Oct. 29-Nov. 2 Weekly Trading Update PMs, S&P500, BTC, EMs

As we review the trading of the market in the last week of October and early November transition trading, we had returned ciaos taking full flight in all indexes. The 10 year bond peaked back to 3.22%, was forced down earlier this week but rose above the 3.2% mark again, affecting stocks. Emerging markets and the rest of the world's markets rose up looking a BTFD mentality. Earning meeting expectation but warning of lower earning ahead as a result of the trade tariffs. Trade was busy in the news cycle.

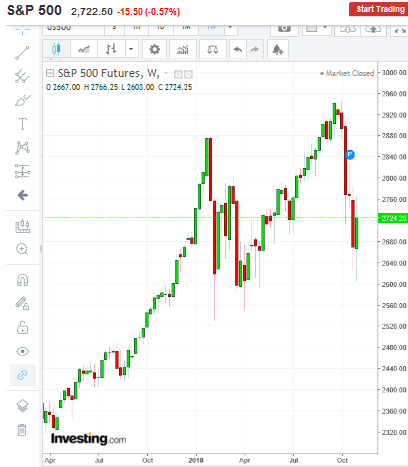

All our charts will be in the weekly candlestick mode.

Precious metals rose for the week, showing volatility against the wild gyrations of the USD. Silver rose above upper resistance to 14.92, but the powers to be beat silver back down below 14.84 resistance once again before the week-end. The USD closed at 96.50 after peaking above 97.

S&P500 and stawk futures rose for 4 consecutive days, only to fall on Friday due to strong economic numbers and a failure of trade war talks with China. I feel Window-Dressing was more of an effect as mutual funds buy strong companies and replace weak stocks in their portfolio's along with investing monthly contributions to 401K accounts. Green candle for the week but shot to a lower low, barely retracing a first level Fib retracement.

Crypto was as flat as I've ever seen it, hardly moving no matter what the news was, total marketcap around 207 Billion, crypto mixed all week.

Keep stacking. Go get you some.

Thanks for following @RollingThunder

Nothing very good out there in Investment Land, hang on to your Precious Metals.

It does seem every market is Over-valued except precious metals and precious metals miners, including the juniors. Go get ya some.

Great Post...

Lucky, lucky lucky Neighbor

lol... I forgot to up-vote... Oh wait, I just up-voted myself...

That two Cents should have been yours...