Investment: Don't place all your eggs in one basket

Money... Finances... Livelihood.

I think in this mounting great depression sort of market recently for many countries has pretty much made many people think they just don't have enough to sustain a month.

But often times because of the loom and gloom news that the dollar is going to collapse anytime soon there are just too many people are jumping into one direction - crypto.

However, from my observation even though with BTC holding on strong it is running much far ahead in this marathon race over the alt-coins, there are just not much people who truly understand the very essence of the word - investment.

Source: Wealth Smart

Investment isn't just a short term profit stake via trading and get a quick buck out of it (like those trading softwares that are looming and pounding on the advertisements whenever I login using @partiko); it signifies something potential that can return on the long run, many years ahead.

Take for the instance of the Chinese community in Malaysia that I grow up with.

Image reference: Chow Sang Sang Jewelry

Wedding gifts in gold for newly weds have been a norm for the Chinese community across the world because they know that young couples will always have a hard time having a head start; and these jewelry cast in pure gold will serve as their rainy days savings when going gets tough.

This is relatively true when twice my mom had to pawn her gold when my dad was retrenched during the 1984 recession, just to keep the family afloat.

I also know that when I used to listen to Infowars speakers that came on board speaking about the dollar collapse will always remind people to invest on precious metals even for a tiny bit because of its long standing value over centuries.

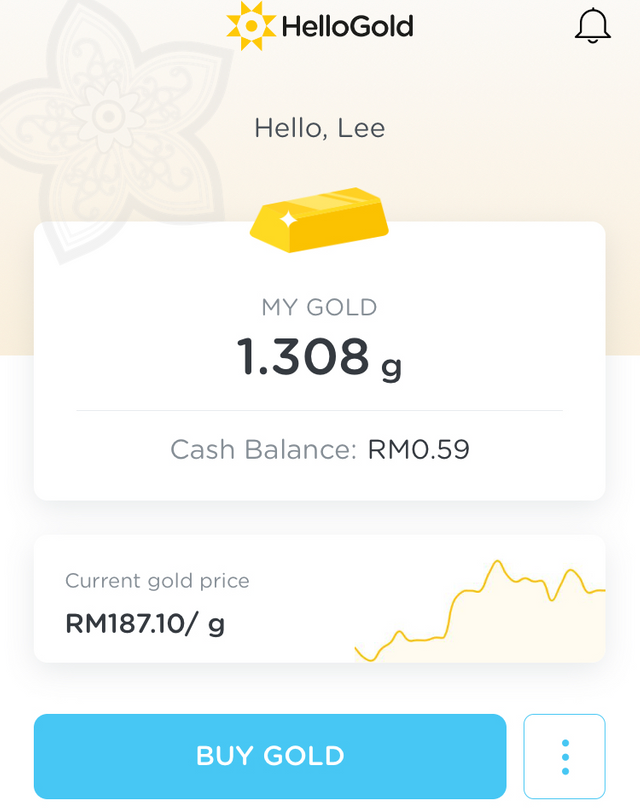

Even talking closer to home ever since Hello Gold launched in Malaysia, I started the mini investments of MYR30 a month when the price was around MYR160 /g; and recently when the going gets tough, I sold some of them just to regain some cash flow for me to either use it or reinvest into my monthly savings.

Please take note that I am not really shelling on precious metals only.

The main thing is that whenever we choose to invest, we need to know more than just the market-cap price of the entity in our investment, but also to know whether it actually has a tangible use in the real world to last the long run.

BTC so far has proven its sustainable usefulness way before it was turned into a trading frenzy for traders, the whole concept of easily transfer monetary value from one place to another without the international red tapes (but later perverted by the dark net.... sigh... humans...)

Steem, with the help of the Steemit community pusing the idea of self-creating content and later more communities like #teammalaysia , #venezuela and so much more who are really pushing hard for the adoption of STEEM / SBD parallel to the fiat ecosystem of their own country by rounding and pushing talks to the business sector, has ensured its survival for up till 4 years.

So my point is...

Are you chosing the right investment?

Even a simple investment like a place to stay (not rental) or even on a promising business could be one of the rainy days savings strategy

Heck, even if you hardly have any time to look at, at the moment while countrys' banking economy hasn't fully collapsing, the tiniest "investment" you can make is to put a minimum amount of money under fixed deposit and let it keep rolling until needed.

Investment at the end of the day is how you use of what you have at the moment and find ways to let it grow itself for you.

I think I have said this before many months ago, I will say it again. Don't place all your eggs in one basket.

The most recent cloudflare downtime last week proven enough that while this new technology of the blockchain is still struggling to stabilise with the wits and intelligence of the coders, you still got to have a plan B

And that... requires a lot of wisdom.

Especially for Investments

I hope this post serves its purpose of an enjoyable read and also a reminder that one day, we are all going to finish this journey and along the way we do need some shelter.

Until Then

Thank You for Your Time

Yes, don't place all eggs in one basket. But diversifying to much is also bad!

Yes you are very much correct @hatoto when you speak about not spreading it too thin in investment.

That's why it is important have a reality check on what the prospect of investment.

You can't just have your hands in everything. You'll eventually crash and burn along the way.

Thanks for stopping by with the short but impactful comment.

Posted using Partiko Android

You got voted by @curationkiwi thanks to littlenewthings! This bot is managed by KiwiJuce3 and run by Rishi556, you can check both of them out there. To receive upvotes on your own posts, you need to join the Kiwi Co. Discord and go to the room named #CurationKiwi. Submit your post there using the command "!upvote (post link)" to receive upvotes on your post. CurationKiwi is currently supported by donations from users like you, so feel free to leave an upvote on our posts or comments to support us!

We have also recently added a new whitelist feature for those who would like to support CurationKiwi even more! If you would like to receive upvotes more than 2x greater than the normal upvote, all you need to do is delegate 50 SP to @CurationKiwi using this link.

This post has received a 3.13 % upvote from @drotto thanks to: @curationkiwi.

Thanks for using eSteem!

Your post has been voted as a part of eSteem encouragement program. Keep up the good work! Install Android, iOS Mobile app or Windows, Mac, Linux Surfer app, if you haven't already!

Learn more: https://esteem.app

Join our discord: https://discord.gg/8eHupPq

Dear @littlenewthings

Interesting choice of topic. Upvote on the way :)

Not putting all eggs in one basked is definetly great advise. However my impression is that most people try to diversify their investment/savings to the point that they do not even know what exacly did they invest in.

ps. I love example of chinese community in Malaysia :)

Yours

Piotr

Haha yes, @crypto.piotr

Many people tend to put their toes in every opportunity they can but they don't have a good ledger to follow up.

I totally agree with diversity but not in the sense of stock market, which seems to be very trendy to be a trader now.

I like your method better, invest in humans, and hopefully from there, there will be a catalyst of sustainable community grown out of it, helping one another.

Posted using Partiko Android

Du erhieltest aufgrund deiner LanaCharleenToken ein Upvote von @sebescen81 und von @lanacharleen

Vielen lieben Dank für euren Support. Der Account meiner Tochter wächst und gedeiht.

Oo u invested in paper gold account before ? Do they have service fee? Or purely buy and sell spread for their profit margin ?

Posted using Partiko Android

Hey @auleo, my brother has started his paper gold investment.

The one I know is from Public Bank but yes they charge RM10 per annum but I think it's also with a minimum deposit which was higher than hello Gold.

For me at the moment Hello Gold have very low budget saving plan which encourages young / old with a proper ID to start saving in precious metal, but paper gold is more rigid and hard to make it like a liquidated monetary flow easily.

Posted using Partiko Android