The Asteroid Files #5 | Resource Scarcity and Opportunity Costs

The Asteroid Files are an archive of my detailed, real-time accounts as a cryptocurrency trader. I am not one for posting frequently, but a friend told me to do a fun little series on how I trade, what I trade and why I trade. Maybe this could turn into something fun. Maybe not.

Either way, I'm going to enjoy myself and tie in some fun science fictiony type of stuff with my daily trading endeavors.

Hopefully I can either bring some direct value via entertainment or my sheer trading awesomeness. Regardless, anything you read in my files are not to be taken as financial advice, as that would be wildly irresponsible.

Invest at your own risk and seek help if you are not experienced. My posts are for entertainment purposes only, especially considering that the title of this series is about asteroids which has absolutely nothing to do with trading... or does it?

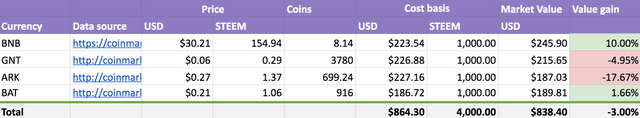

Current Asteroids Portfolio Snasphot:

Resource Scarcity and Opportunity Costs:

How do you approach investments when you have a scarcity of resources and an abundance of opportunities?

I may be relatively new to how Steem works, but I get the picture very clearly as I'm being shown the ropes.

There are a ridiculous number of options in front of us, but 99% of us have a lack of resources to take advantage of all these opportunities.

So what do you do if you have a lack of resources, but want to take advantage of an abundant number of options?

In my life I have invested with the principles of value.

A lot of people are looking for a quick buck... but not me. I am not looking to make a quick dollar and I am not interested in getting rich overnight.

Obviously, I will always look for those kinds of profits and if I see an opportunity to increase my stack, then I may be interested in putting a small amount of effort to that direction.

The contrast though is that I am looking long-term abundance.

Long-term value...

VALUE.

I can't say that enough.

When you look for value rather than a "quick flip", you'll find long-term abundance in your life and in your investments.

This is something that I think every investor needs to learn. It's a fundamental tool in your toolbelt and you shouldn't buy a single stock or crypto or bond or real estate property without first understanding the concept of value investing versus short-term arbitrage.

To listen to the audio version of this article click on the play image.

Brought to you by @tts. If you find it useful please consider upvoting this reply.