How Hot is Our Real Estate Market?

I have been a real estate investor and agent/broker in Greeley Colorado since 2001. It has been a wild and fun ride, but our hot real eatate market is making it tough to do business. I have been selling, buying, and working as an agent in a great market, a huge crash, and a huge recovery and hot market. There are not many graphs that show the median prices for that entire period, but here is a snapshot:

Our median price was around $200k in the early 2000s before the housing crash. Then it dropped all the way down to $110,000 or so. It then jumped all the way up to $300k today. It has been a crazy swing. The interesting part is that we used to have median prices close to the US average, but have shot above that.

Why is Colorado real estate so hot?

A number of factors have pushed prices up. Mostly low inventory. Colorado has one of the best economies in the nation (unemployment 2.3 percent), and people keep moving here. However, they are not building as many houses as you would think. Water is very expensive here

and it is not easy to finance new builds. I wrote an article on this here:

https://investfourmore.com/2017/06/05/will-another-housing-market-crash/

Why is it hard to do business in this market?

Just to be clear, I am doing fine, but things could be better. Usually a hot real estate market means a lot of houses are selling. In this market, very few houses are selling, because almost nothing is for sale. It is really hard to find good deals to flip, although I am finding a few.

I don't think I see things slowing down anytime soon. I just hope we can continue to find good deals and sell a few houses. Especially since I am starting new brokerage!

Do you think you should leverage out of some of the rentals to take advantage of the market and then move back in? It will be interesting to see if rising interest rates means more people improving their current homes and doing more renovations.

I have loans on all of my rentals, but a ton of equity in them. I am actually refinancing some of them on Friday! It is hard to say what people will do. I think for the most part, people do not care about interest rates.

I would agree some with you on the interest rate part. People have to have a nice place to live. If we hit an large inflationary point it will matter but even if house prices go down rents may even see a strengthening so you are pretty well covered both ways.

Does your brokerage focus more on buying and selling or do you have a very strong property management section since you carry so many rentals?

Buying and selling. I only have them manage my rentals for now becuase there is a ton of oversite and requirements for property managerment.

i love real estate business but not enough money.....pray for me sir.

Good luck!

It will collapse like an imploding mountain - just as soon as QE stops giving institutional investors free money.

Stock market collapse, through interest rates raises, and a bond curve yield that inverts.

Tumblweed will become the new real estate logo...

That's the most positive spin that I could put on your post!

😂😂

But good luck to you!

So are you shorting the market to take advantage of the collapse?

How do you short the collapsing real estate market?

Have you seen the big short? It is a great movie and it is possible to short real esate, but complicated. I actually meant the stock market.

Big short was an awesome movie. The biggest lesson was that you can be right and go bankrupt if you are in a corrupt system and the other guy has the money to outlast you. Glad that investor came out ahead when watching the movie.

To listen to the audio version of this article click on the play image.

Brought to you by @tts. If you find it useful please consider upvote this reply.

This post has received votes totaling more than $50.00 from the following pay for vote services:

minnowbooster upvote in the amount of $87.66 STU, $166.02 USD.

appreciator upvote in the amount of $12.19 STU, $23.08 USD.

postpromoter upvote in the amount of $12.33 STU, $23.35 USD.

For a total calculated value of $112 STU, $212 USD before curation, with approx. $28 USD curation being earned by the paid voters.

This information is being presented in the interest of transparency on our platform and is by no means a judgement as to the quality of this post.

You got a 1.65% upvote from @postpromoter courtesy of @investfourmore!

Want to promote your posts too? Check out the Steem Bot Tracker website for more info. If you would like to support the development of @postpromoter and the bot tracker please vote for @yabapmatt for witness!

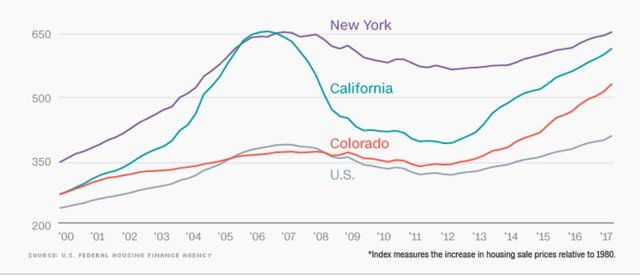

I think that we are on the edge of a correction or even a bit of a bear market in the real estate markets. I've been looking at some data lately, here is a cool chart from marketwatch.com I found.