**Bitcoin Billionaire Evangelist Shelves.........!

Bitcoin costs have more than once endured shortcoming in the course of the most recent a while, and as of late, a Bloomberg examiner anticipated that the computerized money could tumble to as meager as.

Americans are presently "one stock moguls" since they put resources into a little-known penny stock that took off after some time.

Envision their delight as they watched their increases take off past and afterward finished $1 million.

These people presently have the flexibility to resign early, purchase another house, or go on the get-away they had always wanted … or do each of the three, in the event that they pick.

Regardless of whether one ought to put resources into bitcoin or not relies upon whether you figure Bitcoin will turn into a long haul confided in store of significant worth.

In the event that it becomes a long haul confided in store of significant worth, BTC should exchange around a coin (contingent upon what number of coins are lost and are quite flow). That is more than 100x the cost of where BTC is today.

On the off chance that BTC does not turn into a long haul confided in store of significant worth, its reasonable cost will be near zero (except if it turns into a "cool" collectible.

So in the event that you think BTC has a 10% possibility of turning into a long haul confided in store of significant worth, it is a decent speculation with a pleasant expected return. It is still exceptionally dangerous yet proficient financial specialists ought to contribute some little segment of their portfolio for this situation.

It's none other than Microsoft, and obviously these financial specialists needed to get in before shares took off from a couple of pennies to over $100.

And keeping in mind that getting in "previously" a major move like this appears to be inconceivable – that is precisely what Paul Mampilly — the Wall Street legend who prescribed Microsoft at an early stage – is excellent at.

It's the reason, when he was a fence investments supervisor, Barron's named his $25 billion reserve "one of the world's ideal" and Kiplinger positioned it in the best 1%.

Presently, in a dubious new video, Paul uncovers a stock that he accepts could take after a comparative way. He even shows watchers how they can get in before this stock takes off … so you will have the chance to wind up the following "one stock mogul."

The last time Paul discharged a video like this, watchers detailed making.

Be that as it may, here's the thing, Paul trusts this new open door will be greater than each other suggestion he's made in his enlivened profession. As he says in his new video: "This product organization resembles Microsoft in it's earliest stages. It the holds the way to a tech industry prepared to develop.

"Bitcoin is in dump mode, following the direct run-up on the potential for a U.S. ETF," Bloomberg Intelligence investigator Mike McGlone expressed amid an ongoing meeting.

"It may not die down until returning to great help close a year ago's mean."

This plausibility could appear, as indicated by a bunch of market investigators.

Putting resources into cryptocoins or tokens is very theoretical and the market is to a great extent unregulated. Anybody thinking of it as ought to be set up to lose their whole speculation.

"Bitcoin has been exchanging an extremely stable range throughout the most recent couple of months with purchasers venturing in simply over the $5,000 handle and on the best, we have the multi day moving normal going about as an ideal purpose of opposition," expressed Mati Greenspan, senior market examiner for social exchanging stage eToro.

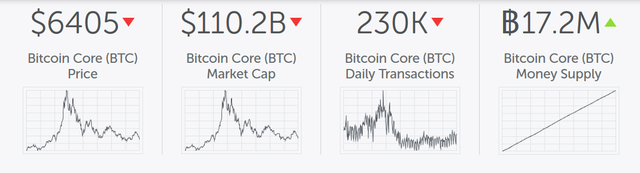

The following is a graph representing Bitcoin's value developments over generally the most recent year, and the cryptographic money's 200-day Moving Average.

He included that "The best thing for crypto reception is remain in this range for some time obviously, a breakout in either bearing is dependably a probability."

Jon Pearlstone, distributer of the pamphlet CryptoPatterns, likewise said something regarding Bitcoin's technicals.

"Bitcoin ricocheted off our key help level of $6200 and requirements to move back above rapidly with no [sizable] pullbacks to keep up the ongoing bullish pattern," he expressed.

"Something else, much lower costs turn into a genuine probability sooner rather than later."

Going ahead, he recommended that dealers "look for a trial of the 2018 lows at."

Bitcoin Market's ETF Fixation

While Greenspan and Pearlstone concentrated on specialized markers, different experts affirmed that digital money brokers are distracted with the U.S. Securities and Exchange Commission's ongoing choice to defer the decision on the VanEck Bitcoin trade exchanged reserve.

Prime supporter and CEO of advanced money information stage CryptoCompare, expressed that Bitcoin's ongoing value decreases are just the market reacting to this move.

On the off chance that the administration organization picks to dismiss the, it "might be the trigger which sends bitcoin to yearly lows." noted Matthew Newton, senior market expert at eToro.

Nonetheless, should the reserve get endorsement, it could "send the value taking off."

Right thoughts you have @sohaibomer, and set them cool

I see you stopped posting on steemit for a month after your content was undervalued. Very happy a whale finds your content interesting and upvotes. At least you are getting some compensation. Keep taking the time to share your info. The little minnow like me appreciates the effort.