2/11 Trading Futures Update - Precious Metals-Down, S&P500-Flat, Crypto-Mixed

As we open trading in the far east, the futures market is open for the second week of February. Interesting to see all the theories about by Wells Fargo was having power outages and an interesting statement, we are accepting deposits only, your other services could be restricted, lucky I transferred my cash and closed my WF account in October.

Precious metals are mixed to down, the USD is at 96.46, up 0.044.

S&P500 is mixed to flat, looking at the China open to allow them to catch up as they were closed all last week for the New Year. Shanghai seems to be up 0.75%. Fair value for US markets is at 0.63, a slight bias to the downside futures numbers. The stawk markets seem to be rolling over slowly, then all at once.

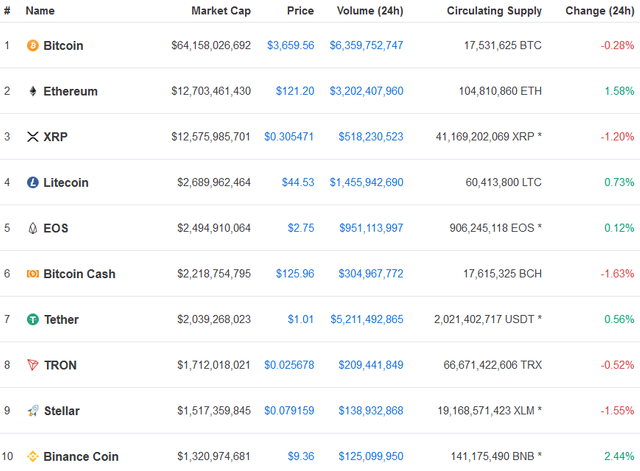

Crypto is mixed with traders digesting the rise on Friday and those numbers seem to be holding into Monday's trading.

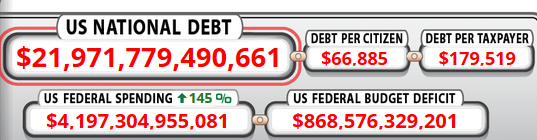

USSA debt approaching 22 TRILLION,

Keep stacking. Go get you some.

Thanks for following @RollingThunder

Keep a Close Eye, on the "Melt Value" of Gold and Silver...

@pocketechange February 11, 2019...

Question, melt value in my dictionary is the spot price. Did you have a different thought?

I usually compare U.S. Bullion Coins with the Melt Value of Generic Rounds or Bars... I believe the Face Value of U.S. Coinage will become the most important factor of the Monetary Reset, which includes the U.S. Bullion Coinage... I believe a person is much better off, holding their Gold and Silver in the form of U.S. Bullion Coinage... Their Face Value will have more "Spending Power" than their Melt Value... Same goes for Clad U.S. Coinage...

Thanks for the clear explanation, I was a little confused, but now I understand.