Zero interest rates ruin my cash savings : drastic actions taken

Dear stackers, investors,

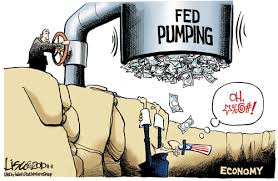

Our Central banks/Fed are buying assets on a large scale already for years. Quantitative Easing they call this. This once "exceptional tool" now has become part of central bankers daily life it seems.

So what does it do?

It lowers the interest rates to now zero or below in Europe which is good for .....countries in debt and those with an excessive government spending which -no surprise- are the same countries. They had to borrow money for years and this acumulated debt created a huge interest cost for the future generations. Not many countries are excepted from this (Norway and Switzerland and some Oil states I think) but some were worse than others. For instance France and Italy have high debt yet alone Greece! This is 80% fine with me. If we can help them this way a little they can recover themselves hopefully (except for Greece who's debt still increases)

What does it mean for citizens like me who must live from their savings?

Well first of all I get almost zero interest on my bank accounts. Secondly inflation is picking up meaning my purchase power goes down. But worse is that the Dutch government taxes all savings above 20K EUR with some 1,2% of that excess. Why ? Because they say you can make 4% on savings (in the past yes!) and ask 30% tax on this fictif 4% return.

My pension fund is neither able to make any return anymore and can no longer index my accrued pension rights for inflation. Here too I suffer (although I am still doing relatively fine of course...). But as an investor I know what it means to miss 2% each year on year..

So f*** 'm all I thought!

I transferred a large savings amount into gold already some years ago, which should protect me against future inflation, I keep it in a privately owned safe (insured) and refuse to pay savings tax on it. I therefore do not declare it.

If the central bank causes interest rates to be low the other European governments should act and change their rigid savings tax (if any). Otherwise savers are ripped twice or even threefold if you imagine that I paid a lot of tax on my past salary already.

So now you know my frustration....some things are very good in the Netherlands but some stink!

Goldrooster

I love this post @goldrooster

More and more people are doing the same thing all over the world. More power to you!

Great post brother! A lot of us stack to protect our wealth from inflation and preserve our wealth!

Move to Brazil and you will not have this problem anymore. Our interest rates are high and we will love to get your silver, gold, fiat...We have some violence problems, but you can't have everything always good...

There must be safe places far away from Rio ? Anyway I am studying Spanish as preparation to migrate to Spain or Chile/Argentina during our wintertime. Not sure if they understand me in Brazil....

Thank you for your continued support of SteemSilverGold