An Analysis of SBD Price

I've been thinking about the SBD price lately. I've read several people expressing surprise that SBD has pulled even and sometimes gone higher than STEEM. As we all know it's supposed to be pegged to $1 USD, but what are the mechanisms that are really driving that? I decided to see what I could figure out. The conclusion I came to is that I should buy SBD, so that's what I'll be doing. I've outlined my reasoning below.

Point #1 - SBD Creation Algorithm

I started by going to the source, literally. The steemit git repo contains all the source code for steemit, freely available to anyone who wants to try to decipher it. There I found this file which seems to contain code that regulates the amount of SBD created as part of author rewards (lines 3476-3481). I don't claim to understand everything about this, but it basically says this:

- if the ratio of the supply of SBD to STEEM is below 2%, then payout using all SBD

- if over 5%, then payout using no SBD

- between 2% and 5% there's a sliding scale, and the closer to 5% the ratio is, then the less SBD you get for your posts.

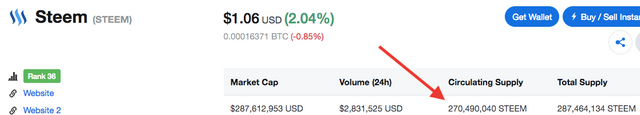

I'm not sure exactly what numbers they are using to calculate the ratio, but using supply info from coinmarket cap, we can get pretty close.

I'm not sure why there is no total supply listed for SBD, but if we use circulating supply as a benchmark, we're actually over 5%. So what does this mean? That post payouts should be receiving little to no SBD! Looking at pending post payouts confirms this. It's mostly all STEEM and SP. Therefore, until this ratio is righted, very little SBD will be generated as author rewards.

According to standard economic models, what happens to the price when supply decreases? Well, nothing, unless there is demand (though sometimes scarcity can inherently increase demand). I would say that demand certainly exists for SBD. Steemians love to spend SBD on SteemMonsters, raffles, auctions, voting bots, etc. It's actually quite a useful thing to have on hand within the platform.

However, there is a wrinkle to all this, and it's called Velocity. There's an upcoming hard fork, called Velocity, the content of which is outlined here. One of the changes directly impacts what we've been talking about. Remember the 2% and 5% thresholds from above? Those are changing to 9% and 10%. So once Velocity hits, we should see the supply of SBD eventually roughly double. However, that's not scheduled to start until Sept. 25 of this year. Until then, the SBD supply will continue to be quite limited.

Point #2 - The Supply Differential

As you may have noticed in the previous point, there exists very little SBD relative to the amount of STEEM in existence, yet they are currently valued roughly equally. The only way to explain this is if there is a massive disparity in demand. As stated above, I do not believe this disparity exists. SBD is a useful resource within steemit. Therefore, assuming the supply ratios stay relatively the same, I expect either the price of STEEM to drop, or the price of SBD to rise. I can't say for sure which one will happen. It could be a combination of the two. But based on the tools currently available to witnesses to maintain the peg, I don't see SBD dropping significantly, which brings me to point #3.

Point #3 - Excellent Risk/Reward Ratio

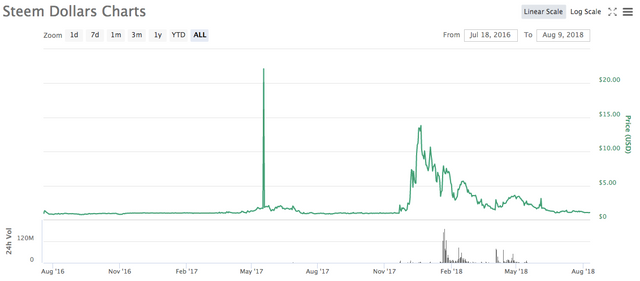

If you look at this historical price chart of SBD, you can see that for most of its history, it's been pegged pretty well at or above the USD. There have certainly been some spikes to the high side, but it's never dropped significantly below $1. More recently, from December to June 2018 it looks like the market decided SBD should be higher, so it was. For confirmation, look at the similarity between the charts for SBD, STEEM, LTC, or pretty much any other crypto. SBD has moved as the market overall has moved, regardless of the peg. All of this leads me to believe that while the controls that the witnesses have access to are pretty good at lifting SBD up to $1, they are not so good at suppressing the price down to $1.

This means that it is unlikely that SBD will drop significantly below $1, but it has the potential to increase well above $1. Say I buy one SBD for $1.06 and it falls and stays at $1, I've lost $.06. That wouldn't be a great transaction, but compare that to the possibility of SBD doubling, tripling, or more. The potential gain far outweighs the potential loss.

Conclusion

So there you have it. If I've gotten anything wrong, or you just disagree, feel free to let me know. For the reasons stated, I'm buying SBD, with the expectation that it will rise in value. And even if it doesn't rise in USD value, it's still good to have some on hand. If I'm wrong I can spend it on voting bots and raffles. If I'm right, I can power it up by multiple factors and continue to grow my account. Either way, it's a win.

Excellent post! You wrote a clear explanation of what is happening with SBD and what we should do. Thank you very much!

Thanks for your kind words. Time will tell if I'm correct or not.

All of the SBD scheduled for my post payouts is gone. Just like you said! Bye bye SBD 😐

Yes, while writing this post, my pending payouts contained trace amounts of SBD. Now there is none. I wish I had figured all this out weeks ago.

Thank you for your continued support of SteemSilverGold

As I just invested quite a large amount in SP at 1,23 I was like you surprised that SBD kept value whereas steem is correlated to bitcoin hence went down. I do not think investors buy a lot of SBD so your post helps to get my thoughts goin. Will think some more before taking action. Thx

Thanks for your thoughts on this. Even just supply and demand alone should mean a rise in the price, not even counting the controls that the platform has in place. But this is crypto, so who knows.