Trade war fear creates opportunity for metals

Amidst a possibly over-hyped tariff adjustments made by Donald Trump, overreactions have occurred that, in my opinion, have opened up some great opportunity for medium to long positions in the precious and base metals sector.

Since I'm more of a technical analyst, I encourage you to give these two articles below a read.

The first article by Jim Wycoff from Kitco.com takes a more unbiased and neutral approach to the markets, factoring in technical and fundamental indicators. The article from Business Times dives deeper into the possible implications of the tariffs put in place by Trump.

Gold, Silver See Tepid Short-Covering Bounces

Metal markets are preparing for a new world disorder

It's very important that when you are taking a position to hear what the experts think, but take it with a grain of salt. They know what they are talking about, but they also do not have a crystal ball (neither do I).

Market Overview

We have a few things to keep in mind before I go over the metals.

Major Market Indeces:

First of all, we are still seeing the US stock market trend higher. While the Dow is all but moving sideways, the S&P 500 continues to tally points to its rally while the Nasdaq 100 and the Russell 2000 scream higher and higher.

The S&P 500

The S&P 500 still maintains a choppy yet positive move upwards. We need to see a successful break through 2800 then through 2875 to keep a positive outlook.

The Dow Jones Industrial Average

The Dow has made a pretty weak recovery after falling in January. We are seeing lower highs and higher lows. This is creating a sideways trend that continues to "squeeze" similar to how gold and silver have been behaving for the past few years. The Dow Jones is considered the market "leader." If it breaks to the downside, the other indices will likely follow suit. This pattern in the Dow is a classic display of market uncertainty.

The Nasdaq 100

Tech stocks continue to scream higher. I foresee new record highs until the Dow makes up its mind.

The Russell 2000

The same goes for the Russell index. It has maintained a bullish trend far more healthy than the other major indeces.

6 months ago, when the market took a big hit, I was fearful of a continued down trend. But right now, I am much more positive on stocks (from a technical standpoint). I hold a position in ITW, the Russell 2000 ETF.

Rising Oil Prices:

Oil has been one of the top performing assets beating the S&P 500 by nearly 100%...

The oil bull run still seems to be in tact, yet Trump has been quoted saying that he wants lower oil prices. It is yet to be seen how his trade policy will effect these prices.

Higher oil prices means slimmer margins for businesses, less disposable income for the working class, and an overall slowing of the economy leading to a recession like we saw in '08 (if this bull market persists).

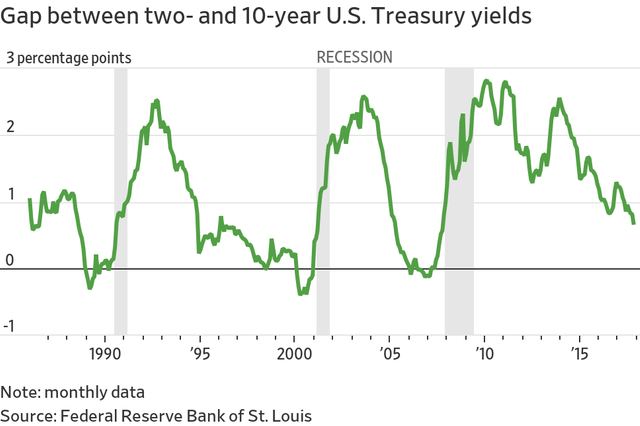

A Flattening Yield Curve:

Lately in the bond market, short-term bonds have been rising rapidly due to the rate hikes by the fed while the longer-term treasury bonds (10-year and 30-year) have been slow to rise. This is commonly a precursor to a economic recession.

Give the article below a read.

What’s the Yield Curve? ‘A Powerful Signal of Recessions’ Has Wall Street’s Attention

Here's a look at the difference between treasury bonds...

When the yield curve nears zero, a recession takes place within a few years' time. I'm not saying that the US will free-fall into a recession over the next few months, but it certainly isn't far off.

Opportunity in the Precious and Industrial Metals' Space

With Uncertainty about the economy playing into the bond market, rising oil prices impacting corporate earnings, and apparent volatility in the stock market coming from both of these factors, there is a high probability that precious metals investors will benefit as well as those involved with copper, the industrial metal.

Gold tends to be a safe haven play and can perform very well during uncertainty paired with rising inflation.

Let's look at things from a technical perspective...

Gold

Gold on the weekly chart...

Gold has been pacing higher since January 2016. While it is still unable to make higher highs past $1365, weaving in and out of its moving averages, gold is still making higher lows and maintaining an underlying up-trend.

Currently we see gold touching base with it's trend line. It is very important that it holds here, or it may be signally a trend reversal. If the thesis of rising gold prices is true, this may be a great opportunity to go long on gold with a physical buy, or in the paper form of GLD.

Gold on the 1hr chart...

Gold took a false breakout at its trend line and made a reversal move to the upside. we currently see it fighting to break above it's moving averages to create a concise up trend.

Silver

Silver on the weekly chart...

Silver has been making a similar "squeeze" as gold, yet rather than making higher lows, it is merely moving sideways. Since silver follows gold, I assume traders are waiting for gold to make up its mind and break the $1365 level. If this is not achieved soon, gold and silver will reverse in trend to the downside. They must make this move up before a big sell off takes place in equities like we saw in '08 when stocks, commodities, bonds and real estate all sold off simultaneously sparking a scary deflationary environment.

Silver on the 1hr chart...

Silver is making the same move as gold and is performing a bit better. Gold tends to outperform silver in short term moves, yet silver moves much quicker. Let's see if this reversal can maintain into an up trend.

Copper

Copper on the Weekly chart...

Copper has disagreed with equities' bullish movement until 2016 (the same time gold and silver started to move up). We see copper maintain a healthy trend upwards signalling a positive outlook in the global economy. Copper is tied very closely with automotive manufacturing, home building, and many other facets of the economy. A major panic sell took place for copper due to Trumps trade policy. It fell until it hit it's 200 day MA to take a pause. A rest on the 200 day MA is a signal (in my opinion) that the trend is still in healthy condition, and may even be a good time to go long on Copper (CPER is the index) and the miners (COPX).

Copper on the daily chart...

We see copper finding support at the $2.80 levels as well as it's underlying trend line.

Copper on the 4hr chart...

Copper seems to be reversing, struggling to break through it's 200 day MA on the 4hr chart.

Platinum

Platinum on the monthly chart...

Platinum is an interesting metal to me at the moment. Back in 2011 when all precious metals and commodities were raging higher, Platinum was considered by many to be more precious than gold being priced at $2,200 per ounce. Now, Platinum seems to be more hated than gold and silver combined. As a contrarian investor, it may be a great time to take physical possession of platinum for a long-term play.

Platinum on the 4hr chart...

Recently, there was a massive panic sell for Platinum, but it found support at $800 and quickly reversed. This may be a signal for a short term rise, before it comes to face the large down trend line seen on the weekly chart.

Wrapping up

Let's wrap up the few points that I made above...

- Equities are becoming increasingly volatile, but are still trending higher.

- Oil prices are moving higher, very quickly, hurting corporate earnings.

- The yield curve for US Treasury bonds is flattening signalling for a recession in the next few years

- Inflation is still pacing higher, strengthening the case for metals

Moral of the story: with rising inflation and an increase in uncertainty, it is fair to say that precious metals could do fairly well during the coming months.

Open Short-Term Trades:

- UGLD

- USLV

- TQQQ

- CHEF

Open Medium to Long-term Trades:

- IWM

- PALL

- CPER

- COPX

- RIO

- TECK

- WEAT

- UNG

- GDX

- ABX

- AUY

- KBWY

Thanks for taking the time to read this post. Good luck out there, and be very careful during your decision making during these times. There is a good amount of risk in the markets.

Disclaimer: I am not a financial advisor. The articles that I write are for educational purposes only. Do your own research and hold yourself accountable for the investments that you choose to make.

Are you a stock trader? Do you hate paying brokerage fees and commissions? Sign up for Robinhood using my link:

http://share.robinhood.com/micahm18

Robinhood is the first zero fee stock market broker that offers free option trading, crypto trading, and much more.

1 in 150 chance of getting a Facebook, Microsoft, or Apple Stock

1 in 90 chance of getting Ford, snapchat, or AMD stock

100% chance of getting a free stock

Robinhood... Taking from the rich, giving to the poor...

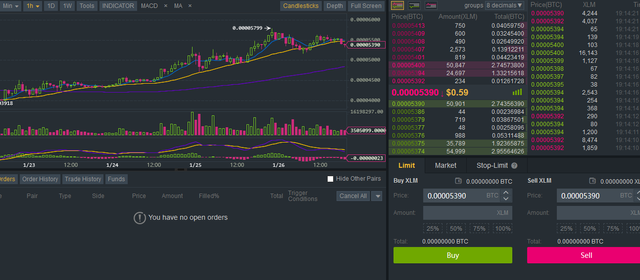

Do you trade crypto?

Looking for a reliable Bitcoin and cryptocurrency trading platform? Try my link at binance for half off trading fees (only 0.05%)

Here's my link: https://www.binance.com/?ref=13626955

One of the reasons I only use binance to trade is that it has high security and offers a wide selection of cryptocurrency pairs. I only recommend products that I use on a daily basis.

Congratulations @cryptomeeks! You have completed the following achievement on Steemit and have been rewarded with new badge(s) :

Click on the badge to view your Board of Honor.

If you no longer want to receive notifications, reply to this comment with the word

STOP