What Is Steem and Why Do I Think It Could Be Revolutionary?

Around a couple of years ago, after several years of science blogging and watching the demise of blog network after blog network, I took the decision to stop blogging and move into science journalism.

This is a series of posts explaining why I’ve decided to start blogging again and why I’ve chosen this platform to do it. This post will explore what Steem is, why I think it has potential and how I see it overcoming the hurdles it faces.

Tomorrow’s post will address why science blogging is so important and why we can’t let it die out. The following day’s post will explore how blockchains like Steem could help fix the broken world of scientific publishing at its very core.

I’ve broken it down because this section is going to be a long read that’s really aimed at newcomers. You might want to grab a cup of tea before you embark, or if you’re an experienced Steemian you can skip this section entirely, but if you do, be sure to check out part one and come back for part three tomorrow!

What is Steem?

Steem is a blockchain, which is the same type of technology Bitcoin is built on but with several key differences. Blockchains use encryption to enable platforms to be decentralised rather than owned by a single entity. I will assume you have a basic understanding of what blockchains are but if you don’t, now would be a good time to take a minute to read up on them. I’ll wait.

Steem is already running several operational decentralised platforms including Steemit, which is the blogging platform I’m writing this on, a fully functioning live streaming platform called Dlive, a fledgling Youtube clone called Dtube (recently featured on Bloomberg), a Twitter clone called Zappl, a Soundcloud clone called Dsound, a promising open source development funding platform called Utopian, a crowdfunding platform called Fundition and myriad other decentralised applications with new ones constantly being created.

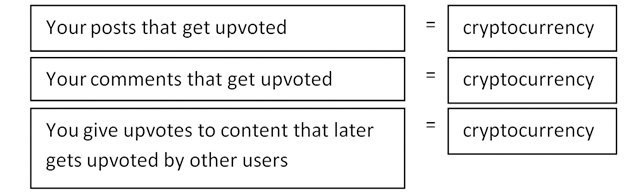

Steemit functions as a cross between the social network Reddit and the blogging network Medium; but as with all the above applications, instead of the money made by creators going to a Mark Zuckerberg of this world, it is divided amongst its users based on Reddit style upvotes in the form of a new currency called Steem.

Participation in all forms is rewarded with Steem to the tune of cryptocurrency worth hundreds of thousands of dollars a day, but where does the value come from? That’s what we’ll look at first as that’s of course the question on the tip of everyone’s tongue.

Proof of Brain

A problem for every new currency is working out how to distribute it, because a currency all owned by the same person isn’t ever going to be a successful currency. For instance, at the moment this is done by Bitcoin in a modern day black-comedy-meets-dystopian-nightmare called Proof of Work. Newly minted bitcoins go to people securing the network by running farms of energy-guzzling computers which shout numbers at each other in a giant game of cryptographic bingo.

Somewhere around a thousand bitcoins are currently minted every day and this number will gradually fall. That’s a lot of money as a single bitcoin is currently worth somewhere in the region of a bit below $10,000.

Steem is currently minted to the tune of a little under 9.5% of its total market cap per year and this number will gradually fall by about half a percent each year until it stabilises at half a percentage point. Those funds go to content creators and voters and the people behind the computers running the network. It can be converted into Bitcoin or another currency and spent.

With Steem, the lion’s share of newly created coins go to the people providing the most value to the network in the form of their thoughts, hence “proof of brain”. The role of securing the network is performed by the most trusted users called witnesses who are continuously voted on by all users in a practice called Delegated Proof of Stake.

Witnesses earn a share of the newly minted coins, but rather than only creating new blocks using their computers as Bitcoin miners do, witnesses also perform other jobs including developing the network’s functionality. As voting for witnesses doesn’t really consume computational power, Steem can be far more powerful and efficient than Bitcoin or other Proof of Stake based blockchains. A side effect of this efficiency is it allows the fees for all transactions to be zero, not even a fraction of a penny, absolutely zero. This could prove to be a complete game changer as it allows microtransactions to be a realistic option for funding creators.

You don’t just earn Steem for creating content however, if a comment or a post you vote on later turns out to become popular you earn a share of the cyptocurrency that post will earn. The earlier you are in the chain of people that discover and upvote popular content, the greater your share of that cyptocurrency. This is called a curation reward and it serves an important purpose. It incentivises users to seek out and upvote things that they think people will appreciate rather than just looking at only what rises algorithmically to the top of their feed as they increasingly do on social networks like Facebook and Twitter.

Theoretically (though certainly not necessarily in practice, hold that thought – we’ll come back to that) this should set the bar higher for creators as their goal is no longer solely a quest for eyeballs, their audience must also approve of their contributions. Columnists who do nothing but incite rage in their readers can’t expect to earn very much money on Steem.

The more Steem you earn, the greater your ability to earn a higher share of the rewards given out for curating content. That’s because curation rewards are allocated factoring in how much Steem Power you possess. Steem Power is simply Steem you commit to keeping locked up in your account for three months, you can think of it a bit like having a share in a company, if Steem were a company.

This has some nice side effects. As Steem is more valuable as Steem Power, it makes sense to keep your Steem in Steem Power unless you intend to spend it within three months. This gives the currency more stability than other cryptocurrencies as the price isn’t as vulnerable to short term speculation. Also, it’s nice to know that if you get robbed at gunpoint you can’t be made to hand over all your Steem Power unless the gunman has three months to wait for it to arrive. If a Steem account is stolen it can be recovered for 30 days, unlike with Bitcoin, where a stolen bitcoin is gone forever.

Importantly, it costs nothing to start earning Steem as you don’t need to own Steem or Steem Power in order to earn rewards for creating content, you only need it to get rewards for curating content, and for that you get some for free when you open your account.

Steem Power equals voting power and it must be earned one way or another. The opportunity to use your Steem Power to earn more Steem by being a smart voter of good content is of course valuable, which is a good reason why people are happy to buy Steem with Bitcoin.

Another reason is that as Steem’s fees will always be zero, this may in future make it an infinitely more attractive currency than cryptocurrencies like Bitcoin for buying a cup of coffee or a packet of chewing gum. In contrast, Bitcoin can cost upwards of $20 in miner fees to send a single transaction when the blockchain is congested. So not only is Steem the foundation for dozens of decentralised platforms all tied to a single identity in the form of an @ handle, it’s also arguably the first real actively used zero-fee money transfer service in existence.

Come on in, the water’s fine

Actually, (sorry) it’s not. Steem is a new, ongoing and rapidly evolving experiment that has gone badly wrong in places. I’m hoping these problems will be ironed out very soon.

First and foremost, the Steemit trending page is currently an almost unadulterated stream of garbage of the highest order as it is almost completely filled with posts that are promoted by paid upvote bots. This isn’t an entirely bad thing, this performs the role of advertising revenue bringing capital into the blockchain and increasing the value of the currency for everyone.

The good news is that once you start using Steem, you can simply ignore the trending page and only follow who you choose to follow, just like you do on Twitter or Facebook.

There are promising signs of big improvements to come, notably the formation of moderated Reddit-style communities where such paid posts can be eradicated. The introduction of moderated communities could well be the turning point that takes Steem mainstream and the upgrade is due to be happening soon.

Another issue is that Steem doesn’t yet have many of the best content creators, especially in its science section (the section I'm most interested in). I don’t see this as a flaw, I see it as an opportunity. This is already rapidly changing thanks to the hard work of the folks at @steemstem.

This makes now an opportune moment to try your hand at blogging on here. If you do, everyone wins in the process. Steemit users get to read your work, you get the benefits of a brand new audience on a viral platform and your work appears on a highly Google-ranked website, it costs nothing but might just fund your next study/shop/holiday. If you blog on Wordpress already you can just port your blog straight in using SteemPress.

Steem and its descendants might prove to be revolutionary far beyond blogging

A key line that resonated with me in the Steem Whitepaper was this:

“It doesn’t matter how good the service is, people expect certain things to be free.”

Do you pay for journalism anymore? If you’re anything like most people, the answer is probably no (which is why journalists like me are going out of business). Subscriptions are only working in a few places and only in a relatively small way when compared to the billions that are being made off the back of free content by Google and Facebook and neither of those platforms are performing the job they once did for creators.

Steem could solve that problem. With Steem you effectively pay for content without it costing you a penny. Micropayments are a nice idea in theory but no one has really made them work in practice. With Steem, all it takes is a single click of a vote that costs you nothing and a creator gets paid. Psychologically, it’s simply easier to give a post a vote using one single mindless click than it is to decide whether to part with your hard earned cash.

But if Steem is inflationary why is it worth anything?

Most currencies are inflationary. I’m not talking just about what you normally think of as the rate of inflation. In the 2008 recession, the U.S. money supply grew 100% in less than a year when the Federal Reserve radically increased the monetary base as the graph below demonstrates.

When countries print money, the spoils of that newly created capital don’t necessarily go to its citizens. Often it goes to servicing debts and bailing out banks, to cite just a couple of examples.

While the dollar value of Steemit will fluctuate based on speculation, we will always know exactly how many new coins are being created and where those coins are going. Every step on their journey is tracked cryptographically forever.

Businesses could in future trade in a currency called the Steem Backed Dollar (SBD), which is a Steem token loosely pegged to the US dollar in the hope that this provides a cryptocurrency that isn’t as volatile as existing cryptocurrencies. Steem can be converted to SBD and back again in a heartbeat.

Think of how much better that is than Bitcoin

Do we really want all those billions of dollars of newly minted bitcoins going to people who just happen to own the vastest banks of the fastest computers in the world at any point in time? Why support contributing to global warming and the colossal waste of valuable computational power, when your cryptocurrency could passively support funding creators and those ensuring the content we read is valuable?

Here’s a simple analogy I’ll paraphrase from the Steem Whitepaper. Say in future, we assume a user with $25 dollars worth of cryptocurrency transacts once per week and pays a $0.04 cent fee each time, they would pay over $2.00 in fees per year. A user would have to earn a 8% rate of return on their $25 dollars just to break even with paying miner fees. If that user was using say PayPal for foreign transactions that number would be far higher still. I know this all too well, for several years I was paid my blog earnings in foreign currency (USD) via PayPal and the money I lost in commissions would make you weep.

So we’ve established that Steem is unique because it doesn’t and never will charge fees to send money. How do we know this isn’t going to change as the network grows? The proof is in the pudding. Steem already performs more transactions than any other blockchain in the world including Bitcoin, because everything that takes place on the network is a form of transaction and these transactions can flit through the network with ease.

Bitcoin notoriously struggles with a fraction of the transaction volume Steem handles every day, and Bitcoin’s transactions are often lost in the blockchain for days if the transaction fee paid by the user is too low. Steem effortlessly performs all its transactions within three seconds flat.

It’s also simply more practical than Bitcoin. Wouldn’t you rather send money to someone via a public addresses with a simple “@” handle like “@simoxenham” that you already know and can look up in a heartbeat, rather than have to ask someone which currency they are using and what their wallet’s public key is? If that’s not an easy question for you to answer, then you should know a Bitcoin public key looks like this: 1xxAmZpucCWBS4yJ3c9YW73UKkaqu4daG (that’s the Bitcoin address for MAPS by the way, my current favourite charity).

Resistance to attack

An important consideration for any media platform or currency is that it can stand up to attack. Take Bitcoin, the most secure blockchain currently known to man. As demonstrated in the Steem Whitepaper, an attacker holding 1% of all coins (say $60 million dollars) could deny the Bitcoin blockchain service for 16 years unless the miners increased fees or capacity. Even if fees were raised to $15 per transaction the attacker could still keep the network flooded for 16 days. With Steem’s mechanism, someone who holds 1% of all coins who tried to flood the network would achieve their goal for less than 30 seconds, according to Steem’s creators.

The possibilities are endless

Compare Steem for a second to Reddit, its closest competitor, which happens to be worth $18 Billion (with its users seeing not a sausage of that). In 2015, Reddit’s 8.7 million users generated an average of 23 comments per second. There were 73 million top-level posts and an average of 2 new posts per second. There were also about 7 billion up votes creating an average voting rate of 220 votes per second.

In total, if it were on a blockchain, Reddit would have had to handle 250 transactions per second. The technology Steem is built on can already easily handle several times that and there is no reason to believe it won’t scale.

Simply put, this comes down to one very simple conclusion: from this point forward, we no longer need gatekeepers and rent seekers to run the websites we communicate on.

Nothing to lose, so much to gain

Think about how much you kick yourself for not mining Bitcoin when it was a few cents on the dollar and now imagine how much you’ll kick yourself if the same thing happens to Steem when you could have had it for free.

Absolute worst case scenario – you help make the world a slightly better place. Best case scenario - you’ll have your thoughts heard by millions and earn a second income in the process.

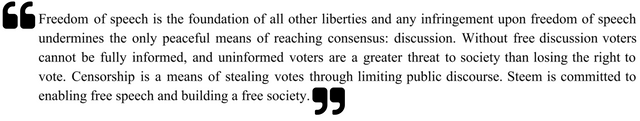

I’ll end this section with a quote from the White Paper that captures the Steem ideology.

Welcome to the future and see you on the other side.

This is part two in a four part series. Come back tomorrow for part three.

PART 1: I Have a Dream for Science on Steem

PART 2: What Is Steem and Why Do I Think It Could Be Revolutionary?

PART 3: Why Science Blogging Needs Saving

PART 4: How Blockchains Could Fix Science

You can also find me on Twitter and Facebook and subscribe to weekly email updates on my posts.

Full Disclosure: I’ve made what seems to be ballooning into a substantial investment in Steem Power so I can help encourage and reward the best science content on here and earn curation rewards for myself in the process. I’ll be using some of that investment to promote this series however that’s something I won’t be doing in future. I’m going to promote each post a few hours after it’s released to give you hard working science curators out there a good shot at the curation rewards.

God bless you. @biblegateway

Coins mentioned in post: