How to Lose $700 Million

Let me tell you a story today of how Mike Tyson went through $700 million dollars of career earnings, and what his net worth would be today in 2019 if he had invested with me at Cardone Capital instead.

For those of you who may not be familiar with him, Mike Tyson was the heavyweight boxing champion of the world.

Back in 1987, at just 21 years old, he was making more money in one night to fight than many people make in their entire life.

But he didn’t have the financial knowledge to handle the big money coming his way.

He grew up in the late 1970’s in Brownsville, New York, a bad neighborhood in Brooklyn that has the highest poverty rate of any neighborhood in New York City.

Brownsville has the most densely concentrated area of public housing in the United States, and it’s consistently considered to be the murder capital of New York City by ranking 69th out of 69 precincts for crime.

Mike Tyson joined a local gang who committed robberies—and by age 13 he had already been arrested 13 times.

Coming from the ghetto, Mike never had money before and didn’t know how to manage his $30 million dollar paydays for winning a big boxing match.

After getting sentenced to prison for rape, he got out after 3 years in 1995 and still had $300 million.

By 2004, before his 39th birthday, he was $38 million in debt….

This is How Mike Tyson Lost Hundreds of Millions of Dollars:

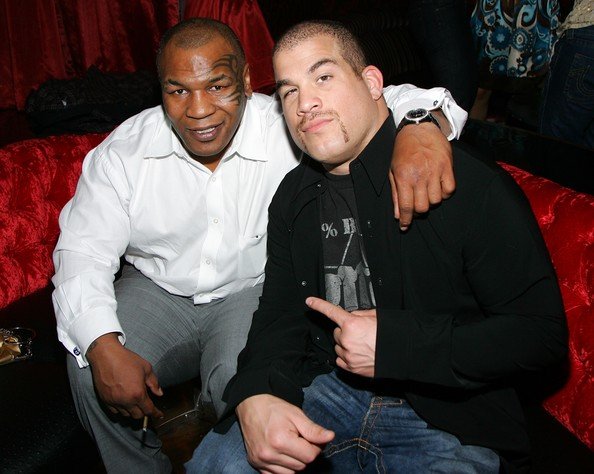

#1 Lavish Parties

Details of this event are hard to find, but in 1996 when Mike turned 30, around 700 guests were invited to Mike’s luxury estate in Connecticut. Security for the party included hiring 12 off-duty police officers. He spent $410,000 for the one-night celebration.

#2 Houses

Speaking of Tyson's Connecticut mansion, this 50,000-square-foot estate is the same house that 50 Cent bought a few years later from Mike's ex-wife. When 50 Cent went bankrupt in 2015, it came out that this mansion’s mortgage, property tax, and other maintenance fees cost him $67,000 a month.

But this wasn’t the only house Tyson bought. Mike also had estates in Maryland, Ohio, and Las Vegas.

These were the types of places with 10+ bedrooms, infinity pools, basketball courts, gold-plated furnishings, and ponds. One of these mansions even had an on-site casino and a nightclub inside.

#3 A 24-Karat Gold Bathtub

As a gift for his wife, Mike bought quite possibly the most expensive bathtub in the world, dropping $2,200,000 on a bathtub inside his Ohio mansion.

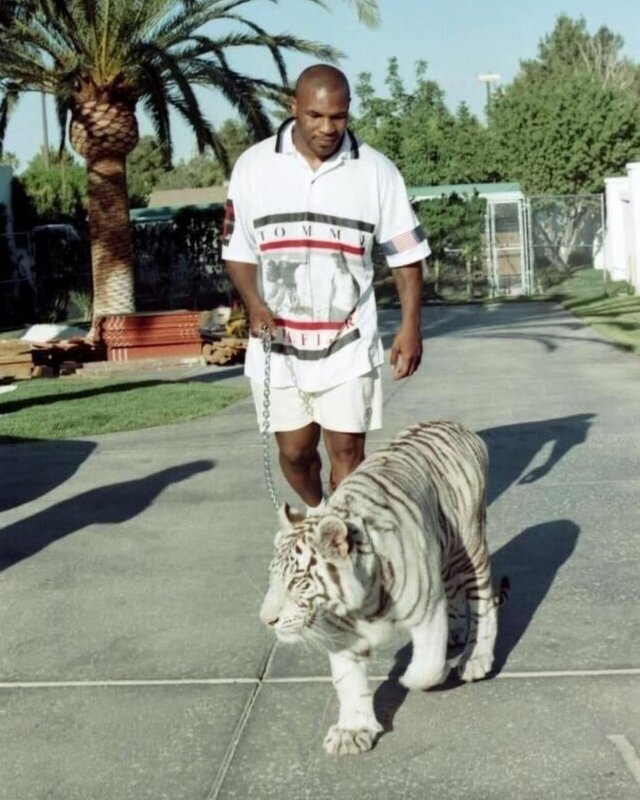

#4 Employing People Who Don’t Bring Any Revenue

Mike hired an animal trainer for $125,000 a year to take care of his pet Siberian tigers. He also employed an entourage of people, including bodyguards, chauffeurs, chefs, and gardeners.

None of these people were assets bringing in any revenue, they were simply monthly expenses that drained his savings.

#5 Expensive Cars

Tyson bought 111 cars. He owned a limited-edition Bentley Continental SC that cost $500K and was one of only 73 ever made.

He owned several Ferraris, Lamborghinis, a Range Rover, a Mercedes-Benz 500, and a 1995 Rolls Royce—which he totaled in accident and left at a garage and told them to keep it.

A few times he even got phone calls from the police after members of his entourage were pulled over driving cars he forgot he had even bought.

Buying a luxury vehicle isn't a good investment, but buying a fleet of luxury vehicles is crazy!

#6 Jewelry and Clothes

Tyson spent $100,000 a month on jewelry and clothes, including things like a diamond-coated watch for $800,000 and an emerald and diamond bracelet for $250,000.

Mike Tyson had no financial direction and went broke.

He routinely spent $10,000 to $12,000 a day with his “walk around” cash.

The hundreds of millions he made over his boxing career vanished within a few short years.

Since going bankrupt, his net worth in 2019 is now back up to $3 million by doing numerous TV and movie appearances and debuting a show in Las Vegas at the MGM Grand.

What if Mike Tyson did Cardone Capital?

If Tyson invested the $300 million he had after getting out of prison in 1995 with me, what would he have today?

To put things in perspective, I bought my first multifamily apartment deal in 1995 with a down payment of $350,000. This bought me a $1,900,000 property in San Diego.

That was the seed money that has turned into 4,774 units and an $890 million-dollar portfolio.

If Mike had $300 million dollars invested in cash flowing real estate in 1995, he would have been making back then, conservatively, $1.5 million every month in cash flow.

He likely could have doubled or even tripled his money within 6 to 12 years, and by today in 2019, he’d easily be a billionaire. And he’d have more cash flow coming in every month than his entire net worth is now.

Invest or Spend?

As you make money in life, you can choose to spend it or invest it. If you invest, you’ll have more money to spend later. If you spend, you’ll have less money to invest later!

I’d encourage you to learn more about Cardone Capital and how you can join me and grow your wealth.

I’d also encourage you to check out my upcoming 10X Business Boot Camp at https://grantcardonebootcamp.com/, because while you're likely not going to make millions of dollars boxing like Mike Tyson—you’ll need to learn how to grow a business to increase your income.

Be great,

GC

Grant Cardone is a New York Times bestselling author, the #1 sales trainer in the world, and an internationally renowned speaker on leadership, real estate investing, entrepreneurship, social media, and finance. His 5 privately held companies have annual revenues exceeding $100 million. Forbes named Mr. Cardone #1 of the "25 Marketing Influencers to Watch in 2017". Grant’s straight-shooting viewpoints on the economy, the middle class, and business have made him a valuable resource for media seeking commentary and insights on real topics that matter. He regularly appears on Fox News, Fox Business, and MSNBC, and writes for Forbes, Success Magazine, Business Insider, CNBC, and Entrepreneur. He urges his followers and clients to make success their duty, responsibility, and obligation. He currently resides in South Florida with his wife and two daughters.

Our offerings under Rule 506(c) are for accredited investors only.

FOR OUR CURRENT REGULATION A OFFERING, NO SALE MAY BE MADE TO YOU IN THIS OFFERING IF THE AGGREGATE PURCHASE PRICE YOU PAY IS MORE THAN 10% OF THE GREATER OF YOUR ANNUAL INCOME OR NET WORTH. DIFFERENT RULES APPLY TO ACCREDITED INVESTORS AND NON-NATURAL PERSONS. BEFORE MAKING ANY REPRESENTATION THAT YOUR INVESTMENT DOES NOT EXCEED APPLICABLE THRESHOLDS, WE ENCOURAGE YOU TO REVIEW RULE 251(D)(2)(I)(C) OF REGULATION A. FOR GENERAL INFORMATION ON INVESTING, WE ENCOURAGE YOU TO REFER TO WWW.INVESTOR.GOV.

For our anticipated Regulation A offering, until such time that the Offering Statement is qualified by the SEC, no money or consideration is being solicited, and if sent in response prior to qualification, such money will not be accepted. No offer to buy the securities can by accepted and no part of the purchase price can be received until the offering statement is qualified. Any offer may be withdrawn or revoked, without obligation or commitment of any kind, at any time before notice of its acceptance given after the qualification date. A person's indication of interest involves no obligation or commitment of any kind. Our Offering Circular, which is part of the Offering Statement, may be found at www.cardonecapital.com

That is a powerful juxtaposition of stories. Keep hustling, Grant.

To listen to the audio version of this article click on the play image.

Brought to you by @tts. If you find it useful please consider upvoting this reply.

10x baby!