithm to renew a channel, but those who try to misbehave may be subjected to dispute penalty.

This revive algorithm is a tool which can optimize the entire network and the network can become even more congestion free. The best case scenario of revive is that it is free if all the users will honestly apply revive algorithm to renew a depleted channel.

Bob wants to send 2 ETH to Alice and he wants to make it cost effective and in best scenario rather want to make it with zero transaction cost. He has heard of off-chain solution but he is looking for a more effective off-chain solution which does not have any custodial role during the transfer and it should be secured and should be faster.

How can Bob does the same in Liquidity's off-chain solution ?

If this case will be executed in liquidity's payment hub, then it will happen through following steps:-

(1) Liquidity's off-chain payment hub is a NO-CUST payment hub which does not take the custody of the payment of a user. It works through a smart contract and a hub operator. Here the hub operator is a non-custodian banker.

(2) Bob will first join the payment hub which is free of cost & he does not have to do any on-chain transaction for that. Bob will have to deposit the required amount into smart contract so that he can send 2 ETH off-chain to Alice. Alice should be connected to the payment hub to receive the fund from Bob.

(3) Bob needs to talk to the payment hub operator through the communication protocol. After the hub operator gives clearance, the payment will be effective and instantly transferred to Alice. Here there is no such requirement of block confirmation for the payment to Alice as it is an off-chain solution. Bob also executed the transaction with out any transaction fee.

Here Bob transferred 2 ETH to Alice without waiting for block confirmation, instantly and without any gas fees. Both the sender and receiver experienced an almost instant payment system and in a simple & cost effective way.

The off-chain solution may not be new but the features like No-CUST hub and REVIVE algorithm are very new & unique in Blockchain industry and this feature makes LIQUIDITY NETWORK distinct & distinguished in Blockchain space. LIQUIDITY can make it possible to unlock the door of unlimited potential for retails users and merchants for application of Blockchain technology. The zero transaction for personal purposes is huge upside off-chain solution offered by liquidity. This will definitely attract more people to connect to the NO-CUST payment hub of Liquidity and that can indirectly on-board more people to blockhain space.

Going forward Liquidity can prove to be the true and real off-chain solution to the real world application and with its amazing features, its future prospect is really very bright and promising.

That summarizes the write up. Thank you

The relevant images, illustrations & logos are taken from Liquidity Network's website and white paper.

More Information & Resources:

- Liquidity Network Website

- Liquidity Network Wallet

- Liquidity Network WhitePaper

- Liquidity Network NOCUST Paper

- Liquidity Network REVIVE Paper

- Liquidity Network Apple App Store (IOS)

- Liquidity Network Google Play Store (Android)

- Liquidity Network Telegram Group

- Liquidity Network Telegram Announcement

- Liquidity Network Twitter

- Liquidity Network Github

- Liquidity Network Blog

This article is written in response to @originalworks sponsored writing contest. The details of the contest can be found from this link: https://steemit.com/crypto/@originalworks/2500-steem-sponsored-writing-contest-liquidity-network

lqd2019

This post has been submitted for the @OriginalWorks Sponsored Writing Contest!

You can also follow @contestbot to be notified of future contests!