US Interest Rates Headed to NegativLand

I hate to be the bearer of bad news and, to be honest, I can't even believe I'm saying this myself, but

Get ready, folks, we're headed for negative rates.

In America.

That's right. The land of the free and the home of the brave is gonna have to begin rebranding that into the land of the free money and the home of the brave lenders.

Pretty much, that's where we're at now that the world stock markets have now collectively shat the bed. We're bound to see some more volatility throughout the remainder of traditionally low-volume August. But, in general, central banks are now firmly entrenched in a collective race to the bottom.

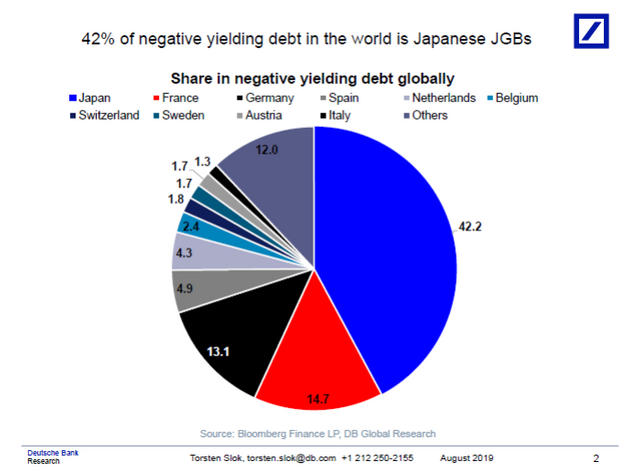

It's inevitable. The world is already awash in $15T worth of negative-yielding debt from countries with less seignorage than the United States enjoys.

Why not throw a couple good quality American T-bones on the barbie? That's the good stuff right ther. From 'Murica! By all accounts, the American economy right now is the cleanest shirt in the dirty laundry. So why does that mean I think we are inevitably headed to NegativLand rateswise?

Well, for one thing, our dear Orange President is not exactly wrong when he insinuates central bank competition in the following tweet:

In other words, if the Fed doesn't decrease interest rates, other central banks will (in some cases, even into EXTREME negative territory). That interest rate differential will work against the Fed and American economic growth. And for what reason? Because we love zero? That doesn't make any sense. And yes, I know, it doesn't make any sense to me why this doesn't make any sense. It just doesn't make any sense, knowwhudimean?

Putting Trump's competition argument aside, there's a better, more convincing reason that the Fed will soon be forced to lower interest rates. That reason has to do with the Fed's preferred method of measuring inflation. You've probably heard of the Consumer Price Index (CPI). But that's old news! These days the Fed would rather use the Personal Consumption Expenses Index (PCEI) to measure inflation. In fact, it's been that way since 2012.

Remember that measuring inflation is pretty fucking important to the Fed because they like that to be around 2%. For some reason, no one can exactly explain why but some people blame New Zealand of all places, it's really really important to them that the Fed keep inflation at 2%. If it's well below that, well, they are bound to be reducing interest rates soon enough.

Dem's just the rules!

Well, guess what? For each of the months of May & June, the PCE inflation rate came in at 0.1%! Zero point one percent!. Even if we strip out some of the more volatile elements of this measurement that are overly affected by volatile gas and food prices to get to so-called "core PCE" that measurement was only up 0.2% these past 2 months.

Signs are not pointing to it getting better in August.

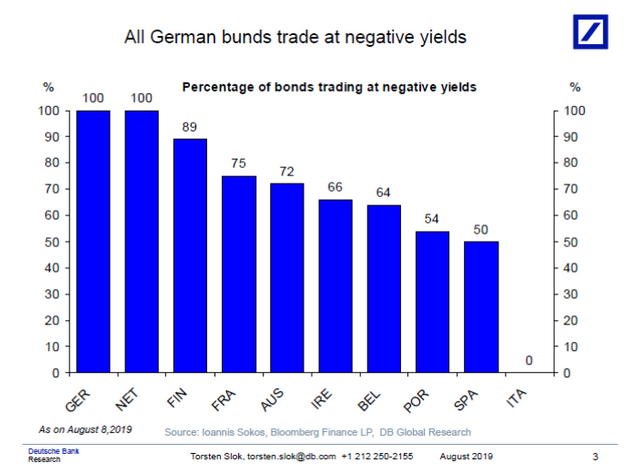

And let's not forget Ol' Orangey's argument about the increasingly competitive central bank environment. More and more countries are issuing more and more of their debt with negative yields. Some of them, like Germany and the Netherlands, don't even issue debt with positive yields. And yet, for some reason, investors are still scooping these issues up. That has got to start triggering a reset of expectations in the minds of many economists and regulators soon enough.

So, I really hate to say this, and believe me I'm usually the first person to say that this kind of monetary policy is crazy. Downright insane, actually. But you can't argue with the data. That's how central banks have to operate. They've been saying it for awhile now. They are "data dependent". And with this kind of data, you can make only one conclusion:

NUMBER MUST GO DOWN.

It's pretty simple, really. The stock market told us on Wednesday, August 14 that it would like rates to be cut a little more, too.

Even old fuddy duddy Alan Greenspan came out and said there's nothing special about zero in the US bond market. Nothing special at all.

Again, I hate to be the bearer of bad news, but it's off to NegativLand the United States must go. Along with all the Europeans and the Japanese.

It's starting to look more and more like some caricature of "The Hunger Games" to me... we'll end up with a tiny uber-class holding all the wealth, and the rest of us living in cardboard boxes and ghettos... hate to be so cynical, but struggling to see how it's going to go any other way.

Just as long as I can get one of those Denmark negative yield mortgages, I can live till retirement getting paid to borrow! 🥳

Posted using Partiko iOS

Looks like Trump and the Fed are determined to lower the rates and print more money in order to keep the equity market propped up. The middle class will be annihilated throughout this phase of the reset.

Yep, inevitably the rich get richer.

Negative interest rates are a precursor to rampant inflation. Any surprise that gold went past the $1,500 support line?

Yeah, that's the whole point of NIRP. Central bankers would rather have inflation than deflation. We are pretty accommodating right now and basically have no real inflation. That's why I'm making this prediction. It's basically fated to happen at this point.

Thank you for contributing to RealityHubs @shangaiprenuer.

You have submitted a very nice post.

We are looking forward tonyour future contributions.

How to make your own unique review? Check Here

Do you have any questions? Chat with us on Discord

RealityHubs Moderator

Thank you so much for participating in the Partiko Delegation Plan Round 1! We really appreciate your support! As part of the delegation benefits, we just gave you a 3.00% upvote! Together, let’s change the world!

Stupid Trump

Congratulations @shanghaipreneur! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

You can view your badges on your Steem Board and compare to others on the Steem Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOP