Saving for Retirement (The Fast & Easy Way) - Seriously!

Disclaimer: This is not a paid advertisement, scam or promotion. I am not getting anything from any company or product mentioned in this article and haven't been in contact with any of them either. This is from my own personal experience and what I have learned and I am offering it in the hopes it will help others!

Planning: What you want to do and in what time frame!

This is often the hardest part of saving for retirement. Deciding what you are going to want to do, how you want to live, where you want to live, etc. after you retire all play a major part in figuring out how much money you are going to need to save towards your retirement. Deciding at what point in your life (age) you want to retire is another major point you need to consider.

For me I decided about 2 months ago I wanted to retire before I turned 50 years old (in January of 2022). I made up my mind I would retire by December 2021. That was the easy part. Then I had to figure out what my Post-Retirement Life was going to look like. I have always loved to travel, loved nature, loved taking photographs and recently began developing a penchant for shooting video and I love to write. So for my Post-Retirement life I want to Travel (the world) and plan on starting my retirement in an Off-Road Overland vehicle and travel all 26 countries (I can drive to) in the Americas (North, Central & South). It would be a 3+ year 46,000+ mile adventure that I will film and post regularly to my Youtube Channel (linked in bottom of this article). Then I had to figure out how much of a vehicle I would need, to spend the rest of my life in traveling. Once I got a rough idea of the vehicle (and the cost) I had to figure out how much more money I would need (on top of the cost of the vehicle) to live on while I build my Youtube Channel and start earning enough from it to continue to travel.

That all worked out to me needing roughly $100,000 USD to be able to START MY RETIREMENT. That's $50,000 USD to buy/build my vehicle and $50,000 USD to live on for a few years while I build up my Youtube Channel. I have calculated I can live on roughly $1,000 a month while traveling almost constantly if I rig the vehicle with ample solar power, composting toilet and grey water filtration so I do not require RV Parks and can live Off-Grid while traveling. That gives me a little over 4 years of Reserve Money to get my Income from Youtube (and other sources) up to at least $1,000 a month.

Now chances are your Post-Retirement Life will look vastly different from mine. However, I have a few suggestions for those who are interested!

Option #1: Van Life

Many many people are choosing to live in Small Vans/RV's rigged for Off-Grid Living when they retire. They travel around their home country parking in Free Campsites for as long as they are allowed to and then move to a different Free Campsite. You can buy a good used Cargo Van like a Mercedes Sprinter, Ford Transit or Ram Promaster for $20,000-30,000 USD and convert it to a Mobile Tiny Home rigged for Off-Grid Living yourself for an additional $10,000 USD. Then if you only travel when you absolutely must you can live Off-Grid in Free Campsites and prepare all your own meals for under $1,000 USD a month (and that is for a Heavy Smoker).

Option #2: Tiny Home Sustainable Living

Many places around the world are very open minded to Fully Off-Grid Sustainable Living. You can build a really nice Tiny Home (on a trailer so it is mobile) in most countries for under $30,000 USD. Then acquire a cheap (rural) piece of land to put it on (under $10,000 USD) and install a Rain Water Collection System and Filtration System, Solar Power, Solar Hot Water Heater and a small greenhouse and composting pile (all for another $10,000 USD) and you can live very comfortably on around $200-400 USD a month (for stuff you don't grow like clothes, internet/tv, personal hygiene, etc.). If you have a pickup truck capable of towing your Tiny Home you could even move if you so desired.

So before we get to how to Save for Retirement you need to sit down and right out:

- What I want to do when I retire

- Where I want to live when I retire

Along with detailed plans on everything you will need to fulfill that goal and a rough estimate of what it will cost you (upfront and on an on-going basis). Once you have an estimate of what you need (money wise) to retire and live on the rest of your life add 25% to that estimate and proceed with the next step!

Saving: How to do it easily!

There are a plethora of different ways to save money. You can:

- Open a high interest savings account, but they don't pay very well (0.25% APR at best right now in the USA with $100,000 deposit) and they require large sums of money to even begin to start saving!

- Buy 10-20 year Savings Bonds, a typical US Savings bond will pay out only a few % when mature.

- Hire a Retirement Planner (Investment Counselor) however as low as Earnings on Investments are right now chances are anything you EARN over your Investment will get eaten up by their fees.

- Buy/Sell/Trade Stocks/Crypto-currencies on your own. This is highly risky, even for the uber geek and you could make millions or loose your ass in the blink of an eye.

- Buy Precious Metals (Gold, Silver, Platinum, etc.) and store it in a vault/safe in a secure location (there are services available for this). This is one of the safest options and if you do your research and find the right service to buy and store your precious metals with it can be a viable option for almost anyone.

- Use a Aggregate Investment Application to invest in stocks. This is a relatively new option in the retirement savings arena and one I have chosen to use. There are several options out there but the only one I have found that is FREE (as in FEE-LESS) is Stash! They offer an Android App, iOS App and Browser-Based App. It is relatively safe (as long as you follow their hints, tips, helpful how-to video's and community advise.

Stash is by far the best option for most people as it is ridiculously easy to use, very safe, very flexible and very diverse. Once you register and link (and verify) your bank account you can setup Auto-Stash to automatically deduct funds from your bank account (whenever you want) and deposit into your Stash Accounts.

They offer two types of savings (in the USA anyway). One is Stash Invest the other is Stash Retire (ROTH IRA ACCOUNT) but I am betting they offer a similar Retire option in most countries, or will soon!

With both Stash Invest and Stash Retire you can pick Groups of Stocks you want to invest in. You can manually invest in those groups or setup your Auto-Stash to invest whatever amount you want into each group whenever you want it to.

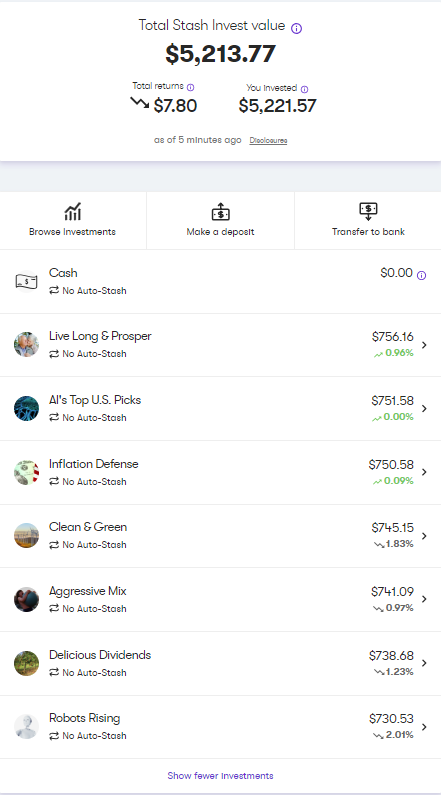

Right now my Stash Invest account has 7 different Groups of Stocks I am investing in and I have an Auto-Stash setup to put $50 USD into each Group every Friday.

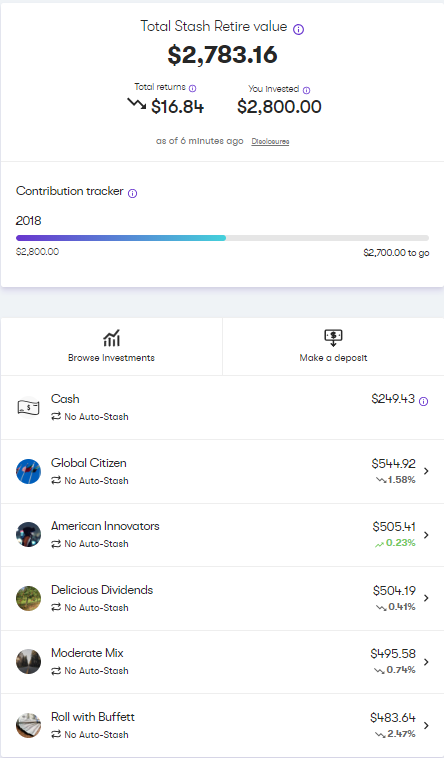

My Stash Retire account has 5 Groups of Stocks I am investing in and I have an Auto-Stash setup to put $50 USD into each Group every Friday.

Additionally, I have lowered my cost of living (I am an Over-The-Road Truck Driver) to $55 a month in fixed costs (my cellphone bill) and around $1,000 a month in variable costs (food, clothes, smokes, etc.). So I add additional funds to both my Stash Invest and Stash retire accounts every week. I am currently investing roughly Half my Weekly Pay into my Stash Accounts.

It is so simple and easy that I have managed to save $8,000 in 2 months. If I continue at this pace (I started slow for the first month) that will add up to $48,000 a year saved, or over $150,000 USD saved by the time I retire in December 2020. That isn't even counting the Dividends I earn on my investments.

Now, I mentioned earlier I had 7 Groups of Stocks in my Stash Invest account and 5 Groups of Stocks in my Stash Retire Account. Why? Well the answer is simple, in both the Invest and Retire accounts I have a couple EXTREMELY SAFE GROUPS I invest in. These are stocks that have historically stayed even or gone up slightly. Minimal risk but also minimal reward. Then I have a couple Medium Risk Groups of Stocks in each. These are historically stable but are pronged to swings up or down. Then I have at least one High Risk Group of Stocks in both the Invest and Retire accounts. These are generally relative new-comers with High Earning potential but also high risk of crashing and burning.

As you can see I am currently DOWN about $24.64 across all my investments but I have some that are Up and Some that are Down. The last two weeks stocks have all been Down (at least most of them) but what you can't see in those Screenshots is that I have made about $50 USD in Dividends (that I reinvested) in 2 months, so I am actually up around $25 USD.

If I continue putting Half my Pay in for the next 40 months (170 weeks - til November 2020) that is roughly $1,000 a week ($750 USD in Stash Invest and $250 USD in Stash Retire) I will have over $178,000 Actual Investment plus Dividends (reinvested) when I retire. With the Dividends that number will be closer to $200,000. However, I will not wait that long. Once I have the money, in my Stash Invest Account to buy/build the vehicle I want I will cash it out and take a few weeks off work to buy/build the vehicle. Then go back to work and continue Saving until I have $50,000 USD between my Stash Invest and Stash Retire accounts, at which point I will retire. At the rate I am saving now I am looking at actually being able to retire by Christmas of 2019.

If you are interested in Stash here are some helpful links:

- Andoid App: https://play.google.com/store/apps/details?id=com.stash.stashinvest&hl=en_US

- iOS App: https://itunes.apple.com/us/app/stash-invest-learn-save/id1017148055?mt=8

- Browser: https://app.stashinvest.com/

Make sure you follow me on Youtube @ VenusPCS!

This post is Powered by @superbot all the way from Planet Super Earth.

Follow @superbot First and then Transfer 0.100 STEEM/STEEM DOLLAR to @superbot & the URL in the

memo that you want Resteemed + get Upvoted & Followed By @superbot and 1 Partner Account.

Your post will Appear in the feed of 1300+ Followers :)

So don't waste any time ! Get More Followers and gain more Visibility With @superbot

#Note - Please don't send amount less than 0.100 Steem/Steem Dollar ,Also a post can only be resteemed once.

Thank you for using @superbot

If you would like to support this bot , Please don't forget to upvote this post :)

Stay Super !

Nice article, sir! Hoping that you will have a fruitful retirement life and stable financial growth!

Consider buying and holding dividend ETFs. https://www.globalxfunds.com/ has quite a few. You can make between 5-8% interest on some of them. This would be the equivalent of one hour of wages per $1000 invested per year.

I confess I don't have a flipping clue what the heck these are but gonna go check them out RIGHT NOW @joshman!

this is the post i was looking for my man!

Glad I could help!

Good luck I hope you can retire. Stash seems like a good app.

Interesting, didn't know this even existed! Thanks

Hv your own efforts to success best wishes to all of you..

Resteemed by @resteembot! Good Luck!

Check @resteembot's introduction post or the other great posts I already resteemed.

Nice post

good information

Thanks, took 2 months to write this post and several years of research before I started "Saving".

Congratulations! This post has been upvoted from the communal account, @minnowsupport, by VenusPCS (The Colbert Report) from the Minnow Support Project. It's a witness project run by aggroed, ausbitbank, teamsteem, theprophet0, someguy123, neoxian, followbtcnews, and netuoso. The goal is to help Steemit grow by supporting Minnows. Please find us at the Peace, Abundance, and Liberty Network (PALnet) Discord Channel. It's a completely public and open space to all members of the Steemit community who voluntarily choose to be there.

If you would like to delegate to the Minnow Support Project you can do so by clicking on the following links: 50SP, 100SP, 250SP, 500SP, 1000SP, 5000SP.

Be sure to leave at least 50SP undelegated on your account.