Unusual Options Activity In Regional Banking ETF, KRE

The economy added 136,000 new jobs, but expectations were for150,000 increase. This is the slowest pace of job growth in four months, as businesses grew more cautious about hiring due to the uncertainty in the global economy. Now traders are increasing wagers that the Federal Reserve will continue to cut interest rates which isn’t good news for the financial sector. For example, just look at the relative strength of the SPDR financial sector the last two weeks.

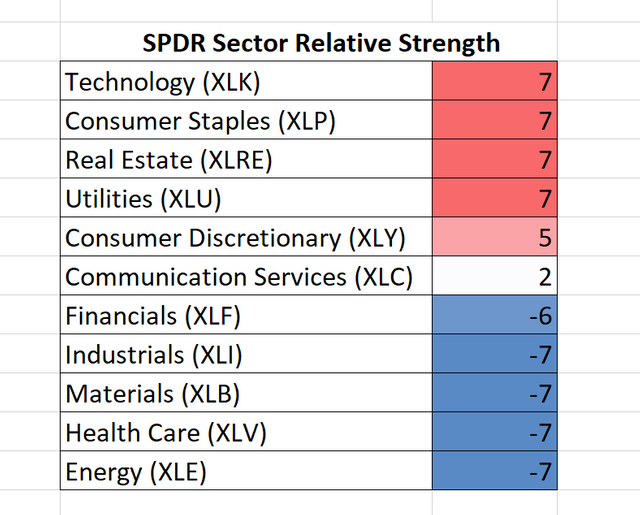

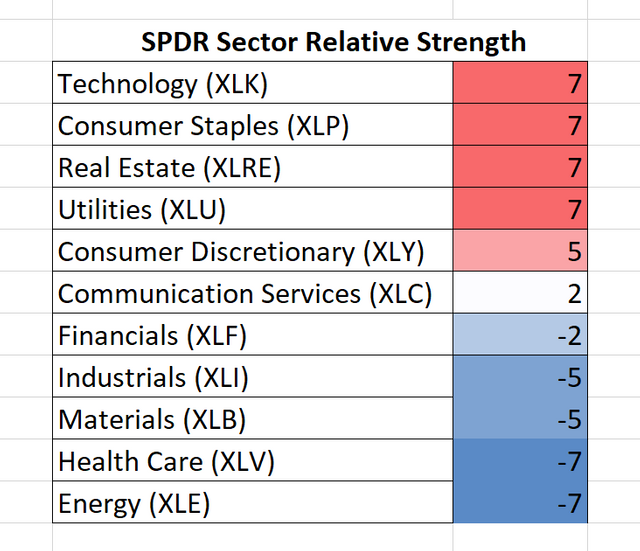

The SPDR sectors' relative strength, relative to the SPY are the following:

Two Weeks Ago

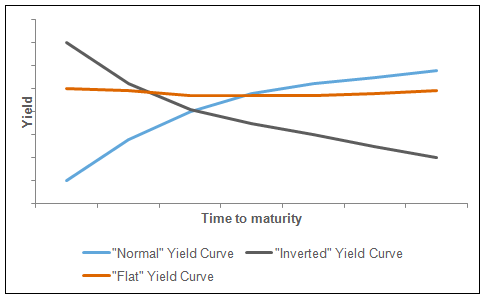

You see, a flattening or an inverted yield curve hurts the banks’ profitability profits because as short-term rates raise and long-term rates decline, it causes a bank’s net interest margin figure and eat into bank profits. To put this another way, banks make money by borrowing cash at short-term rates and then lending them out at long-term rates, but a flattening or inverted yield curve forces banks to spend more money funding the loans, resulting in less money being made.

The SPDR S&P Regional Banking ETF (KRE) is an ETF that seeks to track to the performance of an index derived from the regional banking segment of the U.S. banking industry. Some of the banks include, but aren’t limited to PNC, SunTrust Banks and KeyCorp. And based on head and shoulders pattern on the monthly chart, the chart suggests further downside.

Thus, I wasn't surprised to see unusual options activity on Friday. The Smart Money bought a November 15th bear put spread buying.

A bear put spread is achieved by purchasing put options while also selling the same number of puts on the same asset with the same expiration date at a lower strike price. The maximum profit using this strategy is equal to the difference between the two strike prices, minus the net cost of the options. This is actually a $6.3 million bet to potentially make $4.7 million in profits.

The chart suggests price could get to the target price of $44 (funny how their target is just before the monthly demand zone), I just don't know if it will get there in 40 days. Thus, the Smart Money must be anticipating some type of bearish event (s) over the coming weeks. Stay tuned to see if the Smart Money will be right on this trade set-up.

This post is my personal opinion. I’m not a financial advisor, this isn't financial advise. Do your own research before making investment decisions.