KuMEX (Kucoin) 5 BTC HODL incentive (plus trading advice...)

NOTE: Although I interchange KuMEX and Kucoin, they are different aspects of the Kucoin platform... you will need a Kucoin account to use the Contracts derivatives (Found under the Contracts tab, with a seperate trading wallet).

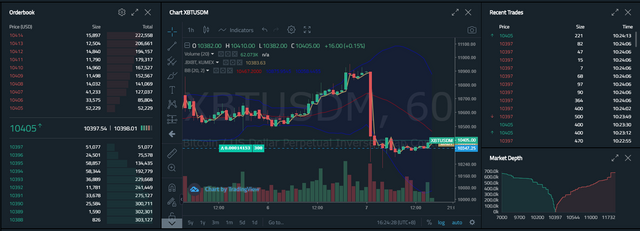

Quite a few exchanges are hopping on the derivatives bandwagon that was first pioneered by BitMEX with Kucoin launching their variant in the last month and Binance following closely behind with two versions in testnet. KuMEX (the Kucoin variant) is a decent take on the derivatives idea, but it does suffer from a lower volume and thus thinner order books than the established BitMEX platform. This is a mixed blessing as it does allow smaller traders to get in a little easier on the action than being smashed around by big players... but it can lead to some strange behaviour as order books gets smashed by forced liquidations and unintentional large market orders... or lead to contracts hanging at a market price that doesn't reflect the price of the underlying Bitcoin asset!

There is one other upside as well, as part of their approach to trading on their regular platform (and also to try and gain more traction...) Kucoin do run trading and participation contests which can net you a little bonus for trading or just taking part in a Twitter/social media campaign.

Currently, they are holding two promotions on the KuMEX (Kucoin) exchange, the first of which is a straightforward trading contest with two divisions for the small trader and the high frequency trader. This is a contest that encourages liquidity and the constant turnover of positions for profit.

Today, I saw that they had launched a new promotion... with 0.5 BTC each day over the next ten days (5 BTC) being distributed to accounts that are holding long/short positions. This is a bit of a counter to the previous promotion as it encourages traders to hang on tight to existing postions... a tactic that I normally wouldn't adopt as it can be risky, with the potential to be caught out in a quick swing and be liquidated...

Yield Analysis: To trade 100 lots on KuMEX, a user needs to deposit only about 5 US dollars equivalent of Bitcoin. According to the Open Interest number on 6th September, the daily reward is about 0.25 US dollars, and the annualized expected return is 1800%! The bigger the position, the more the reward!

My Two Cents

This is a pretty interesting idea... to pay out for just holding a position... but I would have to say that you would have to use quite a bit of caution when trying for this, despite the fact that the returns seem to be quite stunningly high! Remember, in holding a position for a lengthy period of time, you are running the risk of the underlying asset turning against you. As with all leveraged trading you will face the prospect of a forced liquidation if you are in a position that isn't able to be backed by your existing assets.

I would take a bit of issue with their marketing of the contest... the 100 USD position that you open with 5 USD that they use an example requires the use of the 20x leverage (the maximum), which would put the liquidation point at around 500 USD off the current market price. For me, that would be uncomfortably close as Bitcoin can quite easily swing that much in the matter of minutes.... I would advise using the 10x leverage (which gives you around 1000 USD in buffer, but cuts your "profits" by half...)... after all, if you are liquidated, you aren't getting anything!

Also, don't try to open up a large position too close to the market price (unless you are 100% sure that you are in the right direction... and even then, DON'T DO IT!)... instead, open orders on the way down (or up... depending on which way you think it is safer...)... this will stake your position at a more favorable entry price and give you much more buffer towards your liquidation price. Keep in mind that you are trading on the direction of the asset (Bitcoin) against your entry position, you aren't trading in Bitcoin itself... this is something that not everyone has seemed to grasped on the platform (which you can take advantage of!).

I would heavily advise on a Stop-Loss order close to your liquidation price (I set mine roughly 100 USD inside of it...). Sure, you might be lucky and the price will swing around just before you get liquidated... or you will be wiped out.. don't take the risk, take the loss and avoid losing everything. Keep some XBT in reserve (not all staked in a position), you will need to have a flexible reserve to respond to changes and also to avoid deleveraging...

My personal advice to newcomers here is to take things easy and not use too much leverage and just place small orders to learn how it is working... it is all too easy to get burnt in the fast moving derivatives market, and get entranced by the potential for huge profits... whilst forgetting that you are taking on debt to leverage your position and the potential for large losses are also magnified equally!

Normally, I would not be directly aiming to participate in this contest... as I am a cautious trader who likes to catch large swings with some outlier orders and take many small profits on the way back in (I'm also a lazy trader who can't sit at the computer all day!)... but yesterday, I was lucky and caught a large swing when Bitcoin plummeted and I now a decent Long position with (hopefully) quite a lot of room between the current market price and the liquidation price. I am kicking myself for not taking up a larger short position before the fall... I really didn't think that Bitcoin was going to keep rising unchecked, but I figured it was too risky to be holding a short position at this moment. Oh well, I was wrong this time... but at least I didn't lose anything!

So, for the moment, I will hold my Long position for much longer than I would want (10 days is an eternity in Crypto markets....) to collect in the bonus. I'm not totally happy about it... but I think I'm good unless Bitcoin takes a dive to 9,000 USD. Plus, it means that I don't have to worry about opening and closing orders (except for a Stop-Loss order...) for the next week!

Coin Tracking

Looking for a quick and easy way to keep track of your cryptocurrencies? Coin Tracking offers a free service that includes manual tracking or automatic tracking via APIs to exchanges, allowing you to easily track and declare your cryptocurrencies for taxation reports. Coin Tracking can easily prepare tax information sheets that are catered to each countries individual taxation requirements (capital gains, asset taxation, FIFO). Best to declare legally and not be caught out when your crypto moons and you are faced with an unexpected taxation bill (unless you are hyper secure and never attach any crypto with traceable personal information, good luck with that!).

Keep Your Crypto Holdings Safe with Ledger

Ledger is one of the leading providers of hardware wallets with the Ledger Nano S being one of the most popular choices for protecting your crypto currencies. Leaving your holdings on a crypto exchange means that you don’t actually own the digital assets, instead you are given an IOU that may or may not be honoured when you call upon it. Software and web based wallets have their weakness in your own personal online security, with your private keys being vulnerable in transit or whilst being stored upon your computer. Paper wallets are incredibly tiresome and still vulnerable to digital attacks (in transit) and are also open to real world attacks (such as theft/photography).

Supporting a wide range of top tokens and coins, the Ledger hardware wallet ensures that your private keys are secure and not exposed to either real world or digital actors. Finding a happy medium of security and usability, Ledger is the leading company in providing safe and secure access to your tokenised future!

Account banner by jimramones

.gif)

Always interesting but difficult to understand. I'm trying to get used to this language of traders, thank you! !trdo

Congratulations @bluemoon, you are successfuly trended the post that shared by @bengy!

@bengy got 6 TRDO & @bluemoon got 4 TRDO!

"Call TRDO, Your Comment Worth Something!"

To view or trade TRDO go to steem-engine.com

Join TRDO Discord Channel or Join TRDO Web Site

Thanks for the TRDO shout out!

It is like most subjects, the terminology is complex sounding... but the underlying concepts are simpler to understand... however, like most things... it is easier to explain in person rather than trying to read it online!

Thanks for sharing this on steemleo very useful

My pleasure, good luck with it!

Thank´s for sharing!

My pleasure, good luck if you are joining!

Congratulations @bengy! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

You can view your badges on your Steem Board and compare to others on the Steem Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPTo support your work, I also upvoted your post!

Vote for @Steemitboard as a witness to get one more award and increased upvotes!

You got a 15.36% upvote from @ocdb courtesy of @bengy!

@ocdb is a non-profit bidbot for whitelisted Steemians, current min bid is 2 SBD and max bid is 10 SBD and the equivalent amount in STEEM. Check our website https://thegoodwhales.io/ for the whitelist, queue and delegation info. Join our Discord channel for more information.

If you like what @ocd does, consider voting for ocd-witness through SteemConnect or on the Steemit Witnesses page. :)